However, the literature has so far not taken into account a potentially important source of firm fluctuations, namely the location of firms and especially the density of economic activity in the surrounding areas. 3Unconditional volatility simply means the volatility of the growth rate of a given firm-level variable such as (real) sales, employment, value added or capital for a given time window. 7 For a summary of the related theoretical literature on the extent and causes of the agglomeration economy, see Puga (2010).

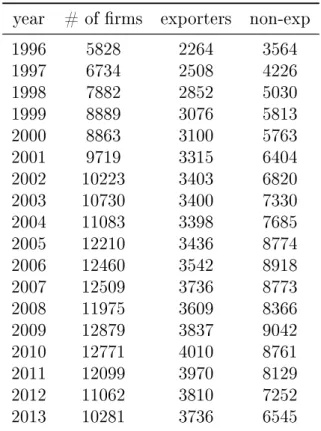

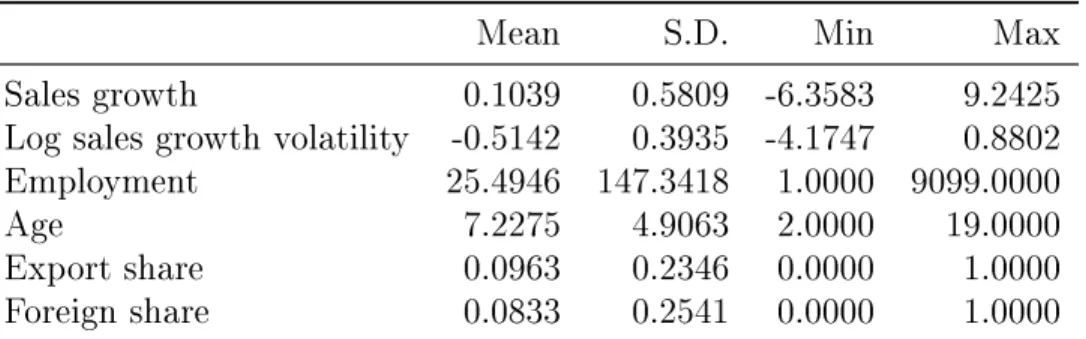

The total number of manufacturing workers in a given region negatively affects the volatility of Hungarian manufacturing firms' real sales and employment growth rates in the period 1994 and 2013. In the first one, I calculate the sales growth of each firm𝑓 at that time𝑡 rates as the log difference of sales in the current period 𝑋𝑓 𝑡 and the sales of the previous period𝑋𝑓 𝑡−114. 2014) argue that growth rates calculated as log differences are a poor proxy at the firm level because of the often large annual changes.

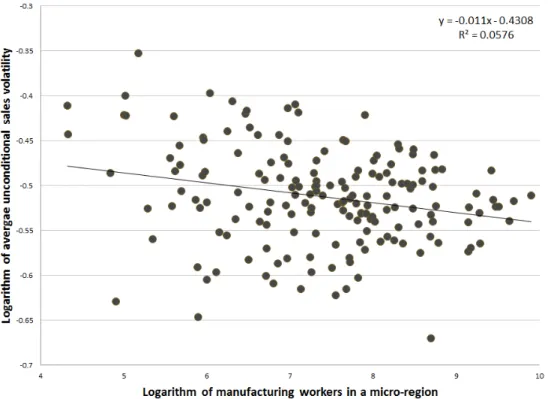

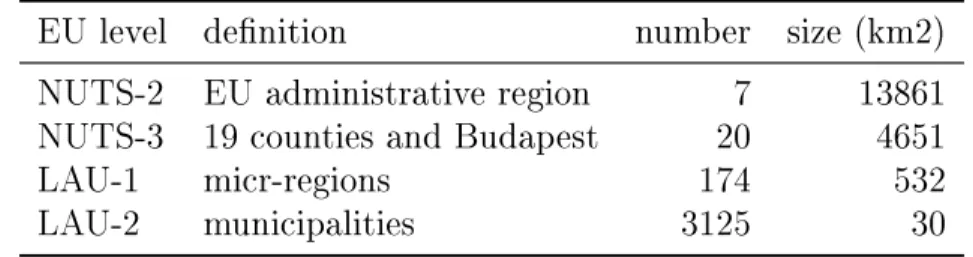

Also, to ensure the consistency of the results, in equation (3.3) I use a year-varying volatility measure, defined in the following Kalemni-Ozcan et al. First, agglomeration is defined as the logarithm of the sum of production workers in a given micro-region ln (∑︀ . 𝑟emp𝑟𝑡) as in Békés and Harasztosi (2013). Figure 3 shows a significantly negative correlation between firm volatility, measured as the firm-level logarithm of the standard deviation of real sales growth rates conditional on the microregion average, and the logarithm of the microregional total number of workers.

Although OLS estimation is a good baseline portrayal of the relationship between firm fluctuations and agglomeration forces, equation (5.1) raises endogeneity concerns at both the regional and firm level even after controlling for time-invariant unmeasured local characteristics.

Main results

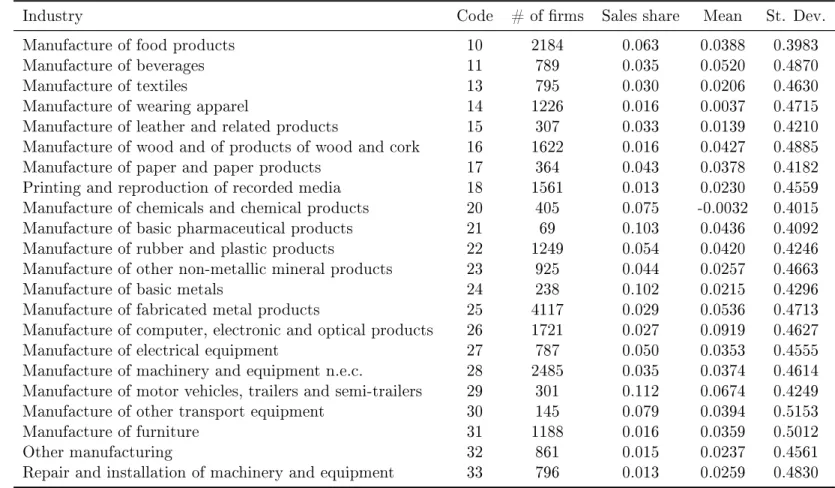

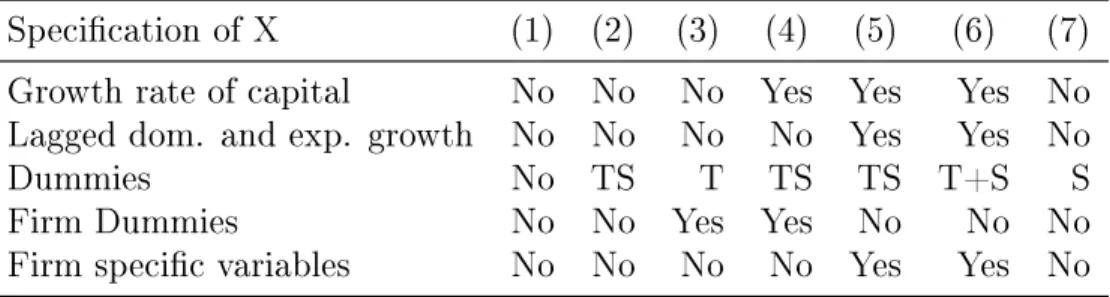

The estimation equation (5.1) and (5.2) is carried out in the specifications using three different time horizons for the calculation of firm fluctuations as explained in detail in section 3, the three definitions of the aggregation measure (see section 4) and at different levels of spatial stratification. Up to a certain threshold, around 50%, trade involvement increases volatility, however after this threshold is reached, the diversification effect tends to overcome the higher exposure to external shocks. This finding is similar to that of Vannoorenberghe (2012) who found that the volatility of total firm sales depends positively on the export share after adjusting for firm covariates and sector fixed effects, however, he found a positive coefficient estimate for the square of the export share. .

Also, larger firms usually export more and it is well observed that larger firms trade with a larger number of partners, as recently documented by Kurz and Senses (2016) and Békés et al. 2011) showed for Hungarian data, therefore they can more easily diversify imperfectly correlated shocks. The Budapest dummy controls for the outlier characteristic of the capital city: Budapest has one-fifth of the total population and two-fifths of the total economic activity of the entire country, implying a possibly different fixed behavior. The first three columns report pooled OLS estimates, while column (4)-(6) use panel fixed effects estimation to look within effects.

In the end, both the pooled OLS and panel fixed effect method yield the same conclusion: denser economic activity is negatively correlated with firm fluctuations. Using the 6-year measure of conditional firm sales volatility, table 8 implies that doubling the density of workers will result in a 5% decrease in firm volatility through the panel fixed effect estimate (see column (4) and (5) , which is slightly higher than the estimated effect from the pooled OLS specifications (see column (1) and (2). Regarding the covariates, firm size is significantly negative, while sales growth is significantly positive in each specification, regardless of the inclusion of firm fixed effects.

Nevertheless, after controlling for unobserved firm characteristics, ownership no longer matters (although the sign of the coefficient remained positive), in contrast to the findings of Kalemni-Ozcan et al. (2014) who showed a positive relationship between direct foreign investment and volatility, even with firm fixed effects. Changing the benchmark for defining fluctuations in company sales does not affect the main results of the article. Again, a doubling of economic density, measured as the total number of employment in industry in a given micro-region (columns (1) and (4) or per micro-region (columns (2) and (5)), reduces fluctuations in turnover of companies - increases of about 5-6%.

Also, according to column (3) and (6), the number of firms does not affect the stability of firm sales. The estimated coefficients of firm covariates also behave similarly: larger firms with slower average growth rates result in lower fluctuations, while changes in foreign ownership, tangible fixed assets, or age have no significant impact on firm sales volatility. Increasing involvement in export markets has an increasingly larger relationship with firm volatility as the weight of export is positive and its square negatively affects sales volatility.

Robustness checks

To check the robustness of the results for regional stratification, I re-estimated the specifications mentioned above to compare the estimated coefficients of agglomeration for Hungarian urbanized areas, which is the settlement classification offered by the Hungarian Statistical Office (KSH) (see Figure 4). Settlements belonging to the same urbanized area have close socio-economic links with each other, so a change in the degree of aggregation into urbanized areas can result in the use of more homogeneous economic areas. The sign and significance (except for the specification of a firm fixed effect for the annually variable definition of volatility in column (2)) of the estimates are the same with slightly different magnitudes regardless of the measure of volatility or agglomeration or the inclusion of a firm fixed effect.

An interesting difference is that the number of companies in a given urbanized area also matters: a doubling of the number of companies implies a 10% decrease in fluctuations in company sales.

Separation of agglomeration into localization and ur- banization

This paper makes progress in understanding the magnitude and variation of fluctuations across firms and focuses on measuring the impact of the density of economic activity on firm-level volatility, using Hungarian production panel data for the period when new stylized facts about the relationship between agglomeration and business activities are established. inconstancy. Cede, Urška, Bogdan Chiriacescu, Péter Harasztosi, Tibor Lalinsky, and Jaanika Meriküll "Export diversification and output volatility: Comparative evidence at the firm level." European Central Bank, working report, (2016). 34; Volatility and dispersion in corporate growth rates: publicly traded versus privately held companies. " NBER Macroeconomics Annual 2006, Volume 21.

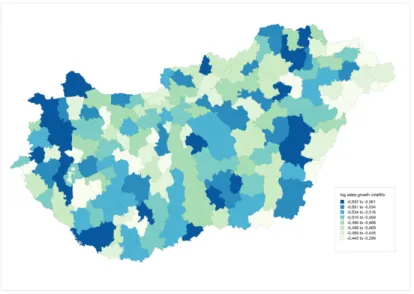

34; An illustration of a pitfall in estimating the effects of aggregate variables on micro-units." The review of Economics and Statistics. Note: This figure represents the micro-regional averages of the logarithm of real sales growth at the firm level between 1996 and 1996. 2013. Note: This figure plots the micro-regional means of the logarithm of the standard deviation of conditional real sales growth at the firm level against the logarithm of the average number of manufacturing workers in a given region between 1996 and 2013.

Log unconditional volatility measured as the logarithm of the standard deviation of real sales growth at the firm level. Note: The dependent variable is the logarithm of firm-level real sales growth unconditional and conditional volatility using the 18-year time window approach. 34;Total employment" is the logarithm of the sum of all production workers in a given microregion where the company operates, "Area" is the size of the microregion measured as the logarithm of square kilometers.

34;Employment density" is the ratio of total manufacturing workers and the area expressed in logs and "Number of firms" is simply the log of the average number of operating firms in the region during the entire period. Foreign ownership indicates that more than 5 % of the registered capital is foreign-owned, size measured as average real sales Note: The dependent variable is the logarithm of fixed year-level real sales growth unconditional and conditional volatility.

34; "Total employment" is the logarithm of the sum of all production workers in a given micro-region where the firm operates, "Area" is the size of the micro-region measured as the logarithm of square kilometers, "Employment density" is the ratio of total production workers and area expressed in logs and "Number of firms" is simply the log number of firms operating in the region. Foreign ownership indicates that more than 5% of the subscribed capital is foreign-owned, the size of measured as real Sales Agglomeration is measured as the logarithm of total manufacturing employment per region together with the area of the region in log square meters, the log production density per region, or the total number of log firms per area.

Each point in the table represents different regressions Agglomeration is measured as the logarithm of total manufacturing employment per region along with the area of the region in log square meters, wood production density per region or log-total number of companies per territory. Each point in the table represents different regressions. Agglomeration is measured as the logarithm of total manufacturing employment per urbanized area together with the area of the urbanized area in log square meters, wood production density per region or log total number of companies per territory. Localization is measured by the total number of employees in log in a given region in the same sector where a given company is active minus the company's own employment plus, and urbanization is the total number of employees in production in different sectors.

Each table item represents different regressions. Agglomeration is measured as the logarithm of total manufacturing employment per region together with the area of the region in log square meters, the density of log production per region, or the log of the total number of enterprises per area.