Economics of the welfare state

Economics of the welfare state

Sponsored by a Grant TÁMOP-4.1.2-08/2/A/KMR-2009-0041 Course Material Developed by Department of Economics,

Faculty of Social Sciences, Eötvös Loránd University Budapest (ELTE) Department of Economics, Eötvös Loránd University Budapest

Institute of Economics, Hungarian Academy of Sciences Balassi Kiadó, Budapest

Economics of the welfare state

Authors: Róbert Gál, Márton Medgyesi Supervised by: Róbert Gál

June 2011

ELTE Faculty of Social Sciences, Department of Economics

Economics of the welfare state

Week 7

Cross-sectional vs. longitudinal analysis

Róbert Gál, Márton Medgyesi

Topics

• Poverty and income inequality in cross-section and over the life cycle

• The welfare state as a system of life cycle financing

• Equilibrium conditions of an intergenerational resource- flow

• Intergenerational resource-flow in a traditional society:

– age profiles of transfer-flows and accumulation of life cycle wealth in traditional and industrial societies – family as the organizer of ”welfare programs”:

insurance performance

Poverty and income inequality in cross-section and over the life cycle

The longitudinal reinterpretation of cross-sectional categories:

• Poverty risk frequently has a demographic

nature. Income inequalities are influenced by changes in the age composition of society.

• Redistribution – political economy: the actual allocation of social expenses is a result of

political choice; voters’ preferences differ by their position in the life cycle.

• The issue of targeting has to be reinterpreted if

welfare programs are to finance the life cycle

rather than to alleviate poverty.

The welfare state as a system of life cycle financing

Most social expenses are intergenerational transfer-flows

1. Human life cycle can be split into three basic stages: childhood, active age, and inactive old age.

2. To put it in terms of a life cycle: there is a discrepancy between the consumption path and the labor income path over the life cycle:

people have to consume when they are children or old even if they produce only in their active age.

3. To put it in cross-sectional terms: society always includes different age-groups: children, active-age, and old-age people; consumption of people in their inactive age is financed by people in their active age.

4. Consumer goods and services cannot be reallocated over time.

5. There exists a longevity risk: no one knows how long s/he will live.

→

Every society works out an institutional system for the reallocation of services and income between overlapping generations.

Age profiles of social expenses in Hungary, 2005

Source: Gál (2011).

Note: See the classification of social expenditures by function (ELTECON 2nd semester course on Social Policy).

Age profiles of consumption and labor income in Hungary with weighted average-ages and

Lee-arrow, 2005

Source: Calculation by Gal, Gergely and Medgyesi; (NTA database, www.ntaccounts.org) Note: on Lee-arrows see slide 12.

0 500 000 1 000 000 1 500 000 2 000 000 2 500 000 3 000 000

0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80+

munkajövedelem fogyasztás Ay = 42,1

Ac = 42,5

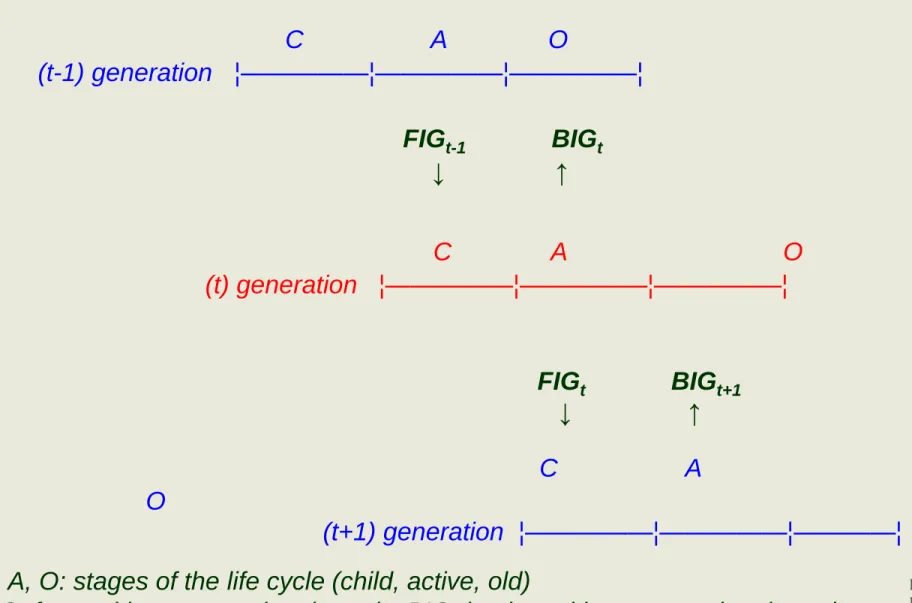

C A O (t) generation ¦—————¦—————¦—————¦

C A

O

(t+1) generation ¦—————¦—————¦————¦

C A O

(t-1) generation ¦—————¦—————¦—————¦

FIGt-1 BIGt ↓ ↑

FIGt BIGt+1 ↓ ↑

C, A, O: stages of the life cycle (child, active, old)

FIG: forward intergenerational goods; BIG: backward intergenerational goods Source: Rangel (2000, 2003)

A pattern of intergenerational transfer-flows

Equilibrium conditions of an intergenerational resource-flow

The welfare state finances the life cycle by maintaining a system of resource-reallocations between overlapping generations.

What are the equilibrium conditions of a sustainable chain of the resource-flow?

What are the steps in getting from the simplest game to the model describing the welfare system?

Equilibrium conditions of an intergenerational resource-flow

1. One-shot game with simultaneous steps.

2. Repeated game with simultaneous steps.

3. Sequential game with a fixed set of players.

4. Sequential game with one player exiting and another one entering in every sequent; entry is exogenous;

transfers among players flow in one direction Hammond (1975).

5. Sequential game with one player exiting and another one entering in every sequent; entry is endogenous;

transfers among players flow in two, opposite directions;

Rangel (2003): opposite transfer flows have to be tied.

Age profiles of transfer-flows and accumulation of life cycle wealth in traditional and industrial

societies

Accumulation of life cycle wealth

Direction of transfer-flows in extensive agrarian, intensive agrarian and industrialized societies

Changing directions of net transfer-flows

Age profiles of transfer-flows and accumulation of life cycle wealth in traditional and industrial

societies

In Willis (1988), everyone finances his/her own life cycle.

Infants take up loans at their birth to finance their childhood;

these loans are paid back later.

Let Ac and Ay be the money-weighted average ages of consumers and workers, respectively.

If

Ac < Ay

consumers take up loans against their future income; a negative wealth (debt) is accumulated.

If , in contrast

Ac > Ay positive wealth is accumulated.

Lee-arrows of selected countries and tribal societies

Source: Lee, RD (2010):

National Transfers

Accounts. Concepts and Theories. Presentation at the 7th NTA conference, Honolulu.

Lee arrows represent the difference between the

average age of workers and consumers (distance

of the sole and head of the arrow) and the magnitude of the reallocation (area of

arrow).