MACROECONOMIC STATISTICS

Sponsored by a Grant TÁMOP-4.1.2-08/2/A/KMR-2009-0041 Course Material Developed by Department of Economics,

Faculty of Social Sciences, Eötvös Loránd University Budapest (ELTE) Department of Economics, Eötvös Loránd University Budapest

Institute of Economics, Hungarian Academy of Sciences Balassi Kiadó, Budapest

2 Author: Gábor Oblath

Supervised by Gábor Oblath January 2011

Week 8

Summary, recapitulation and exercises Outline

• Brief recapitulation

• Statistical sources

• Simple tools of analysis

• Understanding chain-linking – advantages

– disadvantages

• Exercises based on Lequiller-Blades (2006)

Brief review of previous part

• Statistical vs. textbook concepts

• Concepts of ”real” in macro statistics

• Some important relationships

• (Review of statistical sources

• Consistency)

3

Statistical sources

• National

– SNA (GDP) – BOP

– FA

(contents; consistency, how to combine them)

• International

– Various sources for PPPs

– Sources for comparable national data

Simple tools

• Volume/value changes

• Shares

• Decompositions (impact of non-intuitive factors)

• Contributions (effect of known factors)

Contributions to GDP-change: there is trade-off

• Aggregates measured at constant prices:

– the more reliable volume indices are,

– the more difficult it is to calculate contributions to GDP – (and vice versa)

• This is where chain linking comes into the picture

4

Chain-linking

• Earlier: fixed base year

– Advantage: components were additive (made up total GDP)

– Disadvantage (the further away from the base year, the less relevant volume indices)

• Chain-linking

– Advantage: volume indices more reliable

– Disadvantage: components non-additive (in quarterly series)

Chain-linking – annual data François Lequiller -Derek Blades:

Uderstanding NATIONAL ACCOUNTS

(OECD, 2006). Ex. 6

5

Chain-linking – quarterly data

• Three methods:

– Annual overlap – One-quarter overlap – Over-the-year

• Details:

http://portal.ksh.hu/pls/ksh/docs/eng/modsz/modsz31.html

• In HU: ”annual overlap”

6

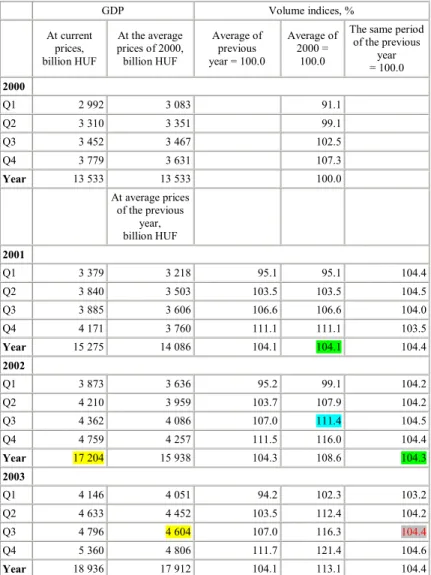

Illustration of the ”annual overlap” method Hungarian quarterly GDP time series

GDP Volume indices, %

At current prices, billion HUF

At the average prices of 2000, billion HUF

Average of previous year = 100.0

Average of 2000 =

100.0

The same period of the previous

year

= 100.0 2000

Q1 2 992 3 083 91.1

Q2 3 310 3 351 99.1

Q3 3 452 3 467 102.5

Q4 3 779 3 631 107.3

Year 13 533 13 533 100.0

At average prices of the previous

year, billion HUF

2001

Q1 3 379 3 218 95.1 95.1 104.4

Q2 3 840 3 503 103.5 103.5 104.5

Q3 3 885 3 606 106.6 106.6 104.0

Q4 4 171 3 760 111.1 111.1 103.5

Year 15 275 14 086 104.1 104.1 104.4

2002

Q1 3 873 3 636 95.2 99.1 104.2

Q2 4 210 3 959 103.7 107.9 104.2

Q3 4 362 4 086 107.0 111.4 104.5

Q4 4 759 4 257 111.5 116.0 104.4

Year 17 204 15 938 104.3 108.6 104.3

2003

Q1 4 146 4 051 94.2 102.3 103.2

Q2 4 633 4 452 103.5 112.4 104.2

Q3 4 796 4 604 107.0 116.3 104.4

Q4 5 360 4 806 111.7 121.4 104.6

Year 18 936 17 912 104.1 113.1 104.4

For example:

Q3 2003 4604/(17204/4)=107,0%

107,0*104,3*104,1=116,3 116,3/111,4=104,4

7

Contibutions – as calculated by the CSO

• Due to the chain-linking method additivity does not exist between the GDP total and its components at the reference year prices.

• Therefore our calculations were based on the previous year prices data, where additivity still exists.

• From these data GDP components were calculated at actual year average prices (like 2008 Q1 at 2008 average prices).

• From this, contribution to growth can be obtained at 2009 Q1 as

– the difference between value added in 2009 Q1 at previous year prices and that of

– 2008 Q1 at 2008 average prices

– divided by GDP total in 2008 Q1 at 2008 average prices http://portal.ksh.hu/pls/ksh/docs/eng/modsz/modsz31.html

8

Contribution to GDP growth (production approach), calculated from indices compared to the corresponding period of

previous year

http://portal.ksh.hu/pls/ksh/docs/eng/xstadat/xstadat_infra/e_qpt009h.html

9

Exercises based on Lequiller–Blades (2006) [L-B]

• Answers at www.SourceOECD.org/understandingnationalaccounts

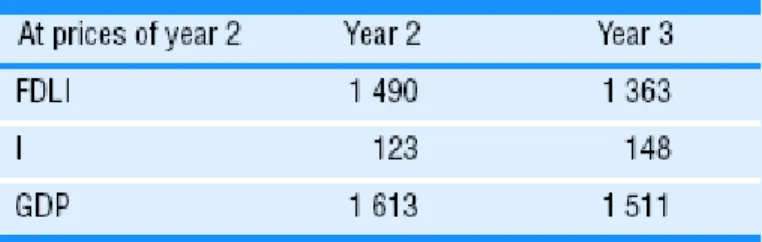

L–B: Ch. 2; p. 67, ex.7

• Exercise 7. Volume changes in inventories: levels or contributions to GDP?

• Let us suppose GDP is broken down as final demand minus changes in inventories

• (FDLI) and changes in inventories (I). Here are the accounts, expressed in prices of year 1:

• Is it correct to say that the accounts of year 1 are in current prices? Is it correct to say that the accounts for year 2 are in volume terms? Why are these accounts additive?

• (e.g. GDP = FDLI + I)? Calculate growth rates for year 2. Why is it not possible to calculate a growth rate for I? Calculate contributions to change in GDP for both FDLI and I.

10

Ex 7. (cont.)

• Below are the volume accounts for year 3, expressed in prices of year 2. Calculate growth rates and contributions to GDP growth.

• How would the OECD economics department present a table including the three years?

• Explain why it is not possible, because of changes in inventories, to easily present the same table but with all variables expressed in chain-linked levels (i.e. where year 1 is the reference year). Propose a solution whereby the levels of changes in inventories correspond exactly to those from which one can derive exact contributions to change of GDP.

L–B Ch. 3. Ex. 1 p. 93

Calculations of GDP per head in constant PPP and comparison with

current PPP

• Question 1: Table 1 below shows PPP for the United States, Sweden and Japan;

Table 2 shows GDP in volume (at 2000 prices) for the same countries; and Table 3

11 shows their populations. Using data from these three tables, create a new table of relative indices of GDP per head in volume (USA = 100), at constant 2000 PPP also called “at constant prices and PPPs of 2000”.

Ex.1 (cont.)

• Question 2: Table 4 presents the GDP of these same countries but this time at current prices. Calculate a series for GDP per head deflated by current PPP.

Compare the results with the table you created to Question 1. Comment on the differences.

12

L–B Ch. 5. Ex. 2 p. 150 Final uses of GDP

True, false or choose from the list

• a) Which of the following are included in household consumption expenditures:

fees levied by government for the public television service; the purchase of apartments; interest paid on loans; parking fines; driving licence fees?

• b) A farmer produces 300 litres of wine each year. He sells 160 litres to his neighbours and stocks 140 litres for his own consumption. Which figure should be included in household consumption: 160 litres or 300 litres?

• c) Total consumption expenditure by households includes expenditure by foreign tourists in France. True or false?

• d) Actual household consumption is equal to household consumption expenditure plus that of general government. True or false?

• e) Actual consumption of general government is equal to its collective consumption expenditure. True or false?

• f) Which of the following items of expenditure are “collective” and which are

“individual”; primary education; medical research; reimbursement of medicines;

police and fire brigades; operating costs of pension funds; cost of free concerts in municipal parks; expenses of troops serving with United Nations forces.

• g) Fixed capital formation excludes transport equipment and live cattle. True or false?

13

L–B Ch. 6. Ex. 1 p. 178 Household account

True or false?

• a) When share prices rise: i) household disposable income increases; ii) household saving declines.

• b) When a tenant buys the apartment he/she had previously been renting, GDP increases because it now includes an imputed rental income of homeowner- occupiers.

• c) When, in a given year, the number of road accidents is higher than usual, household disposable income also tends to be higher than usual.

• d) A rise in the rate of income tax automatically leads to a decline in household disposable income.

• e) A farmer whose olive plantation is destroyed in a storm automatically suffers a decline in his disposable income.

• f) A cut in the rate of inheritance tax automatically leads to a decline in household saving.

• g) A cut in the rate of reimbursement of dental care leads to: i) a rise in GDP; ii) a decline in household disposable income.

14

Additional exercises

• Try to quantify the following identities from the AMECO database:

http://ec.europa.eu/economy_finance/ameco/user/serie/SelectSerie.cfm – S–I=CA and

– S–I + T(K) = CA+NFTK= NL

• For the total economy

• Private sector

• Government sector

• What are the difficulties in reconstruction for sectors?

• Suggestions for solving the difficulties?