MARKET VERSUS BUREAUCRACY – PRICE REGULATION IN THE ELECTRICITY RETAIL SECTOR

Felsmann, Balázs – Mezősi, András – Szabó, László

Corvinus University of Budapest, Regional Energy Policy Research Centre

E-mail: balazs.felsmann@uni-corvinus.hu, andras.mezosi@uni-corvinus.hu, lszabo@uni-corvinus.hu

Abstract

While several economists and European institutions support further liberalization of the energy retail sector, others oppose it on the grounds that end-user price control and the right of states to maintain a system of regulated prices results in more sustainable energy service at affordable prices for households. The roots of this dilemma can be traced to a longstanding economic debate on the primacy of coordination types in society. Although the general coordination form of the capitalist system is indisputably the market, there are several situations whereby other forms of coordination such as bureaucratic, ethical and aggressive (Kornai, 1983) still have a significant role. In this paper we review the regulatory framework of the European countries and examine the impacts of price setting forms on consumer price trends in the electricity sector. Our aim is to measure the impact of the regulatory regime on the main stakeholder groups such as energy consumers, economic actors and the society. We seek to answer whether the energy market actors are capable of effectively coordinating social interactions, or if not, should a central planner correct the anomalies and market failures.

Available EU electricity sector statistical data is used to assess the impacts of the various price setting regulatory methods on the functioning of the market.

1. Introduction

In 2016, the European Commission proposed a new legislative measure on the termination of end-user price regulation within the European Union, after a longstanding debate between EU Member States (MSs) on the future of regulated prices in the electricity retail sector. The Commission suggested to phase-out regulated prices because price

regulation – mainly the prices below cost – limits the competition and distorts the market

2

equilibrium (EU, 2016). After several consultations with stakeholders and debates within the Council, the Council published a new proposal at the end of 2017, which still holds the opinion that retail price regulation constitutes “a fundamentally distortive measure that often leads to the accumulation of tariff deficits, limitation of consumer choice, poorer incentives for energy saving and energy efficiency investments, lower standards of service, lower levels of consumer engagement and satisfaction, restriction of competition as well as fewer innovative products and services on the market.” (Council, 2017, p. 7). However, as a compromise, Member States are allowed to maintain the system of regulated prices in the case of severely constrained supply or permanent market failures when other regulatory measures seem inappropriate.

A fault line essentially divides EU MSs into two groups that is reflective of their historical background and geographical location. The group of “non-regulated” countries includes 15 MSs, which have already phased out end-user price regulation. This group mainly represents the old EU members, but Czech Republic, Slovenia and Estonia are exceptions. The “regulated” group comes from the new members, although France, Denmark and Portugal still keep enforce some elements of retail price regulation.

The main issue arguing for or against the regulated prices is whether the current market conditions justify a substitution for the market - the primary coordination form of the capitalist system - with a centralized bureaucratic control mechanism. The divided current practices of European countries demonstrates that the answer has not been crystallized yet.

Our study compares the two types of regulatory framework, looking to find whether any broad circumstances, such as the society’s welfare, justify centrally defined regulatory prices.

First, we review the theory of price regulation, giving a brief overview on the impact of dominant coordination forms. This is followed by a concise assessment of the EU electricity markets, where the performance of the two clusters – regulated and non-regulated markets – are assessed

according to two dimensions: on the mark-ups applied in the various MSs and on the supply cost ratios achieved. The assessment covers the EU MSs, but we also apply a price regulatory example of Hungary, with its specific characteristics. The conclusion section summarizes our findings.

2. Economic roots of the debate – price regulation in the theory

The path of coordination is affected by several primary factors relating to both organizational and social levels. Kornai (1983) distinguishes between four forms of coordination: market, bureaucratic, ethical and aggressive. A coordination mechanism regulating a specific process might change in either time and/or space. Generally, capitalism

3

is accepted as the primacy of market coordination. However, nowadays, scientific discussions about increasing direct state involvement in certain economic areas is coming of age. The economic model based on market coordination was obviously shaken around the world by the crisis in 2008, inspiring various economists and politicians to revise their theses on

coordination mechanisms that support the way out of such crises. The post-crises management literature reflects the changing attitude to direct state involvement to the economy. Numerous articles about the crises of the global capitalism and the increasing share of the state – such as guarded way of globalization, the model of the state capitalism and protectionism (Bower et al., 2011, Bremmer, 2014, Ghemawat, 2010) – illustrate emerging challenges on the

dominance of market coordination in the capitalist system.

2.1. Impacts of dominant coordination forms

The role of the state to society and industry is manifested in the structure of formal institutions. The institutional environment is part of a complex system, including

organizations and firms, industries and the social, ecological, political, technological and economic environment. Formal institutions have been established to define and guard the general rules of the game (North, 1990 p. 3). While the main role of institutions “is to reduce uncertainty by establishing a stable (but not necessarily efficient) structure for human

interaction” (North, 1990 p. 6), this does not mean that the institutions themselves are unchangeable. The relationship between institutions and organizations has a mutual impact:

“institutions affect the economy and are themselves shaped by the behaviour of the actors in the economy.” (Nye, 2008, p. 76.). Although a change in any institutional environment is a slow process, the distribution of resources and political institutions tend to persist, and this fact does not represent an immovable constraint but, rather, a slow, evolutionary way of modification of institutions and firms (Acemoglu, 2008).

The state has various opportunities to intervene in market processes through entry and exit barriers, market rules and regulations. These interventions are intended to correct market failures, restore the equilibrium and increase overall economic welfare. Our study examines the price regulation as a commonly used method of direct state interventions. OECD (1993) defined the notion of price regulation as the following: “the policy of setting prices by a government agency, legal statute or regulatory authority.”

Kornai (2011) compares the performance of capitalist and socialist economies in terms of innovation capabilities. He clearly associates the successful criteria with capitalist

4

enterprises, which state-owned companies are unable to reproduce. In order to be the driver of innovation, it needs to meet certain requirements, ones which are difficult to reproduce in a state environment. Kornai comes up with five factors - the drivers of innovation - in a capitalist economy: a) a chance for decentralized initiatives; b) available - and non-

constrained - premium; c) competition; d) possibilities for and the right to experiment; e) free capital and flexible financing. He does not say that the above conditions are impossible within a framework of bureaucratic coordination and central planning - though his empirical research does show that it is quite difficult. Kornai warns that an optimal mix of bureaucratic and market coordination is illusory since they cannot be combined arbitrarily. If the existence of both mechanisms is justified in a process, it is desirable to separate them as clearly as possible, precisely defining what elements of the process are entrusted to the market and to the "wisdom" of bureaucracy. Based on the five factors listed by Kornai, it is clear that price regulation limits their effectivity. Centrally controlled prices restrict competition, limit the profitability and abolish the prevalence of decentralized initiatives. To justify the legitimacy of the bureaucratic control on electricity prices there need to be strong arguments which can balance the lower innovation potential of the centrally regulated market.

Bergson (1967) and Kornai (2005) draw attention to a similar problem in a different context, citing an earlier economic debate in the 1930s between Lange and Dickinson, on the one hand, and Hayek and Mises, on the other hand. The major question of the debate was whether a central planner could fulfill the "anarchic" but functioning co-ordination role of the market in a centralized economy. According to Lange (1936), the price-fixing role of the market can be interchanged with an artificially developed price system where the central planning board (CPB) adjusts the price of a given product accordingly, justifying the change in its demand and supply conditions. Prices are approaching the equilibrium by dynamic changes (through trial and error processes) even if the central planner designated the starting price artificially.

Hayek (1940), in his critical reaction, draws attention to several problems related to the centrally developed price system. How will the CPB be able to handle the high volume of prices in parallel, to fully understand their interactions with one other and to make appropriate price-setting decisions on that basis? According to Hayek, the artificial pricing of products with relatively homogeneous characteristics, such as commodities and utility prices, are also problematic. These products (typically raw materials and energy services) are incorporated into very different types of end products where the final product price will be the most

5

important parameter of what the project-level price is ready to accept from the end-product contractor for the required raw materials. However, Hayek's reading not only means that all product prices should be set, but that it should be possible to set individual central prices for all possible combinations of all products, which is methodologically challenging to

implement. Additionally, if we accept that for technical reasons prices cannot be change continuously, only intermittently (periodically), and cannot be defined as unique product combinations, but only in groups of these, this system will deviate from a free market coordination mechanism and performance will inevitably lag behind. The analogies of

economic debate of the 1930s and the current European political debate on regulated end-user electricity prices are clear. It is not difficult to discover the similarity between Lange’s Central Planning Board and the price-fixing methods of energy administration authorities.

2.2. Regulatory prices in the electricity system

Price regulation can be found all along the electricity value chain (Cambini & Rondi, 2010, Cave & Stern, 2013, Pollit, 2012, Pápai et al., 2013). The fixing of network prices is generally within the scope of regulation by authorities, including the prices of the

transmission system operator (TSO) and distributed system operators (DSOs). Input

operations and output control are distinguishable with the degree of regulation. Selection of a regulatory method depends on the controllability, predictability and ability to monitor the activity (Glachant et al., 2012). If these conditions are partly fulfilled, the authorities generally regulate inputs through the approval of the real cost incurred by the effective service provider.

If the activity of a service provider is predictable, the authority can choose to have either partial or total control of prices. A price cap or revenue cap are examples of partial control, though official price fixing ensures exclusive control of the regulated activity.

The above-mentioned regulatory models are used mainly by the authorities for defining the prices of natural monopoly services – the tariffs of network service providers. Yet the central price fixing is still applicable in the case of actors in the commercial value chain. The regulatory bodies may intervene to create a universal service price in several ways due to the above price-regulating possibilities. The first possibility is partial regulation, in which the official price is fixed via benchmarking between universal service providers and their

customers, or a regulated (maximized) margin, which covers operational costs and the income of the universal service provider. This model theoretically ensures competition between universal service providers if they are able to undercut official benchmarked prices and/or

6

their operational efficiency is better than their competitors. The other regulatory method is the output regulation - the price fixing of universal services through regulatory actions. In this model, the authority fixes prices via law for a definite time period (generally for each quarter), which shall be applied by all relevant service providers.

The fact that the European Union regulated the basics of market organization and public services in the field of electricity via Directives and not Regulations gave MSs wide range of opportunities to decide whether and in what way they might apply the official regulations regarding the energy trade.

3. (De)regulating electricity supply prices – impact on retail prices and competition

The European electricity sector is characterised by increasing competition in the retail market segment promulgated by the various EU legislation (first, second and third EU energy packages). The wholesale electricity market is deregulated in all MSs and the only segment where price regulation is fully retained is the network related operations at the transmission and distribution levels. Many countries have also completely deregulated the retail price segment so all consumers (including households and SMEs) buy electricity in competitively organised markets. However, many countries maintain regulated prices for end-user

households and SMEs, aiming to protect these consumer groups from sudden price increases expected at the onset of the market opening process. Their main defence is that the small consumer segment is more vulnerable to exposure to market competition. Governments implementing price regulation in the retail segments argue, that these consumers are not well informed, which would prevent them from selecting the right contracting partners, or policy makers expect less completion amongst suppliers due to some specific markets

characteristics, such as small market size or very concentrated supplier market. ACER Market Monitoring Reports show that 13 out of 28 EU MSs still apply retail price regulation in their electricity market for household consumers.

3.1. Assessment of the price setting mechanisms

The following initial assessment looks deeper into this situation and tries to detect if there are observe meaningful differences in the prices and price setting mechanisms between the two groups of countries with regulated and non-regulated retail prices. The split of

7

countries is based on the ACER Market Monitoring reports, tasked with assessing the

European wholesale and retail electricity and gas markets (ACER MMR reports 2012-2016).

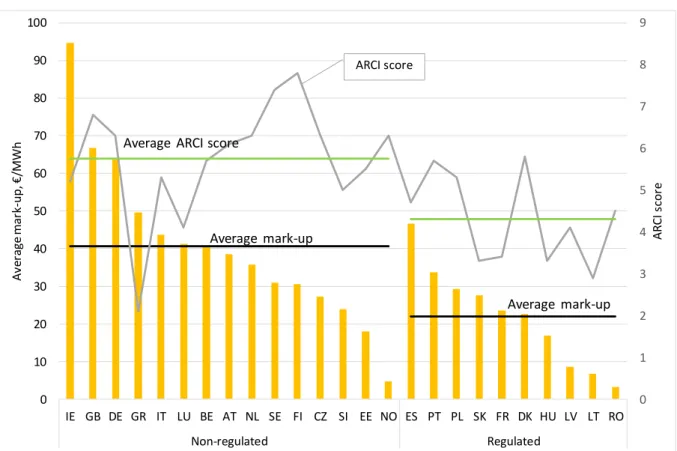

Figure 1 categorises the 24 MSs plus Norway (Bulgaria, Cyprus and Mala are not covered due to limited information availability) that will be assessed, including the average mark-ups and characterises of their retail competition level based on the ACER ARCI index (ACER 2015). This index is introduced first in details in Table 1 below.

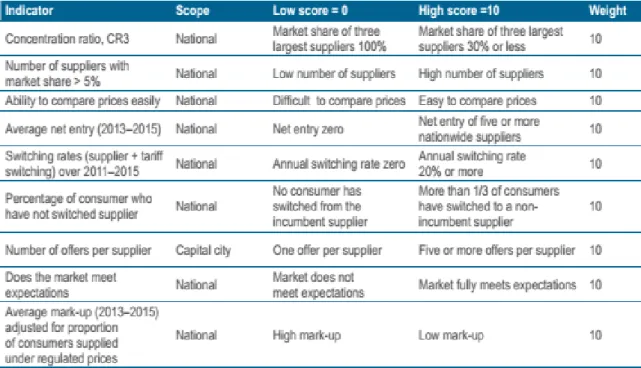

Table 1: Composition of ACER Retail Competition index (ARCI)

Source: ACER (2015)

The ARCI index is the weighted sum of the nine components listed in the above table, measuring the intensity of competition for consumers, characteristics of suppliers, consumer behaviour, information availability on offers and switching rates. The index applies equal weighting schemes to the components. It must be noted that the mark-up rate is amongst the components, which raises endogeneity concerns when the index is compared to the mark up level, however with only a 11 % weight it is not as consequential.

8

Figure 1: Average mark-ups between 2012-2016 in EU countries and their ARCI scores

Source: ACER (2013), ACER (2014), ACER (2015), ACER (2016), ACER (2017) and own collection (wholesale price)

The average mark-up is calculated as the difference between the country specific retail price and wholesale price. Retail price values are used from ACER MMRs of 2012-2016.

This is a ‘cleaned,’ energy only, retail price, and because pass-through elements like RES support, network costs and taxes are excluded in the calculation, the mark-up is comparable between the countries. The wholesale price used is the average day-ahead baseload price over a given year. The grouping of regulated vs. non-regulated countries is based on ACER (2016), which identifies 10 countries with regulated and 15 countries with non-regulated prices. The two groups are mixed geographically: the non-regulated group includes some new members states as well (CZ, SI and EE), while the regulated group has mature EU member states, such as FR, DK and PT.

Comparison the two groups provides some straightforward messages. The ARCI scores are significantly higher in the non-regulated countries, indicating stronger competition

characteristics in the group. Interestingly the lowest scoring country, Greece, is in the non- regulated group. There is an even more robust difference in the average mark-up level

0 1 2 3 4 5 6 7 8 9

0 10 20 30 40 50 60 70 80 90 100

IE GB DE GR IT LU BE AT NL SE FI CZ SI EE NO ES PT PL SK FR DK HU LV LT RO

Non-regulated Regulated

ARCI score

Average mark-up, €/MWh

Average mark-up Average mark-up

ARCI score

Average ARCI score

9

between the two groups. Non-regulated countries have a 20 €/MWh higher mark-up than the regulated group, which is quite significant given this mark-up is above the wholesale price itself in some countries. At the same time there is a high variation within the two groups as well, between 5 to 95 €/MWh in the non-regulated segment and 3 and 47 €/MWh in the regulated group. On the surface, the results seem to support advocates of retail price regulation that protect consumer segments from the price increase due to market opening, even if due to the limited availability of data this difference is not conclusive.

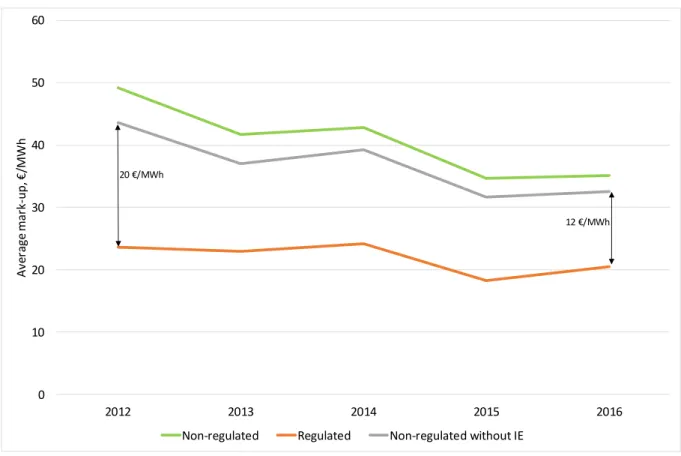

Taking a simple average of the mark-up in the two groups over the five-year period, the trend is more accentuated for the non-regulated mark-up, falling from the 47 €/MWh to 34

€/MWh, and only a 6 €/MWh in the non-regulated segment. These trends reaffirm that non- regulated retail markets track market developments while regulated markets have are less volatile.

Figure 2: Average yearly mark-ups between 2012-2016 in non-regulated and regulated countries

Source: ACER (2013), ACER (2014), ACER (2015), ACER (2016), ACER (2017) and own collection (wholesale price)

0 10 20 30 40 50 60

2012 2013 2014 2015 2016

Average mark-up, €/MWh

Non-regulated Regulated Non-regulated without IE

20 €/MWh

12 €/MWh

10

The spread between regulated and non-regulated mark-ups falls from 20 €/MWh to 12

€/MWh. Although the ARCI index only started in 2015, it increases in both categories within a similar range in the two years.

Table 2: ACER ARCI index for 2014 and 2015

2014 2015 Diff

Average ARCI score

NR 5.51 5.75 0.24

R 4.01 4.30 0.29

NR* 5.56 5.79 0.23

All 4.91 5.17 0.26

Source: ACER (2015)

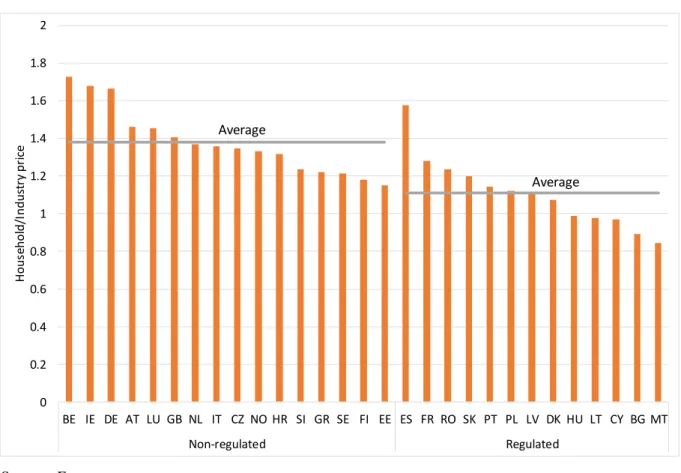

A comparison between the industrial and household price levels further separates each group.

Figure 3: Household (between 2500-5000 kWh/year consumption) and industry (between 20-500 MWh/year consumption) supply cost ratio in 2016

Source: Eurostat

We calculated the ratio of household and industrial retail prices (H/I index) for costs related to energy and supply, excluding network costs, taxes and levies, but possibly including

0 0.2 0.4 0.6 0.8 1 1.2 1.4 1.6 1.8 2

BE IE DE AT LU GB NL IT CZ NO HR SI GR SE FI EE ES FR RO SK PT PL LV DK HU LT CY BG MT

Non-regulated Regulated

Household/Industry price

Average

Average

11

RES fee (as the reference does not provide information on it). In theory household/industry cost ratio should be significantly higher than 1 because, due to more volatile consumption characteristics and lower economy of scale, supplying households tend to be more costly compared to industrial consumers. Figure 3 shows that the household/industry cost ratio is 1.1 in regulated countries and 1.38 in non-regulated countries Furthermore, several countries below 1 in the H/I index (e.g. MT, BG, CY, LT, HU) are observable, indicative of sizeable cross-financing. Cross-financing can result from natural adjustment in countries with highly suppressed household prices, as retailers might try to recover some of the foregone income of the household segment in the competitive segment covering industrial consumers. This indicator reveals an important negative impact of retail price regulation, namely the appearance of cross-financing between the various consumer groups.

3.2. Impacts on flexibility

The various regulatory practices introduced in section 2.2. have adverse effects on the operational efficiency of the regulated markets, notably the inability of actors to follow market trends in their pricing. In this section we present the example of Hungary to demonstrate how the system loses its flexibility in price formation.

After markets were fully opened in Hungary between 2008-2011, a partial price

regulation model was implemented. After the government took power in 2010, it changed the model to an output regulation, and under Act LV of 2010 gained the power to define fixed regulated prices. From 2011 the universal price of electricity has been regulated by

Ministerial Decree.

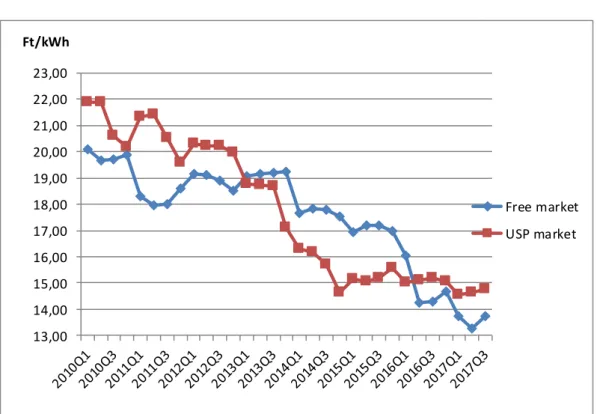

Hungary introduced a three-step price reduction scheme in 2013 and 2014, where a 24.55% end-user electricity price cutback was achieved for the universal service segment (mainly consisting of the household consumers). Figure 4 illustrates the price development for the universal services segment and the market segment. The prices are from the Hungarian Energy Regulator (HEPURA) database, and calculated as the ratio of total revenue to supplied electricity.

12

Figure 4: End user prices for electricity – Hungary, 2010-2017

Source: Compiled by the authors, based on HEPURA data

As the figure illustrates, the politically mandated 25% price reduction brought the Hungarian universal service price well below the price of the market segment. This price difference reflects an inefficient pricing structure, as the universal service consumers are more expensive to serve than larger industrial consumers. The expected price spread did not emerge following the 2013 price intervention, when average universal service prices were below large consumer prices. This pattern held until the end of 2016, when further wholesale price

reductions led to significant price cuts even in the large consumer segments. Interestingly, universal services did not follow the course, remaining constant in the 2015-2017 period. This demonstrates how the politically mandated price cut regime of 2013-2014 built up

inflexibilities in the pricing system.

Although the price trends in the figure suggest that the overall policy intervention was not without a long term economic rationale, the timing of the cuts suggest that policy makers were rather anxious to see lower prices before elections in 2014. But this rather rapid change kept universal service prices constant for a longer period (even up till now), reflective of the high rigidity characteristic to the system.

13,00 14,00 15,00 16,00 17,00 18,00 19,00 20,00 21,00 22,00 23,00 Ft/kWh

Free market USP market

13

4. Conclusions

➢ Price regulation can reduce mark-ups for consumer segments which can be highly volatile in some countries. However, we cannot judge if the mark-ups measured by ACER in some countries (e.g. Ireland, UK and Germany) can be explained by non- captured country specific factors.

➢ It is clear that end user price regulation contribute to some negative externalities in the sector, such as cross-subsidisation of various consumer groups. This has negative consequences for both segments, reducing competitiveness of large energy intensive industries and eroding HH incentives for energy saving measures.

➢ Additionally, price regulation may impact the flexibility of market actors to follow market forces in their pricing strategy. As the Hungarian price regulation case illustrates, the politically driven price cuts of 2013-2014 resulted in price rigidity for more than a five year period, whereby universal service providers could not adjust to the falling wholesale prices over the period.

References

[1] Acemoglu, D. (2008): Growth and institutions. In: The New Palgrave Dictionnary of Economics, Second Edition, 2008. Ed.: Durlauf S. N. & Blume L. E. Palgrave Macmillan, 2008, pp. 1-9. (online edition, http://www.dictionaryofeconomics.com)

[2] ACER (2016): Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets in 2016 - Retail Markets, October 2017, ACER/CEER

[3] ACER (2015): Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets in 2015 - Retail Markets, November 2016, ACER/CEER

[4] ACER (2014): Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets in 2014, November 2015, ACER/CEER

[5] ACER (2013): Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets in 2013, October 2014, ACER/CEER

[6] ACER (2012): Annual Report on the Results of Monitoring the Internal Electricity and Gas Markets in 2012, November 2013, ACER/CEER

[7] Bergson, Abram (1967): Market Socialism Revisited. Journal of political Economy, Vol. 75, No. 5 (Oct, 1967) pp. 655-673.

[8] Bower, J. L., Leonard H. B. & Paine L. S. (2011): Global Capitalism at Risk: What Are You Doing About It? Harvard Business Review, pp. 105-112.

[9] Bremmer, I. (2014): The new rules of globalization. Harvard Business Review, 92(1), 103- 107.

[10] Cambini, C. and Rondi, L. (2010): Incentive regulation and investment: evidence from European energy utilities. Journal of Regulatory Economics, Vol. 38. No. 1. 1–26. o.

14

[11] CEER (2012). CEER Status Review of Customer and Retail Market Provisions from the 3rd Package as of 1 January 2012. Council of European Energy Regulators, C12-CEM-55-04.

Brussels, 7 November 2012

[12] Council of the European Union (2017): Outcome of Proceedings: Proposal for a Directive of the European Parliament and of the Council on common rules for the internal market in electricity. Brussels, 20 December 2017

[13] Coase, R. H. (1937): The nature of the firm. Economica, 4 (16), pp. 386-405.

[14] Deák, A. (2006): Diversification in Hungarian Manner: The Gyurcsány Government’s Energy Policy. International Issues & Slovak Foreign Policy Affairs (03-04/2006) pp. 44-55.

[15] ERGEG (2010): Status Review of End-User Price Regulation as of 1 January 2010. European Regulators Group for Electricity & Gas. Ref: E10-CEM-34-03. Bruxelles, 8 September 2010.

[16] European Commission (2014): Energy prices and costs report. Comission Staff Working Document, SWD(2014) 20 final/2. European Commission, Brussels, 17 March.

[17] European Commission (2016): Proposal for a Directive of the European Parliament and of the Council on common rules for the internal market in electricity. Brussels, 30.11.2016 COM(2016) 864 final. 2016/0380 (COD).

[18] Eurostat household and industry price database, www.eurostat.eu

[19] Ghemawat, P. (2010): Finding your strategy in the new landscape. Harvard Business Review, 88 (3), 54-60.

[20] Glachant, J. M., Khalfallah, H., Perez, Y., Rious, V., & Saguan, M. (2012). Implementing incentive regulation and regulatory alignment with resource bounded regulators. EU Working Papers, RSCAS 2012/31. European Universitiy Institute.

[21] Gulati, R., Nohria, N., & Wohlgezogen, F. (2010). Roaring out of recession. Harvard Business Review, 88(3), 62-69.

[22] Hayek, Friedrich A. von (1940): The Competitive ‘Solution’. Economica, New series, Vol. 7, No. 26 (May, 1940), pp. 125-149.

[23] Kornai János (1983): Bürokratikus és piaci koordináció. Közgazdasági Szemle, XXX. évf. 9.

szám, 1025-1038. oldal.

[24] Kornai János (2011): Innováció és dinamizmus. Kölcsönhatások a rendszerek és a technikai haladás között. In: Gondolatok a kapitalizmusról. Akadémiai Kiadó, Budapest 2011.

[25] Lange, Oskar (1936): On the Economic Theory of Socialism: Part One. The review of Economic Studies, Vol. 4, No. 1 (Oct. 1936) pp. 53-71.

[26] North, D. C. (1990): Institutions, Institutional Change and Economic Performance. Cambridge University Press.

[27] Nye, J. (2008). Institutions and Institutional Environment. In: Brousseau, E., & Glachant, J.

M. (eds.). New Institutional Economics: a Guidebook. Cambridge University Press. pp. 67-80.

[28] OECD (1993). Glossary of Industrial Organisation Economics and Competition Law, compiled by R. S. Khemani and D. M. Shapiro, commissioned by the Directorate for Financial, Fiscal and Enterprise Affairs,.

[29] Pápai, Z., Nagy, P. & Micski, J.(2013). Az összehasonlító költségvizsgálatok módszertani kérdései és használata az energiaelosztók szabályozásában. In: Valentiny, P., Kiss, F., L. &

Nagy, Cs. I.(szerk.): Verseny és szabályozás, 2012. MTA KRTK Közgazdaság-tudományi Intézet, Budapest, pp. 222–255.

[30] Pollitt, M. G. (2012). Lessons from the history of independent system operators in the energy sector. Energy Policy, 47, 32-48.

[31] Williamson, O. E. (1985): The economic intstitutions of capitalism. Simon and Schuster.