CORVINUS JOURNAL OF SOCIOLOGY AND SOCIAL POLICY Vol.4 (2013) 2, 31–52

The Fixed PoinT. A Review oF John von neumAnn’s meThodology

GerGely KõheGyi1

Abstract This paper gives an overview of John von Neumann’s methodology and provides a criticism of ’ordinary’ historical explanations concerning von Neumann’s writings. His broad multidisciplinary works are traditionally analysed within separate fields, completely detached from social and multidisciplinary context. This can often lead to oversimplified historical explanations. As an illustration of this I discuss one of his lesser-known articles which plays a central role in general economics in the postwar period. This is, however, the only one which concerns directly theoretical economics. I review the possible explanations behind his motivation for writing this article and propose a different historical approach to outlining his exceptional train of thoughts.

Keywords History of Science, Philosophy of Science, History of Economic Thought, John von Neumann, von Neumann Model, von Neumann’s Fixed Point Theorem, Holistic Scientific Methodology

inTRoducTion

The main purpose of this paper is to give an overview of John von Neumann’s methodology and to provide a criticism of ’ordinary’ historical explanations concerning von Neumann’s works. As an illustration, the paper will focus on the analysis of a short, 8-page long article from John von Neumann (Neumann 1946): ’A Model of General Economic Equilibrium’ [and a Generalization of Brouwer’s Fixed Point Theorem]2. The original version of the article was

1 Eötvös Loránd University Budapest, Faculty of Social Sciences, Department of Economics, H-1117 Budapest, Pázmány Péter sétány 1/A, e-mail: gkohe@elte.hu

2 ‘Über ein ökonomisches Gleichungssystem und eine Verallgemeinerung des Brouwerschen Fixpunktsatzes.‘ Erg. eines Math. Coll. Vienna, ed. by K. Menger, 8:73-83. Translated into English by G. Morgenstern. Rev. Econ. Studies 13:1-9 [VI, 3].

written in German and was published among the results of Karl Menger’s Vienna Colloquium (Ergebnisse eines Mathematiche Kolloquiums) in 1937, although the first version of the model in the article was presented at a Princeton seminar in 1932. In comparison with his grandiose works in the field of the mathematical foundations of quantum mechanics (Neumann 1932), ergodic theory, computer sciences, brain structures (Neumann 1958) or even the theory of games (Neumann–Morgenstern 1944), this is a lesser known paper, but the only one which concerns theoretical economics directly. Nevertheless, it played a central role in the period 1945-1970 and in Weintraub’s view is

”the single most important article in mathematical economics” (Weintraub 1983, 13). I argue that the analysis of this representative work may give us some insight into von Neumann’s incomparable methodology and make clear how misleading it is to analyze the train of thought and motivation of John von Neumann from within a single discipline.

After a short introduction I outline John von Neumann’s economic model, which is the starting point in his article. Then I briefly discuss its consequences, firstly on the history of theoretical economics, and secondly on the history of mathematics, or more precisely, the history of fixed point theorems (the technical details can be found in the appendix at the end of this paper) Finally, I appraise his work from the point of view of ’standard’

Lakatosian methodology. It will be clear that this approach to the theory evaluation involves a certain ambiguity; however, an alternative approach may be suitable for avoiding this. The key to this alternative approach is in understanding von Neumann’s methodological view, especially concerning interdisciplinary relations in science. At the end of the paper I summarize my findings.

2. The neumAnn-model

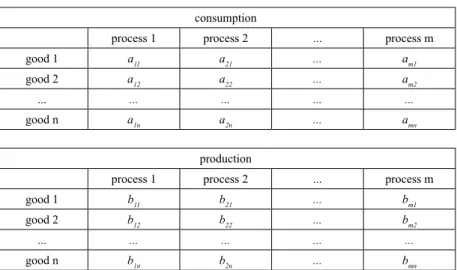

Von Neumann’s model works with n goods and m production processes.

The main characteristic of the abstraction is that goods are mainly produced from each other. With this particular approach von Neumann removed the traditional distinction between primary factors and outputs and grasped the circular nature of production. This means that in the model there are no

’original’ factors, such as labour in traditional theory. Labour is now a factor of production because workers need to consume commodities to produce other commodities. In addition, certain goods can be produced by more than one process, and certain processes generate ’by-products’ which can also be very useful goods.

33 THE FIXED POINT

Table 1 The coefficients of consumption and production consumption

process 1 process 2 ... process m

good 1 a11 a21 ... am1

good 2 a12 a22 ... am2

... ... ... ... ...

good n a1n a2n ... amn

production

process 1 process 2 ... process m

good 1 b11 b21 ... bm1

good 2 b12 b22 ... bm2

... ... ... ... ...

good n b1n b2n ... bmn

Von Neumann assumed the existence of fixed proportions in production or constant returns to scale. For example, a21 denotes the quantity of the first commodity that the second process requires and b21 denotes the quantity of the first commodity that the second process produces. He presumed a ’closed economy’, so that an exchange of goods with the environment is impossible, but that ”the natural factors of production, including labour, can be expanded in unlimited quantities” (von Neumann 1946, 2). The model is dynamic and uses discrete rather than continuous time, so there are several periods of production. As there are fixed proportions in production, all outputs expand at the same rate; i.e. economic growth can be characterized by a constant growth factor α, and while only relative prices impact real processes, the interest rate is the same throughout the economy and a constant β is sufficient to indicate the interest factor. In addition, von Neumann assumes that ”[c]onsumption of goods takes place only through the process of production which includes necessities of life consumed by workers and employees. In other words [...]

all income in excess of necessities of life will be reinvested” (von Neumann 1946, 2). And finally, that aij+bij>0; i.e. every product is used or produced by a process.

If we denote the quantity of the good i using xi and the unit price of the good k using pk, the equilibrium in von Neumann’s model is specified by three types of inequality conditions:

34 GERGELY KŐHEGYI

CORVINUS JOURNAL OF SOCIOLOGY AND SOCIAL POLICY 2 (2013)

1. It is impossible to consume more than was produced in the previous period. However, if the supply exceeds the needed quantity of any commodity, then its price becomes zero and it is deemed a ’free good’:

than continuous time, so there are several periods of production. As there are fixed proportions in production, all outputs expand at the same rate; i.e. economic growth can be characterized by a constant growth factor , and while only relative prices impact real processes, the interest rate is the same throughout the economy and a constant

is sufficient to indicate the interest factor. In addition, von Neumann assumes that ”[c]onsumption of goods takes place only through the process of production which includes necessities of life consumed by workers and employees. In other words [...] all income in excess of necessities of life will be reinvested” (von Neumann 1946, 2). And finally, that

aijbij 0 ; i.e. every product is used or produced by a process.

If we denote the quantity of the good

iusing x

iand the unit price of the good

kusing

p

k, the equilibrium in von Neumann’s model is specified by three types of inequality conditions:

1. It is impossible to consume more than was produced in the previous period. However, if the supply exceeds the needed quantity of any commodity, then its price becomes zero and it is deemed a ’free good’:

; , 1,

= ,

1

= 1

=

n j

x b x

a m ij i

i i ij m i

and if strict inequality holds for any

j=k, then p

k= 0 .

2. None of the processes can be profitable; i.e. the aggregate value of products cannot exceed aggregate costs of production plus interest (because the purchase of factors takes place one period earlier than the sale of products). And if a process is loss-making, then it is unused:

; , 1,

= ,

1

= 1

=

m i

p b p

a n ij j

j j ij n j

and if for any

i=lstrict inequality holds, then x

l= 0 .

and if strict inequality holds for any j = k, then pk = 0.2. None of the processes can be profitable; i.e. the aggregate value of products cannot exceed aggregate costs of production plus interest (because the purchase of factors takes place one period earlier than the sale of products).

And if a process is loss-making, then it is unused:

production, all outputs expand at the same rate; i.e. economic growth can be characterized by a constant growth factor , and while only relative prices impact real processes, the interest rate is the same throughout the economy and a constant

is sufficient to indicate the interest factor. In addition, von Neumann assumes that ”[c]onsumption of goods takes place only through the process of production which includes necessities of life consumed by workers and employees. In other words [...] all income in excess of necessities of life will be reinvested” (von Neumann 1946, 2). And finally, that

aijbij 0 ; i.e. every product is used or produced by a process.

If we denote the quantity of the good

iusing x

iand the unit price of the good

kusing

p

k, the equilibrium in von Neumann’s model is specified by three types of inequality conditions:

1. It is impossible to consume more than was produced in the previous period. However, if the supply exceeds the needed quantity of any commodity, then its price becomes zero and it is deemed a ’free good’:

; , 1,

= ,

1

= 1

=

n j

x b x

a m ij i

i i ij m i

and if strict inequality holds for any

j=k, then p

k= 0 .

2. None of the processes can be profitable; i.e. the aggregate value of products cannot exceed aggregate costs of production plus interest (because the purchase of factors takes place one period earlier than the sale of products). And if a process is loss-making, then it is unused:

; , 1,

= ,

1

= 1

=

m i

p b p

a n ij j

j j ij n j

and if for any

i=lstrict inequality holds, then x

l= 0 .

and if for any i = l strict inequality holds, then xl = 0 .3. There is non-negativity of quantities and prices in the equilibrium:

3. There is non-negativity of quantities and prices in the equilibrium:

m i

x

i 0, = 1, ,

n jpj

0, = 1,

,

and at least one has to be positive:

0

>

1

= i m i

x0.

>

1

= j n j

pVon Neumann pointed out that the later equilibrium conditions can be formulated alternatively.

Let us define the functional

with the help of ’input and output matrices’ (

Aand

B) formed by technological coefficients (

aijand

bij), quantity vector and price vector (

x,

p):

pAx p pBx

x

, ) = = (

1

= 1

= 1

= 1

=

i ij j n j m i

i ij j n j m

i

x a p

x b p

This functional has a saddle point in the equilibrium. Therefore the existence of a saddle point of the latter-defined functional is a necessary and sufficient condition for the existence of equilibrium in von Neumann’s economic model.

3. THEORETICAL ECONOMIC CONSEQUENCES

At this point I will briefly discuss von Neumann’s model’s role in the history of economic thought. Von Neumann’s work has had a particular position in the history of economics, because, on the one hand, his motivation to write the paper is not at all obvious, and on the other hand the

and at least one has to be positive:

3. There is non-negativity of quantities and prices in the equilibrium:

m i

x

i 0, = 1, ,

n jpj

0, = 1,

,

and at least one has to be positive:

0

>

1

= i m i

x0.

>

1

= j n j

pVon Neumann pointed out that the later equilibrium conditions can be formulated alternatively.

Let us define the functional

with the help of ’input and output matrices’ (

Aand

B) formed by technological coefficients (

aijand

bij), quantity vector and price vector (

x,

p):

pAx p pBx

x

, ) = = (

1

= 1

= 1

= 1

=

i ij j n j m i

i ij j n j m

i

x a p

x b p

This functional has a saddle point in the equilibrium. Therefore the existence of a saddle point of the latter-defined functional is a necessary and sufficient condition for the existence of equilibrium in von Neumann’s economic model.

3. THEORETICAL ECONOMIC CONSEQUENCES

At this point I will briefly discuss von Neumann’s model’s role in the history of economic thought. Von Neumann’s work has had a particular position in the history of economics, because, on the one hand, his motivation to write the paper is not at all obvious, and on the other hand the

Von Neumann pointed out that the later equilibrium conditions can be formulated alternatively. Let us define the functional Φ with the help of

’input and output matrices’ (A and B) formed by technological coefficients (aij and bij), quantity vector and price vector (x, p):

35 THE FIXED POINT

3. There is non-negativity of quantities and prices in the equilibrium:

m i

x

i 0, = 1, ,

n jpj

0, = 1,

,

and at least one has to be positive:

0

>

1

= i m i

x0.

>

1

= j n j

pVon Neumann pointed out that the later equilibrium conditions can be formulated alternatively.

Let us define the functional

with the help of ’input and output matrices’ (

Aand

B) formed by technological coefficients (

aijand

bij), quantity vector and price vector (

x,

p):

pAx p pBx

x

, ) = =

(

1

= 1

= 1

= 1

=

i ij j n j m i

i ij j n j m

i

x a p

x b p

This functional has a saddle point in the equilibrium. Therefore the existence of a saddle point of the latter-defined functional is a necessary and sufficient condition for the existence of equilibrium in von Neumann’s economic model.

3. THEORETICAL ECONOMIC CONSEQUENCES

At this point I will briefly discuss von Neumann’s model’s role in the history of economic thought. Von Neumann’s work has had a particular position in the history of economics, because, on the one hand, his motivation to write the paper is not at all obvious, and on the other hand the

This functional has a saddle point in the equilibrium. Therefore the existence of a saddle point of the latter-defined functional is a necessary and sufficient condition for the existence of equilibrium in von Neumann’s economic model.

3. TheoReTicAl economic consequences

At this point I will briefly discuss von Neumann’s model’s role in the history of economic thought. Von Neumann’s work has had a particular position in the history of economics, because, on the one hand, his motivation to write the paper is not at all obvious, and on the other hand the further development of the model is very curious. von Neumann’s work thus seems to be both a meeting and a junction point of conflicting theories (Zalai 2004, 3).

Indeed, the author’s motivation remains a source of debate because he failed to refer to his predecessors and simply stated that ”It is obvious to what kind of theoretical models the above assumptions correspond” (Neumann 1946, 2).

If one enters the debate she can see that it is not obvious at all. According to the ’traditional’ view (eg. Arrow 1989, Weintraub 1983 and 1985, Punzo 1989) von Neumann had a neoclassical motivation. On the one hand, Nicholas Káldor, who knew von Neumann after his university years in Budapest, proposed that he read Wicksell (1893) when von Neumann expressed his interest in economics (Káldor 1989, viii). This book contains the concept of Walrasian general equilibrium theory and also the mathematical form of Böhm-Bawerk’s theory of capital. According to Káldor, von Neumann was sceptical concerning this marginalist approach and subsequently had a look at Walras’ original version (the first mathematized general equilibrium model in economics) (Walras 1874). He then told Káldor that ”they provide no genuine solution, since the equations can result in negative prices (or quantities) just as well as positive ones” (Káldor 1989, viii). On the other hand, according to Arrow (1989, 24) and Weintraub (1983, 13), when Jacob Marschak gave a presentation ”presumably on Cassel’s version” (Arrow 1989, 24) of general equilibrium to an interdisciplinary seminar on the application of mathematics to various fields organized by Leo Szilard in the Kaiser Wilhelm Institute in Berlin between 1928 and 1931, von Neumann, who was a ’Privatdozent’

in Berlin at this time, sharply criticized the use of equations instead of inequalities during the presentation.

Gustav Cassel’s work (Cassel 1918) gives a simplified version of Léon Walras’ general equilibrium model. Cassel starts from empirically determinable aggregated demand functions on the consumer side without any reference to the concept of utility or the marginalist theory of value. This model later exposed many problems concerning the existence of general equilibrium and attracted the attention of Karl Schlesinger and Abraham Wald from Karl Menger’s Vienna Colloquium. Finally, Schlesinger and Wald presented the first correct existence proof in the Casselian system with inequalities at the Vienna Colloquium and their results were also published in part in Egebnisse (Schlesinger 1935, Wald 1935 and 1936).

Apart from the historical facts and externalist arguments, Arrow (1989, 17) argues in an internalist way as follows:

But Cassel’s simplification and even vulgarization had very considerable and fruitful influence, for it permitted a detailed understanding of the process by which prices and quantities are determined. Walras’ generality made it very hard to go beyond the simple counting of unknowns. In fact it is explicitly the Cassel system that Wald analyzed in his first two papers. Though von Neumann makes no reference (von Neumann’s lack of references is in general a source of difficulty in reconstructing the evolution of ideas), it seems very clear that he too took Cassel’s work as a starting point.

Cassel extended his argument to a uniformly-growing economy. He assumed that the quantities of primary factors grew at the same uniform rate. Demand at a fixed price for each commodity grew at the same rate, induced by the growing income. Production may take time, so that production coefficients determine lagged inputs. […] Cassel’s discussion may ”well have suggested von Neumann’s growth model.

(Arrow 1989, 17)

Von Neumann’s model shares several important features which are also emphasized in the work of the Viennese economists: the use of inequalities instead of equations; the complementary slackness conditions for free disposal and a zero price for goods in excess supply as well as an emphasis on long-run equilibrium without profits. And as Karl Menger recalled, ”Wald’s paper on the equations of production greatly interested von Neumann when

37 THE FIXED POINT

passing through Vienna soon after its publication. It reminded him of an equation he had formulated and solved in 1932 and now offered to present in our Colloquium” (Menger 1973, 55). But as Arrow mentions, ”[u]nlike Wald’s paper and unlike the policy of the Ergebnisse, it does not appear that that von Neumann’s paper was in fact presented to Menger’s colloquium. It is not so indicated, and there is no following discussion” (Arrow 1989, 19).

Probably it was only published without presentation in the 1935-36 volume of Ergebnisse, edited by Menger and Wald.

In addition, I have to mention here that Lionello Punzo (1989) links von Neumann and Menger’s Colloquium by their methodologies, instead of their theoretical economic roots, which is formalism (inspired by Hilbert) in mathematics (Neumann seems to have been a formalist at that time) and strict functionalism (inspired by Mach) in the empirical sciences:

The inconsistency is between the two rival principles of reductionism to microeconomic foundations and (a version of) biologistic holism. Strict functionalism could only be a child of scientific outlook inspired by Mach. This was the philosophy shared by members of K. Menger’s colloquium.

(Punzo 1989, 46)

Although von Neumann’s model shares several neoclassical features, the camp of neoclassical authors of the time seems to have been a homogenous group only from a very presentistic point of view. Indeed, the theories of the two Swedish economists Wicksell and Cassel are very different in purpose as well as in methodology, and both differ sharply from the old Austrian (the elder Menger, Böhm-Bawerk and Wieser), the Viennese (the younger Menger, Schlesinger and Wald) and also from the Lausanne school (Walras, Pareto, Barone, Antonelli) tradition.

Furthermore, there is a strong asymmetry between consumption and production because von Neumann (1946) completely neglected not only the marginalist theory of value, but the whole demand-side of the economy;

nevertheless, he emphasizes the circular nature of production processes, and reproducibility. In von Neumann’s model there are no initial endowments that constrain production (which is also a central characteristic of neoclassical theory), because primary factors are assumed to be available without scarcity.

And the growth rate (with the help of which the notion of a uniformly- expanding economy is introduced) is endogenously determined, although in Cassel’s work it is exogenous.

Therefore several authors (e.g. Chakravarty 1989, Kurz and Salvadori 1993 and 2001) have highlighted that there is not only a conceptual parallelism, but

also a structural similarity between von Neumann’s paper and Piero Sraffa’s theory of production (Sraffa 1960). Although Sraffa was invited by John Maynard Keynes to Cambridge in 1927 and it is possible that he worked on his production concept in the 1920s, there is no documented connection between von Neumann and the circle of Cambridge economists (Nicholas Káldor was a research student at the London School of Economics from 1927 to 1932, which was the adversary of Cambridge at that time). Nevertheless, Kurz and Salvadori (1993) (and also Champernown 1945) argue that von Neumann’s model emerged from the classical tradition of Ricardo and Marx rather than from the neoclassical tradition, which can be interpreted as an explanation for the von Neumann-Sraffa conceptual parallelism.

Kurz and Salvadori (1993) provide both internalist and externalist arguments. On the one hand they mentioned that ”in the von Neumann model we encounter exactly the same asymmetry in the theory of distribution that is characteristic of the classical analysis: the real wage rate is given from the outside of system and profits are conceived as a residual magnitude” (Kurz and Salvadori 1993, 136). On the other hand, they emphasize the importance of the Berlin years in John von Neumann’s intellectual development as concerns economic thought. He was a Privatdozent there between 1927 and 1929 and in addition to Marschak’s presentation on general equilibrium, he could have been familiar with a paper by Robert Remak (1929), a colleague at the Berlin Institute of Mathematics who studied the problem of the conditions under which positive solutions to systems of linear equations are obtained.

According to Wittman (cited in Kurz and Salvadori 1993, 145) Remak’s paper (Remak 1929) was probably stimulated by the works of Vladimir K.

Dmitriev, Ladislaus von Bortkiewicz and Georg von Charassoff who are the representatives of the classical economic tradition in Berlin and who mathematically reformulated Ricardo’s and Marx’ theories of distribution.

And it is also possible that Remak or – as Thomson (1989, 221) mentioned – von Neumann read the PhD thesis of Bortkiewicz’ student, Wassily Leontief (Leontief 1928), which contains the first version of his Input-Output model.

Remak’s paper was presented at a meeting of the Berlin Mathematical Society and his ideas were discussed at the Mathematical Institute in Berlin and most of his colleagues ’derided’ its conclusions (Kurz and Salvadori 1993, 148).

According to Kurz and Salvadori (1993, 146-148) Remak’s purpose with the mathematical economic model was to help decide between socialist and capitalist systems, because the capitalist price mechanism is inefficient. And it is possible that von Neumann’s paper was an implicit answer to Remak’s model. There is no more historical evidence but Kurz and Salvadori (1993, 149) point out that both author’s central concept is the notion of efficiency

39 THE FIXED POINT

and that both start from a circular flow production model, where the scarcity of primary factors, such as land, play no significant role.

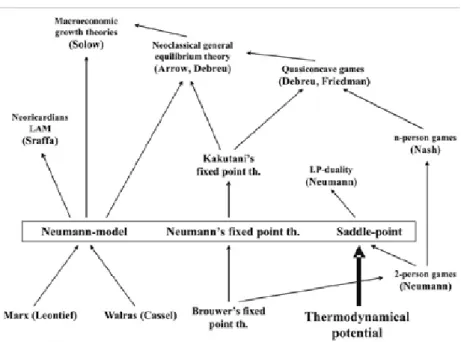

As concerns the impact of von Neumann’s paper, Kenneth Arrow considered von Neumann explicitly as an important predecessor of neoclassical general equilibrium theory (Arrow 1968). In spite of Arrow, Kurz and Salvadori (2001) gave an overview of the conceptual paralelism of Sraffa and von Neumann and argue that the von Neumann model is an important bridge from classical works to neoricardian economic theory; indeed, Kurz and Salvadori (2004) state that ”setting aside some purely formal aspects there are no connections between von Neumann model and Arrow-Debreu model” (Kurz and Salvadori 2004, 60). Besides these two opinions, there are obvious links from the von Neumann model to Linear Activity Models (Koopmans 1951) and because of its dynamic character to macroeconomic growth theories.

4. mAThemATicAl consequences

After a discussion of the theoretical economic consequences let us turn to an analysis of the significance of Neumann’s paper in the history of mathematics.

Von Neumann stated at the beginning of the paper that:

the possibility of a solution is not evident, i. e. it cannot be proven by any qualitative argument. The mathematical proof is only possible by the means of a generalization of Brouwer’s Fix- Point theorem, i.e. by the use of very fundamental topological facts. This generalized fix-point theorem is also interesting in itself. (Neumann 1946, 1)

Hence, he proved the existence of the equilibrium with the help of a ’lemma’

stated and proved after the construction of the model, which is closely related to Brouwer’s fixed point theorem. Brouwer’s fixed point theorem states:

Theorem 1 (Brouwer Fixed Point Theorem): A continuous mapping of a bounded, closed, convex set of the Euclidean space into itself has at least one fixed point3.

The latter theorem has been generalized in many different ways since its formulation in 1909. One of the most important generalizations is Kakutani’s theorem (Kakutani 1941). This is a fixed point theorem of upper hemi-

3 A fixed point of a function f: A → A is a point x in A with x = f(x).

continuous correspondences4 instead of continuous functions, which has had a crucial role both in applied and in theoretical mathematics:

Theorem 2 (Kakutani’s fixed point theorem): An upper hemi-continuous correspondence of a bounded, closed, convex set of the Euclidean space into itself has at least one fixed point5.

Kakutani, the Japanese mathematician, was invited by Hermann Weyl to the Institute for Advanced Studies in Princeton in recognition of his earlier works in the field of functional analysis and ergodic theory. Von Neumann was also a member of the institute during this period. Kakutani probably learnt about von Neumann’s paper there. He attached particular importance to von Neumann’s works, because in his 3-page long article (Kakutani 1941) he demonstrated that, with the aid of his recently-stated fixed point theorem, both von Neumann’s fixed point theorem and his so called minimax-theorem could be proven. The minimax-theorem of John von Neumann concerning the existence of equlibria in two-person, zero-sum games was published in Neumann (1928If one takes a closer look at the theorems, it can be shown (see appendix) that the original version of von Neumann’s fixed point theorem and Kakutani’s theorem are equivalent, while they can be proved from each other.

5. APPRAisAl oF hisToRicAl consequences The lakatosian Framework

At this point let us try to give an appraisal of von Neumann’s paper from the point of view of the history of science. If one intends to give a historical appraisal, she always has to follow the guidelines of a meta theoretical methodology or philosophy of science. In this paper the chosen methodology for the theory evaluation follows Imre Lakatos’ two works: (Lakatos 1978a and Lakatos 1978b).

Lakatos’ philosophy of science is a ’transitory’ concept between the theories of scientific rationality – which stem from empirist-positivist traditions – and post-kuhnian tendencies. Lakatos identifies with both the logical positivist and Popperian standpoints concerning scientific theories and demarcation criteria but he also criticizes Kuhn’s and Feyerabend’s concept as ’over-emphasizing’

irrational aspects of scientific change. He appreciates the historical approach

4 A correspondence is upper hemi-continuous if its graph is closed.

5 A fixed point of a correspondence f:A→2A is a point x∈A with x∈f(x)

41 THE FIXED POINT

of Kuhn and Feyerabend but stays within the Popperian camp because of his persuasion to scientific rationality. Consequently, he intends to generate a theory of scientific rationality which corrects the deficiencies of his predecessor’s works and in which the history of science takes on a crucial role. At this point we shall briefly discuss the basic concepts of the Lakatosian framework which are needed for further investigation.

The main element, the so-called scientific research program, is a series of theories that can be appraised in the light of rational criteria. A scientific research program constitutes a theoretically progressive problemshift ”if each new theory has some excess empirical content over its predecessor, that is, if it predicts some novel, hitherto unexpected fact” (Lakatos 1978a, 34) and an empirically progressive problemshift ”if some of this excess empirical content is also corroborated, that is, if each new theory leads us to the actual discovery of some new fact” (Lakatos 1978a, 34). In the case of both theoretical and empirical progressivity the research program is labelled progressive; if not, it is labelled degenerative. More precisely, if the members of the series of theories provide only post-hoc explanations to empirical facts, then the research program may be called stagnant. In a research program, isolated theories are linked by the positive and negative heuristic. The positive heuristic of the program outlines the problems, problem-solving strategies and procedures to pursue, while the negative heuristic ”tells us what paths of research to avoid” (Lakatos 1978a, 47). The negative heuristic delimits the

’hard core’ – another characteristic element of the research program – which contains irrefutable principles, assumptions, etc. that can never be modified when counter evidence is discovered, or through any other methodological decisions, in spite of the ’protective belt’ of auxiliary, observational, etc.

hypotheses, ”which has to bear the brunt of tests and get adjusted and re- adjusted, or even completely replaced, to defend the thus hardened-core”

(Lakatos 1978a, 48).

Beyond his philosophy of science, Lakatos also provides a methodology for historiography of science which is closely related to his philosophical concept.

He argues that ”philosophy of science provides normative methodologies in terms of which the historian reconstructs ’internal history’ and thereby provides the rational explanation of the growth of knowledge” (Lakatos 1978b, 102). He also points out that any internal history or rational reconstruction

”needs to be supplemented by an empirical (socio-psychological) ’external history’”(Lakatos 1978b, 102); the role of which is to explain those elements of history that cannot be included in a theory of rationality. Hence, scientific research programmes can be evaluated in retrospect by examining the proportion of internal and external histories.

An Appraisal of von neumann’s Paper

Let us first apply this traditional Lakatosian approach – outlined above – to the historical evidence. In the history of economic thought, as concerns the neoclassical research program, von Neumann’s paper clearly represents a progressive problemshift as we saw in the third section of this paper. On the one hand it provided a solution to the existence problem in the Walras-Cassel model. On the other hand, both von Neumann’s model and the fixed point method opened new perspectives in theoretical economic research. Kakutani’s fixed point theorem, which is based also on Neumann’s work, inevitably became a tool for proving the existence of the equilibrium in Arrow-Debreu economy: Uzawa (1962) proved that there exist no other elementary tools with the help of which one can prove the existence theorem.

Indeed, the von Neumann-model also provided the foundations of linear activity models and Neoricardian theories. Nevertheless, the neoclassical and Neoricardian approaches are generally considered to be two competing scientific research programmes. Although Arrow (1989) presents a history of linear development from Adam Smith and Ricardo to the Arrow-Debreu model through the marginalists and von Neumann, Kurz and Salvadori (1993) sharply separate the classical and the neoclassical research program. The hard core of the classical research program – from Quesnay, Ricardo and Marx to Sraffa, through Charasoff, Bortkiewicz and von Neumann – is characterized by the asymmetry in the theory of distribution, where the real wage rate is given from outside the system and profits are residual magnitudes. Furthermore, prices are determined only by production processes which have a circular nature.

However, in the Lakatosian framework it is challenging to consider von Neumann’s paper as an element of both research programs, but one also has to face many similar difficulties in the case of the application of Kuhnian, Popperian or conventionalist methodologies instead of the Lakatosian (see also Chakravarty 1989, 70). Perhaps this is exactly the reason why historians of economics have investigated the economic theoretical background of von Nemumann’s motivation to write the article.

In the history of mathematics, making a value judgement concerning the role of von Neumann’s contribution is also problematic. If we were to give a rational reconstruction of the history of fixed point theorems we would easily identify a progressive problem-shift from Brouwer to Kakutani, where the missing link is von Neumann. In a historiographical approach like this, Kakutani’s theorem is clearly a step forward from von Neumann’s theorem because Kakutani’s theorem can be proved by using the earlier constituted

43 THE FIXED POINT

von Neumann’s theorem. Also, with a strict rational reconstruction one can consider this research programme stagnant, because instead of inference there is equivalence between the two fixed point theorems; i.e. Kakutani’s theorem can also be proven from von Neumann’s theorem, as we saw in the previous section. As a ’simple’ mapping is a special case of pairs of mappings and although von Neumann’s theorem was published earlier, we can identify

’stagnation’, even though Kakutani’s proof is very different when compared to von Neumann’s proof.

The third important component of von Neumann’s article is the introduction of the functional which has a saddle point in the equilibrium. If we start from the Lakatosian approach, namely from the method of rational reconstruction, the saddle point will be a part of external history because there is no ’rational’

explanation (in Lakatosian terms) for why von Neumann introduced that functional, while it has nothing to do either with the existence theorem, or with the fixed point theorem.

The rational reconstruction can be widened if we try to ’rationally explain’

that component by using the text von Neumann mentioned on the first page:

The connection with topology may be very surprising, but the author thinks that it is natural in problems of this kind.

The immediate reason for this is the occurrence of a certain

‘minimum-maximum’ problem, familiar from the calculus of variations. [...] It is closely related to another problem occurring in the theory of games (see footnote I in paragraph 6). (Neumann 1946, 1)

In the given footnote he explicitly shows how the existence-theorem of two-person, zero-sum games (Neumann 1928) can be reconsidered as a special case of this problem. From this point of view one can continue with Nash’s existence-theorem (Nash 1951) concerning n-person games, which was evidently the generalization of the theorem of 2-person games. And, in addition, we have to mention that the generalization of Nash’s theorem to quasi-concave games requires also Kakutani’s fixed point theorem, because the central element of the proof is the so called ’best reply correspondence’

instead of the best reply function. Indeed, the story can be completed with two more points. First, the latter theorem was used as another approach to proving the existence of equilibrium in the Arrow-Debreu economy, and second, the saddle-point (or minimum-maximum) concept is closely related to the Duality Theorem in Linear Programming, the first version of which was also developed by von Neumann (Dantzig 2003, 3). As Thompson mentions, ”He (Dantzig) had a conversation about linear programming with

von Neumann who in November 1947 issued a mimeograph (von Neumann 1947: Discussion of the Maximum Problem, unpublished working paper) which gave the first statement of the duality principle of linear programming”

(Thompson 1989, 233-234).

We have outlined some possible internal histories concerning von Neumann’s work. Some of them were wider or more progressive than others, but all of them left many problems to be appraised: the debates concerning the author’s motivation, the introduction of certain formulae, the method of argumentation, etc. Hence, if we follow the traditional Lakatosian approach, forced into a concrete (economic or mathematical) disciplinary framework, to evaluate the historical significance of Neumann’s article, we face many difficulties.

An Alternative Approach

At this point let us consider von Neumann’s following remark:

A direct interpretation of the function Φ(X,Y) would be highly desirable. Its role appears to be similar to that of thermodynamic potentials in phenomenological thermodynamics; it can be surmised that the similarity will persist in its full phenomenological generality (independently of our restrictive idealisations). (Neumann 1946, 1)

In my opinion, the latter comment, which was not expounded in the original text, plays a crucial role in that history. It suggests that it is unreasonable to restrict the historical analysis to economics or to fixed point theorems, and even to the mathematics of the whole of the social sciences. von Neumann himself suggests an analogy between natural and social sciences. One possible interpretation of this analogy can be found in Bródy (1989), where the author suggests an isomorphism between economics and thermodynamics. Bródy (1989, 145-146) argues that von Neumann’s first equlibrium criterion that

) , (xp

Φ is maximal x in is analogous to the first equlibrium criterion in thermodynamics (i.e. the principle of maximal entropy), while von Neumann’s second equlibrium criterion (that Φ(x,p) is minimal in p) is analogous to the second equlibrium criterion in thermodynamics; i.e. minimal energy.

Although this analogy is not complete – because in phenomenological thermodynamics these equlibrium conditions can be derived from different potential functions which have an extremum point and not a saddle point in equlibrium – Bródy (1989) provides an alternative way of understanding

45 THE FIXED POINT

von Neumann’s motivation in writing the paper in question. He also emphasizes that Neumann’s existence proof is ”the strongest kind available in mathematics: constructive proof” (Bródy 1989, 145). This is important, because in thermodynamics the existence of the desirable potential function is not obvious at all.

Furthermore, as concerns the methodological or philosophy of mathematics background of von Neumann, the existence proof in the paper is constructive, therefore it was made in the spirit of Brouwer’s intuitionism instead of being an indirect proof in the spirit of Hilbert’s formalism, as Punzo (1989, 46) suggests. Von Neumann changed his opinion several times concerning the philosophy of mathematics (von Neumann 1947). Bródy (1989, 141) also provides an external historical argument:

Neumann studied chemistry in Berlin under W. Ostwald, originator of physical chemistry and, more importatntly for us, translator and propagator of J. W. Gibbs fundamental memoir:

’On the Equlibrium of Heterogeneous Substances’ (Gibbs 1878). It is certainly not pure coincidence that two important tools of Gibbsian analysis came to his attention and formed his approach. These new tools were firstly the characterization of permitted variations (of motion, processes, forces, etc.) by inequalities rather than equations, secondly and consequently, the enunciation of max-min criteria for the existence of equilibrium. (Bródy 1989, 141)

Bródy’s arguments outline another historical explanation concerning von Neumann’s motivations for writing the paper and put in a new light the confusion over von Neumann’s classical and/or neoclassical background;

namely that von Neumann simply adopted the thermodynamic idea.

By summing up the previous arguments, one can provide an alternative historical interpretation concerning von Neumann’s article, which is based on his holistic scientific methodology. Three aspects of the article analysed above are very typical of von Neumann’s methodology: First, the way he posed the mathematical problem as a problem of any field, often motivated by an analogy. The second one is his way of constructing relations with many other fields, often by breaking through disciplinary borders. Evidently, there is something similar in the case of computing machines and brain structures (Neumann 1958), where the similarity was not at all obvious. The third one is the profound mathematical solution of the problem.

Figure 1 Map of thoughts concerning the importance of von Neumann’s paper.

If one bears in mind this holistic methodological framework on the one hand and takes seriously the psycho-sociological factors on the other, then a more satisying historical explanation becomes accessible. This new approach to von Neumann’s paper elevates us above the ambiguity caused by the rational method of reconstruction or any other traditional historiographical concept which is motivated by a philosophy of science and which is forced into a disciplinary framework.

6. summARy

This paper attempts to show that the traditional appraisals of one of the most important articles in the history of economics (Neumann 1946) leads us to ambiguous and often oversimplified interpretations of historical facts. After a short introduction I outlined John von Neumann’s economic model, which was created in a general equilibrium framework. Then I overviewed the economic significance of von Neumann’s model in a nutshell and emphasized how substatial this model’s contribution to the development of Economic Science

47 THE FIXED POINT

is, although his theoretical economic background is ambiguous. Further I analyzed the role of von Neumann’s paper in the history of mathematics; more precisely in the history of fixed point theorems. I pointed out that Kakutani’s fixed point theorem (Kakutani 1941) is equivalent to von Neumann’s theorem in that they can be proven from each other. Kakutani’s theorem and hence von Neumann’s theorem is a necessary tool for many obtaining many results in theoretical and applied mathematics, including game theory and the proof of existence of general equlibrium in Arrow-Debreu economy.

Next I gave an appraisal of von Neumann’s work from the point of view of Lakatos’ methodology. I concluded that from a historical perspective this contribution as a part of a scientific research programme can be considered both progressive and stagnant and a probably crucial element of the article becomes a part of external history. So making a value judgement concerning von Neumann’s paper’s historical role is not obvious at all. This ambiguity is caused by the traditional Lakatosian approach to theory evaluation based on research pogrammes that are delimited along disciplinary borders. Such kinds of appraisals of von Neumann’s article result in misleading interpretations and do not help us to find the author’s real motivation for writing the paper. An alternative approach to the appraisal has to involve von Neumann’s holistic scientific methodology and also psycho-sociological factors.

APPendix

If one takes a closer look at fixed point theorems, it can be shown that the original version of von Neumann’s fixed point theorem and Kakutani’s theorem are equivalent, while they can be proved from each other. Let us make this equivalence more transparent.

Theorem 3 Neumann Fixed Point Theorem (original version):

Let

R

m be them

-dimensional space of all pointsX = ( x

1, , x

m)

,R

nthe

n

-dimensional space of all pointsY = ( y

1, , y

n)

,R

m+n the m+n dimensional space of all points( X , Y ) = ( x

1 , x

m, y

1, , y

n)

. A set (inR

m orR

n orR

m+n) which is not empty, convex closed and bounded we call a set C. LetS

0,T

0 be sets C inR

m andR

n respectively and let S0×T0 be the set of all (X,Y)(inR

m+n) where the range of X is S0 and the range of Y isT

0. Let V,W be two closed subsets of S0×T0. For every X in S0 let the set Q(X) of all Y with (X,Y) in V be a set C; for each Y inT

0 let the set P(Y) of all X with (X,Y) in W be a set C. Then the following lemma applies. Under the above assumptions, V,W have (at least) one point in common. (Neumann 1946, 6)If we reformulate the original version of von Neumann’s theorem, we will have the fixed point theorem of pairs of upper hemi-continuous mappings over the bounded, closed, convex sets of the Euclidean space:

Theorem 4 Reformulation of Neumann’s (original) theorem: If

A ⊂ R

mand

B ⊂ R

n are non-empty, bounded, closed, convex sets in them

-, andn

-dimensional Euclidean-spaces and (Q,P) is the pair of upper hemi- continuous, convex mappings of the (A,B) pair of sets into itself, i.e.B A

Q: → and P:B→A; then (Q,P) has at least one fixed point, i.e.

there exists

( x

0, y

0) ∈ A× B

such thaty

0∈ Q ( x

0)

andx

0∈ P ( y

0)

. The latter theorem is equivalent to von Neumann’s original theorem49 THE FIXED POINT

because the correspondences Q(x)=

{

y:y∈B,(x,y)∈V,x∈A}

and{

A W B}

P(y)= x:x∈ ,(x,y)∈ ,y∈ in the original proof are convex and have closed graphs; i.e. they are upper hemi-continuous. Therefore

) ,

(Q P is the the pair of upper hemi-continuous, convex mappings of the (A,B) pair of sets into itself and if

( x

0, y

0)

is its fixed point, thenW V ∩ ) ∈ ,

( x

0y

0 After these preparation, it can be directly shown that von Neumann’s and Kakutani’s theorem can be proven from each other. Let us examine the two possible directions of the proof by following the method of Hegedûs and Zalai (1978).Proof 1 Proof of Neumann’s fixed point theorem by using the Kakutani fixed point theorem: While A and B are nonempty, closed, convex, bounded sets,

n

m

R

R B

A × ⊂ ×

is also a nonempty, closed, convex, bounded set. Let us define the Ψ(x,y)= P(y)×Q(x) correspondence, where (x,y)∈A×B , which is an upper hemi-continuous convex correspondence of the A×B set into itself. Kakutani’s fixed point theorem implies that Ψ(x,y) has a fixed point; i.e. there exists( x

0, y

0) ∈ Ψ ( x

0, y

0) = P ( y

0) × Q ( x

0)

, such that) (

00

x

y ∈ Q

andx

0∈ P ( y

0)

.Proof 2 Proof of Kakutani’s fixed point theorem by using the Neumann fixed point theorem: Let us consider the nonempty, closed, convex set A, and the upper hemi-continuous correspondence Q:A→ A. Let us introduce the following notations:

,

=B

A=

{

(x,y:x A,x=y}

,V ∈

{

( , : , ( )}

.= x y x A y Q x

W ∈ ∈

The recently-defined sets fulfil the conditions of von Neumann’s original theorem; i.e. there exists

( x

0, y

0)

, such that( x

0, y

0) ∈ V ∩ W

. ThereforeA

∈

x

0 andx

0= y

0∈ Q ( x

0)

, which is equivalent to proving the statement.ReFeRences

Arrow, Kenneth J. (1968), ”Economic Equilibrium”, Science, In: David L. Stills ed., International Encyclopedia of Social Science 4, London, The Macmillan Company and The Free Press, pp. 376-88.

Arrow, Kenneth. J. (1989), ”Von Neumann and the existence theorem for general equilibrium”, In: Dore, M.–Goodwin, R. M.–Chakravarty, S. eds., John von Neumann and modern economics, Oxford, Oxford University Press., pp. 15-28.

Bródy, András (1989), ”Economics and Thermodynamics”, In: Dore, M.–Goodwin, R. M.–Chakravarty, S. eds., John von Neumann and modern economics, Oxford, Oxford University Press., pp. 141-48.

Cassel, Gustav (1918), Theoretische Sozialökonomie, Leipzig, C. F. Winter (reprinted in 1923)

Chakravarty, S. (1989), ”John von Neumann’s model of an expanding economy: an essay in interpretation”, In: Dore, M.–Goodwin, R. M.–Chakravarty, S. eds., John von Neumann and modern economics, Oxford, Oxford University Press., pp. 69- 81.

Champernowne, D. G. (1945) ”A note on J. v. Neumann’s article on ‘A model of economic equilibrium’”, Review of Economic Studies, Vol. 13, No. 1, pp. 10–18.

Dantzig, George B. (2002), ”Linear Programming”, Operations Reasearch, Vol. 50, No 1, pp. 42-47.

Gibbs, J. Willard (1878), On the equilibrium of heterogeneous substances. Connecticut Academy of Arts and Sciences.

Hegedûs, Miklós–Zalai, Ernõ (1978), Fixpont és egyensúly a gazdasági modellekben, Budapest, Közgazdasági és Jogi Könyvkiadó.

Káldor, Nicholas (1989), ”John Von Neumann: a personal recollection”, In: Dore, M.–

Goodwin, R. M.–Chakravarty, S. eds., John von Neumann and modern economics, Oxford, Oxford University Press., pp. 3-14.

Kakutani, Shiuzo (1941), ”A Generalization of Brouwer’s Fixed Point Theorem”, Duke Mathematical Journal, Vol. 8, pp. 457-59.

Koopmans, Tjalling (1951), Activity Analysis of Production and Allocation, New York, John Wiley and Sons.

Kurz, Heinz D.–Neri Salvadori (1993), ”Von Neumann’s growth model and the

’classical ‘tradition. ” Journal of the History of Economic Thought, Vol. 1, No. 1, pp. 129-160.

Kurz, Heinz D.–Neri Salvadori (2001), ”Sraffa and von Neumann”, Review of Political Economy, Vol. 13, No. 2, pp. 161-180.

Kurz, Heinz D.–Neri Salvadori (2004),”Von Neumann, the Classical Economists and Arrow-Debreu.” Acta Oeconomica, Vol. 54, No. 1, pp. 39-62.

Lakatos, Imre (1978a) ”Falsification and the Methodology of Scientific Research Programmes”, In: John Worall and Gregory Currie eds., The Methodology of Scientific Research Programmes, Cambridge, Cambridge University Press, pp.

8-101.

Lakatos, Imre (1978b) ”History of Science and its Rational Reconstructions”, In:

51 THE FIXED POINT

John Worall and Gregory Currie eds., The Methodology of Scientific Research Programmes, Cambridge, Cambridge University Press, pp. 102-20.

Leontief, Wassily (1928), ”Die Wirtschaft als Kreislauf”, Archiv für Sozialwissenschaft und Sozialpolitik, Vol. 60, pp. 577-623.

Menger, Karl (1973), ”Austrian Marginalism and Mathematical Economics”, In:

Hicks, John, and Wilhelm Weber eds., Carl Menger and the Austrian school of economics, Oxford, Clarendon Press, pp. 38–60.

Nash, John (1951), ”Non-cooperative games”, The Annals of Mathematics, Vol. 54, No. 2, pp. 286-295.

Neumann, John von (1928), ”Zur Theorie der Geselltschaftsspiele”, Mathematische Annalen, Vol. 100, pp. 295-320.

Neumann, John von (1932), Mathematische Grundlagen der Quantenmechanik.

Berlin, Springer, Berlin, translated from German by Robert T. Beyer, Princeton University Press, 1955.

Neumann, John von–Morgenstern, Oscar (1944) Theory of Games and Economic Behavior, Princeton, Princeton University Press.

Neumann, John von (1945), ”A Model of General Economic Equilibrium”, The Review of Economic Studies, Vol. 13, No. 1 (1945-1946), pp. 1-9.

Neumann, John von (1947), ”The Mathematician”, In: R. B. Heywood ed., The Works of the Mind, Chicago University of Chicago Press, pp. 180-196.

Neumann, John von (1958), The Computer and the Brain, Yale University Press (reprinted in 2000).

Punzo, Lionello F. (1989), ”Von Neumann and Karl Menger’s mathematical colloquium”, In: Dore, M.–Goodwin, R. M.–Chakravarty, S. eds., John von Neumann and modern economics, Oxford, Oxford University Press., pp. 29-65.

Schwalbe, U.–P. Walker (2001), ”Zermelo and the Early History of Game Theory”, Games and Economic Behavior, Vol. 34, No. 1, pp. 123-37.

Remak, Robert (1929), ”Kann die Volkswirtschaftslehre eine exakte Wissenschaft werden?”, Jahrbücher für Nationalökonomie und Statistik, Vol. 131, pp. 703-35.

Schlesinger, Karl (1935), ”Über die produktionsgleichungen der ökonomischen Wertlehre” In: Kal Menger ed., Ergebnisse eines mathematischen Kolloquiums 1933- 34, Heft 6, Leipzig und Wien: Franz Deuticke, pp. 10-11. (English translation:

Baumol, W. J.: ”On the Production Equations of Economic Value Theory” In:

Baumol, William J.–Goldfeld, Stephen M., eds. Precursors in mathematical economics. LSE Series of Reprints of Scarce Works on Political Economy, No. 19.

London: LSE, 1968.

Sraffa, Piero (1960), Production of Commodities by Means of Commodities: Prelude to a Critique of Economic Theory, Cambridge, Cambridge University Press (reprinted in 1975).

Thompson, Gerald L. (1989), ”John von Neumann’s Contribution to Mathematical Programming Economics, John von Neumann and Modern Economics”, In: Dore, Mohammed– Goodwin, Richard M. – Chakravarty Sukhamoy eds., John von Neumann and modern economics, Oxford, Oxford University Press.

Uzawa, Hirofumi (1962), ”Walras’ existence theorem and Brouwer’s fixed point