Missed Opportunities

of Simplification Regarding Personal Income Tax Systems in Hungary

Éva szabóné Bonifert

Budapest University of Technology and Economics eva.bonifert@kormanyiroda.gov.hu

summary

The paper investigates – considering also the simplified basic elements of the current system – the possibilities of simplifying the Hungarian personal income tax system’s composition in the previous years, while tax burden curves of the system change as little as possible. Tax burden curves of the theoretical, simplified tax model established for this investigation are fitted to the curves of the real tax system, while the parameters of the theoretical model are determined by a computer program.

since the modern Hungarian income taxation had been introduced, the system has long been subject to a wide variety of changes concerning the basic elements examined in the study. selecting some of these years of changes, the study analyses the possibilities for simplification in order to ask the question again: whether it is necessary to maintain complex tax systems at all costs, possibly in favour of achieving the most equitable income tax system. The results of the investigation indicate that our simpler theoretical system could have replaced with a good approximation the elements of Hungarian tax systems of previous years with multi-bracket and sometimes complicated tax credit, which even applied more tax benefit elements compared to the theoretical system. on this basis, it may be an important aspect also for the more distant future that in the course of developing personal income tax systems, the sophisticated equity of the systems should be observed through the mathematical spectacles of simplification options.

Keywords: optimal taxation, tax burden curve, personal tax system, simulation systems JEL codes: H21, c61, K34

DoI: https://doi.org/10.35551/PFQ_2021_3_2

I

In order to achieve a desired redistributive effect, there is no single right solution for finding the optimal composition of economic policy instruments, given that factors determining redistribution tend to form an extremely complex system. Nevertheless, the choice between equitableness or efficiency and simplicity is an important area to consider.In a study published in Issue 2020/4 of the Public Finance Quarterly, we examined possibilities for simplifying the 2018 personal income tax systems of the other Visegrád countries – the czech Republic, slovakia and Poland – by drawing conclusions from the theoretical starting point outlined (szabóné Bonifert, 2020).

The simple, opTimal Tax sysTem in general

Now, when analysing the relevant literature, we examine again the possible principles of a theoretical, simple, optimal and efficient tax system, with regard to the fact that tax systems represent one of the most fundamental regulatory areas for governments to use for redistribution purposes.

According to Lentner (2018), as a main requirement, a good tax system must be observable and enforceable, simple, transparent, and clear in terms of its necessity.

Its implementation in practice depends on a government’s objectives, internal financial independence, constitutional principles and considerations of economic rationalisation.

However, according to him, a good tax system is mainly a category of tax theory, which – in practice – can only be approximated.

An efficient tax system allows a government to collect adequate budget revenues by using the tax system for, among others, minimising distortions in the allocation of economic

resources, and supporting economic growth (Parragh, Palotai, 2018).

A government’s economic policy applied for economic growth may also justify a process of changes in the tax system, as shown by an analysis of Erdélyi et al. (2020) in connection with the impact of Hungary’s post-2010 countercyclical economic policy on nominal changes in tax revenues.

Kürthy (2010) pointed out that hidden economy, concealment of income and tax fraud are also obstacles to simplification.

Tax measures in principle only affect legal incomes; however, they may also have the effect of increasing (whitening) or decreasing (blackening) the amount of legal income within incomes actually paid in the economy (Baksay, csomós, 2014).

According to some, there are no tax brackets in a simple tax system, and there are no tax or tax base benefits either (Bánfi, 2011).

others consider a degree of progressivity to be permissible for the sake of equity if a form of linear taxation is used: a combination of a constant tax rate and tax benefits. However, the open international economic environment, in which a perfectly simple tax system is not possible, must also be taken into account.

Pursuant to Giday (2017), progressivity is not equally effective in the case of all types of taxes: a multi-rate system is more efficient for value added tax, and a single-rate system may be appropriate for personal income tax.

If progressivity is increased, it may strengthen equity, but we must also be careful for it can curb income-generating activities.

The tax rate considered to be the most appropriate also depends on what economic operators think about equity and the capacity of taxes to hold back work (Heady, 1993).

When examining optimal parameters of income taxation, Mirrlees (1971) found that the optimal tax table is close to the linear shape; whereas, for example, according to

Diamond (1998) and Saez (2001), it is most appropriate for marginal tax rates if the tax table is “u-shaped”: for low and high incomes, tax rates are higher than in the middle of the income distribution. Heathcote and Tsujiyama (2019), however, drew attention to the fact that the optimal tax table also depends on the pressure on the state to increase revenues: as the pressure increases, the composition of the tax rates of the optimal tax table changes from

“flat” to u-shaped. Farhi and Gabaix (2020) explore a new perspective, and re-examine traditional theories of optimal taxation, using behavioural agents, in order to incorporate behavioural effects into theories. In their view, a number of such factors [e.g., nudge1; how much attention taxpayers pay to taxes;

behavioural attitudes related to non-linear (income) taxation problems etc.] may have an impact on the optimal policy, which factors have not yet – or barely – been measured.

Balogh (2013), however, draws attention to the fact that a system of taxation that is progressive regarding equity may be too complicated due to measures put in place to offset the side effects of progressivity.

opporTuniTies for The

simplificaTion of Tax sysTems

The previous study (szabóné Bonifert, 2020) applied theoretical considerations to examine the possibilities of simplifying parameters of personal income tax systems and the system of tax rates and tax benefits within a certain framework. In this context, however, it applied new considerations as a basis: it examined the possibility of simplifications in the czech, slovak and Polish personal income tax systems, assuming no change in tax burden on taxpayers. The results of the analysis showed that the theoretical and simpler tax model – within certain limits – typically approximated

the tax burden curves of the examined tax systems, and, therefore, we considered it possible to raise the idea of reducing the number of parameters used.

Nevertheless, the study did not go into detail on the analysis of the Hungarian tax system, as the number of its tax brackets and the system and complexity of its tax benefits allowed no further simplification possibilities according to the method of the study.

We thought that what is worth analysing according to the above aspects is the evolution of the Hungarian system over a broader period of time, while examining any missed simplification possibilities in the systems of previous years.

This is the aim of the present study:

using the method outlined and the software application applied in the previous study, it takes samples of some previous Hungarian personal income tax systems to examine possibilities for simplification thereof, so that we may pose the question again: is it necessary to maintain complex tax systems – perhaps to achieve a more equitable income tax system – at all costs?

changes in The hungarian personal income Tax sysTem

The cornerstones of today’s modern Hungarian tax system were laid down before the change of regime, in 1988. The system introduced then made all income taxable, according to a progressive tax table, but a number of exceptions and reductions could be applied to determine the final tax.

In the first twenty-five years of this new tax system, the fundamentals changed many times and to a great extent. Its history was characterised by constant changes in tax rates and a constant broadening of tax bases (Ilonka, 2004).

According to Lentner (2018), in the first two decades after the change of regime, Hungary’s tax policy was characterised by dysfunctionality, with foreign companies (which typically had a high tax burden capacity) receiving tax benefits, while domestic companies operating under normal or even above-normal tax burdens. A high amount of income withdrawn from domestic enterprises and an increase in tax payments led to the strengthening of the black economy and then to a fiscal imbalance in public finances.

The tax system – when the government was facing constraints – differed from the carrying capacity of taxpayers.

The tax table was originally defined with the idea in mind that those with lower incomes should be exempt from taxation, a rule to help increase the social acceptance of the new tax system and create a reducing effect on the costs of introducing and operating the tax system (Juhász, 2019b). In addition to progression, the question of whether or not there should be a zero tax rate band was also debated many times. This was necessary in order to introduce the system, however, the general principles of equal tax treatment were against it. The 0 percent rate was abolished pro-forma starting from 1996 (pro-forma, because, for most taxpayers, the tax benefit system substantially reduced the amount of tax, often to zero, Juhász, 2019a).

After applying eleven tax rates and a highly progressive tax table in the first year, policy-makers believed that the most sensible measures included a simplification of tax tables and a broadening of tax bases through the narrowing of various tax benefits. However, the specific steps were not so simple to take. In the years of high inflation, policy-makers were not free from consciously underestimating expected inflation rates and leaving tax rate bands unchanged (or adjusting them for underestimated inflation rates) to generate

higher-than-budgeted personal income tax revenues (semjén, 2006).

The number of personal income tax rates was characterised by a continuously decreasing trend until the last year of our analysis, 2011, when it became a flat-rate tax.2 The amounts of the lowest and highest rates of the progressive tax table also converged steadily: in 1988, the lowest and highest rates were 0 and 60 percent, respectively, then they changed to 17 and 32 percent in 2010, and then in 2011, the only personal income tax rate was 16 percent.3 The tax rate reached today’s 15 percent in 2016.

Figure 1 shows the evolution of tax rates and band limits since the introduction of the system, for the years examined in the study.

The figure demonstrates that the amount of tax rates applied in the medium term came from the “middle” of the initial tax tables – then the amount of the lowest rate band stabilised as a flat-rate tax. (of course, we must also take into account the aforementioned effect on the tax burden, namely that the abolition of the 0%

rate was compensated by a tax credit system in most years.) The band limits widened in line with the reduction in the number of tax rates, which was also justified by a high inflation rate, however, according to Gáspár (2014), the tax burden increased overall during this period.4 compared to Figure 1, values in Figure 2 are shown at prices of 1990, with band limits adjusted for inflation and average gross earnings of full-time employees– excluding the effects of inflation (gross real earnings).

As opposed to the previous figure, Figure 2 also highlights that the nominal widening of band limits and the longer-term evolution of tax rates did not mean that tax burdens decreased over the years. By 1995, most of the tax bands were related to low incomes (compared to 1990 prices), and the upper tax rate on gross average earnings increased to 40 percent (from 30 percent). Even in 2005, gross average earnings were taxed at an upper tax rate

Figure 1 Changes in braCket limits and tax rates in hungary 1990–2011

Thousand HUF 2 000 1 800 1 600 1 400 1 200 1 000 800 600 400 200

0 1990 1995 2000 2005 2011 year

Tax rate of 41-50% Tax rate between 36-40% Tax rate between 31-35%

Tax rate between 21-30% Tax rate between 11-20% Tax rate between 0-10%

Source: own edited

Figure 2 Changes in tax rates and braCket limits, and gross average earnings at 1990

priCes, 1990–2011 Thousand HUF

700 600 500 400 300 200 100

0 1990 1995 2000 2005 2011 year

Tax rate of 41-50% Tax rate between 36-40% Tax rate between 31-35%

Tax rate between 21-30% Tax rate between 11-20% Tax rate between 0-10% Gross average earnings Source: own edited

of 38%; they were placed in a much lower tax rate category only in 2010–2011. (of course, in order to determine the total tax burden, the effect of all tax rates on a given income must be taken into account together with the effects of tax credits and any other tax benefits.)

Another important change in personal income tax was related to tax benefits: tax benefits of different levels provided to different income earners (according to different tax rate limits) through tax base reducing items were gradually replaced by tax allowance providing the same level of benefit to all income groups.

However, starting from 2003, the number of benefits gradually decreased (semjén, 2006).

When personal income taxation was introduced, the vast majority of the population earned most of their income from employment or cooperative membership. The employment relationship was supported by a benefit allowing a reduction of total income by a fixed monthly amount for each month at work, which fixed amount increased year by year (Juhász, 2019b).

This benefit also changed many times. It was transformed into a tax benefit, so that all employees had the same amount of benefit calculated in tax, then it was discontinued for a while. Later, in 1995, it was reintroduced under the name tax credit, again as a benefit deductible from tax, but an upper income limit was assigned to it, so those with the highest earnings were not granted this benefit. The income limit was first applied in a non-degressive system, and when the pre- determined income level was reached, the tax credit simply ceased to be due. After a tax year with a very complicated tax table in 1996, a percentage tax credit system was introduced, its amount was maximised, and later, it became income-limited with a decreasing amount to be applied above a certain income and up to reaching the income limit. Tax exemption for the minimum wage was also provided by

the institution of supplementary tax credit from 2004, making the system even more complicated for a long time. Tax credits were abolished as part of a complete transformation of the personal income tax system in 2012, when being an employee was no longer as perfectly customary as it was at the time of the introduction of the modern Hungarian personal income taxation.

A benefit supporting having children – as a key social goal – was already created when personal income taxation was introduced:

those raising three or more children could reduce their tax base. In the years following the introduction of the new income taxation, this benefit was extended to taxpayers with two children, then to those with one child under the age of 6, and then to those with children over that age as well. The benefit could be deducted from taxes starting from 1993, then, from 1995, it ceased to exist for a few years. In 1999, when it was reintroduced, it was a tax deductible benefit;

in 2005, it was made income-limited; and from 2006, it was only available to people with three or more children. From 2011 onwards, it became a benefit reducing the tax base again, its amount was significantly increased compared to previous ones, and it was available to all households raising children, to a different extent according to the number of children.

since 2013, the personal income tax table has been flat-rate in Hungary, with a current tax rate of 15 percent. There are only a few benefits now, the most significant being the family tax benefit, which is due for each child – but in different amounts for up to three children –, and is a factor reducing the tax base. under this system, there is a very significant support for people with three or more children.5 In view of the aims of the study, which will be described in detail later, we will not go into a detailed examination of the tax burden of the

Hungarian personal income tax system after 2010, presented by Varga (2017) – also in the context of the entire tax system – in detail.

research meThod, range of daTa used

The test method is unchanged. We set up a theoretical tax system that meets the criteria of a simple tax system, and examine how this theoretical tax model can be parameterised to approximate the tax burden curves of the Hungarian personal income tax systems of the previous years examined.

As before, parameters of the theoretical tax model are searched in the special MATLAB software application system, by using a software application written by the author.

The optimisation algorithm of the application finds the minimum sum of squares of the difference between (i) tax amounts calculated for different incomes with the searched parameters of the theoretical system, and (ii) tax values according to real data, during which parameters are approximated (within specified limit values) to the values resulting in the most appropriate tax burden curve.

The study does not analyse data on the actual total tax burden of taxpayers; instead, it undertakes to examine whether the elements generally defined in the legislation on personal income tax in a given year (tax table and main benefits) could have been more easily determined.

our theoretical model is a flat-rate personal income tax system with itemised tax credits and tax benefits for children. Therefore, the parameters sought are also the same: the amounts of tax rate, tax credit and child tax benefit. The theoretical model set up for the systems of the rest of the Visegrád countries included a tax benefit for spouses; however, such benefit is not applied in the Hungarian

system, so this is not included in our current theoretical model.

In the study, we examined the tax burden conditions of each specific tax year. For the analysis, we chose tax years the tax systems of which show a major, system-level difference compared to each other. The tax years are roughly evenly distributed over the chosen period, thus we can get a somewhat comprehensive picture of changes in the system from the beginning to the introduction of flat-rate taxation. our choice fell on years 1995, 2000, 2005 and 2011 for analysing tax burden data for the personal income tax systems.

Real tax burden data (serving as the basis for comparing the theoretical system with the real system) were calculated according to the Personal Income Tax Act for each given year.

These tax burden data use, also in this study, tax parameters (e.g., tax benefits) that are as general as possible, the least specific, and are applicable to the largest possible group of taxpayers. Moreover, these principles are used to build general tax burden data published by oEcD6, making the tax systems of several countries comparable.

The analysis refers to income levels corresponding to 1–250 percent of the gross average wage, calculated on the basis of data of full-time employees’ average gross earnings as published by the central statistical office.7

Given that the Hungarian system does not apply tax credits for spouses in a general sense, instead of the four family types used in the previous study, in this analysis, we examined only single-earner households with no children or two children, regardless of how many adult family members live in a household. The software application continues to search for optimal tax parameters based on the combined “error function” of the two family types.

Figure 3 shows the process of curve fitting.

resulTs of The research

The tax characteristics of the examined years are presented in Table 1, compared with the tax elements of the theoretical model.

elemenTs of The TheoreTical model

The theoretical model is thus a single-bracket (single-rate) personal income tax system with an itemised tax credit, a flat-rate tax system in

a general sense. An itemised, child tax credit can also be claimed under the system, except for the analysis for 1995, because the child tax credit was not available in the real personal income tax system in that year. Its specific parameters are determined by the software application.

examinaTion of The 1995 Tax year

In 1995, Hungary operated a six-bracket (including a tax-free band), progressive

Figure 3 method of fitting funCtions based on the theoretiCal model

Source: szabóné Bonifert, 2020; own edited

rules for determining tax by family type in the theoretical tax system

Tax burden data by family type

MATLAB SOFTWARE

+

minimum of the total residual sum of squares

parameters of the theoretical system Tax burden according to the theoretical system, with

selected parameters, by family type

difference between the theoretical tax burden and the actual tax burden by family type

(residual sums of squares)

income levels tested

Table 1 main CharaCteristiCs of the personal inCome tax systems of the examined

years, Compared with the parameters of the theoretiCal model

2000 2005 2011 theoretical

model special method for

determining the tax base – – – super-gross –

item reducing the tax base – – – family tax bene-

fit (itemised) –

number of tax rates 6 tax rates 3 tax rates 2 tax rates 1 tax rate 1 tax rate

Tax allowance

Tax credit (itemised, sim- ple income-lim-

ited)

Tax credit (percentage, with a maxi- mum amount,

decreasing amount)

Tax credit (percentage, with a maxi- mum amount,

decreasing amount)

Tax credit (percentage, with a maxi- mum amount,

decreasing amount)

Tax credit (itemised)

– –

supplementary tax credit (percentage, with a maxi- mum amount,

decreasing amount)

– –

Tax allowance for social secu- rity contribution (percentage, in-

come-limited)

Tax allowance on pension con-

tributions and private pension

fund member- ship fees (per- centage, income-

limited)

– – –

family tax allowance (itemised)

family tax allowance (itemised, in- come-limited)

–

family tax allowance (itemised)

Note: explanation of the colours used in the table: = special method of calculating the tax base, = family tax allowance, = tax rate, = tax credit, = tax allowance linked to social security contributions, = there is no such element in the given tax system Source: own edited

income tax system, with tax rates ranging from 0 to 44 percent. In this year, the income- limited tax credit was introduced, which was HuF 7,200 per year if the total income did not exceed HuF 500,000 per year. This also meant that if the total income exceeded this limit by as much as one forint, then the tax credit completely ceased to exist, therefore, as already indicated, the tax credit was not of a decreasing amount up to the income limit.

25 percent of pension contributions (6 percent of the pension contribution base) and of health insurance contributions (4 percent of the health insurance contribution base) deducted from the tax under the social Insurance Act were deductible as tax benefits – taking into account the upper limit amount, HuF 912,500, for paying contributions.

child tax benefit could not be claimed in this year.

Thus, in this year, a multi-band system was in effect, similar to the tax table applied at the time of introducing the system, with an itemised, simple, income-limited tax credit that could be used as a tax benefit, as well as an additional percentage upper-limited8 tax benefit.

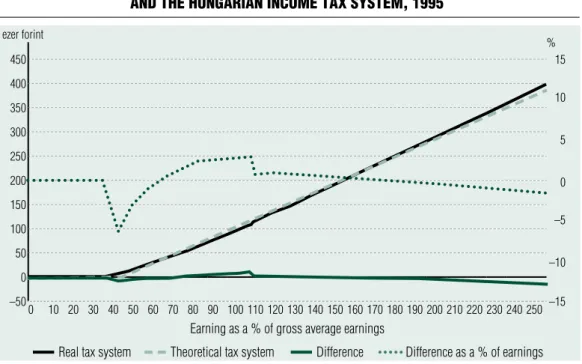

using the software application and applying our theoretical, flat-key model to the tax burden curve of the 1995 real tax system, we can calculate the parameters of the theoretical system. Given that no child tax benefit could be claimed in this year, the tax burden of our two types of families planned to be examined, the single-earner households with no children or with two children, do not differ, so we examine only one tax burden curve, as shown in Figure 4.

The figure clearly shows the breakpoint of the real tax burden curve due to the sudden termination of the tax credit, which is compensated by the theoretical system with a steeper tax burden curve.

The parameters of the theoretical tax system

were determined by the optimisation software run by us as follows:

• tax rate: 39.9 percent,

• itemised tax credit: HuF 80.442 per annum.

We can also analyse in detail the extent to which the tax burden curve of the theoretical system fits the real tax burden curve, which can be done with the help of the relative error.9 The relative error in this case was 0.0435, i.e.

the fit is within the 10 percent value accepted by academic literature, therefore the goodness of the fit is also statistically correct.

In addition to the statistical adequacy of the curve fitting, individual taxpayers are much more affected by the amount of the difference that would be between the tax burden under the real and the theoretical tax systems. This is shown in Figure 5.

The figure shows that the difference between the amounts of tax payable under the real and the theoretical systems is very small compared to the amount of tax payable. At the income level of 43% of the average earnings (this means HuF 200,724), due to a steeper rise of the real tax burden curve than the theoretical one (the tax burden of the theoretical system is still zero at this income level, but in the real system, it is 4.22% of the income), an outlier point can be seen: the difference between the two tax burdens is HuF 8,463, which corresponds to 4.22 percent of the given income. At approximately 108 percent of average earnings (HuF 500,000), the “sudden” termination of the tax credit in the real system is compensated by the theoretical tax burden curve, and this is why, at an income level lower than that, a difference equal to 1.85 percent of earnings is observed between the tax burdens of the two systems.

It follows from this that in 1995, the general tax burden of the six-band Hungarian personal income tax system, which also applied an additional percentage tax benefit

Figure 4 tax burden of the flat-rate, theoretiCal inCome tax system

and that of the hungarian inCome tax system, 1995

Source: own edited

Figure 5 tax payable under the flat-rate, theoretiCal inCome tax system

and the hungarian inCome tax system, 1995

Source: own edited

% 40 35 30 25 20 15 10 5

00 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 190 200 210 220 230 240 250 earning as a % of gross average earnings

real tax system Theoretical tax system

ezer forint

%

450 15

400

350 10

300 250

5 200

150

0

100 –5

50 0

–10

–50 –15

0 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 190 200 210 220 230 240 250 earning as a % of gross average earnings

real tax system Theoretical tax system difference difference as a % of earnings

compared to the theoretical system, could have been well approximated by much simpler means, i.e. by our theoretical model using only a single bracket and an itemised tax credit. The difference between the two tax burden curves, typically expressed as a percentage of earnings, ranges from −1.1 percent to +1.8 percent, by increasing to the level of 4.22 percent of income at only one point.

examinaTion of The 2000 Tax year

In 2000, a three-rate personal income tax system was in force in Hungary, with tax rates of 20, 30 and 40 percent.

The tax on the consolidated tax base was reduced by the tax credit, which could be claimed under more complex rules in this year than before, and became percentage and of an amount decreasing with increasing income.

The tax credit was 10 percent of the salary earned in the tax year, but no more than HuF 36,000 per year if the total annual income did not exceed HuF 1 million. Furthermore, between HuF 1 million and HuF 1.2 million, it was 10 percent of the salary (maximum HuF 36,000 per year), reduced by 18 percent of the part of income over HuF 1 million.

25 percent of the combined amount of pension contributions and private pension fund membership fees10 could be claimed as tax benefits, taking into account the upper limit of HuF 2,020,320 for payment of contributions.

The family (tax) benefit was HuF 2,200 per month for one and two children, and HuF 3,000 per month for three or more children.

Thus, in 2000, only three tax bands were applied in the personal income tax system, which was supplemented in this year by a tax credit system with a maximum percentage amount that could be used as a tax credit.

All this was made more complicated, in a different way than in the previous years, by

the use of a tax benefit system of declining amount. (This will be analysed later.) Given that the lowest tax rate was not 0 percent in this year, and tax credits failed to compensate for taxes payable on the lowest incomes so as to bring them to zero, the tax burden curve did not start from 0 percent for tax-payers with no children. The previous percentage tax benefit for social security contributions remained, but was available only on pension contributions and private pension fund membership fees. Itemised child tax benefit was applied again.

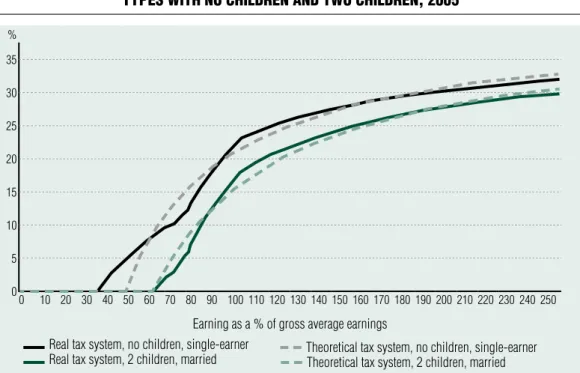

Figure 6 shows the tax burden curve of the theoretical system as fitted to the tax burden curve of the real tax system. In view of the available family tax benefit, it is also necessary to analyse the tax burden of single-earner households with no children and two children.

The parameters of the theoretical tax system would be as follows:

• tax rate: 37.1 percent,

• itemised tax credit: HuF 127.256 per annum,

• child tax benefit: HuF 30,930.5 per child per year.

Table 2 shows the size of relative error, for assessing the adequacy of the curve fitting. The size of the relative error shows a statistically adequate fit for the two-children, single-earner family type, but is slightly higher than the acceptable 10 percent rate for single-earners with no children.

Figure 5 also shows that, as already mentioned, in the real tax system, the tax credit did not provide full tax exemption for low-incomes for taxpayers with no children.

However, the theoretical system with its simple, itemised tax benefit cannot fully follow this line of tax burden, a fact explaining one of the major differences between the tax burden under the two systems. This is mainly due to the fact that the amount of the percentage tax credit of the real system – at low incomes –

increases steadily as income is increasing until the tax credit reaches its maximum value;

however, in the theoretical system, we apply itemised tax credit, which – at low incomes – fails to implement a compensation required for the purpose that the tax credit should, at low incomes, be as low as to ensure that the amount of tax is not reduced to zero11, but

it should, at higher income levels, be high enough to achieve an appropriate fitting of the curve.

In addition, the detailed rules of the real tax credit – maximisation and then withdrawal – cause a breakpoint in the tax burden curve that could not be perfectly approximated on the basis of the simpler rules of the theoretical Figure 6 tax burden of the flat-rate, theoretiCal inCome tax system

and that of the hungarian Central inCome tax system for single-earner family types with no Children and two Children, 2000

Source: own edited

Table 2 size of relative error for the theoretiCal tax system fitted to the hungarian

inCome tax system, 2000

family type size of relative error

single-earners with no children 0.1321

single-earners with two children 0.0513

Source: own edited

% 35 30 25 20 15 10 5

00 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 190 200 210 220 230 240 250 earning as a % of gross average earnings

real tax system, no children, single-earner Theoretical tax system, no children, single-earner real tax system, 2 children, married Theoretical tax system, 2 children, married

system. Although the gradual withdrawal of the tax credit and the termination of it at high income levels did change the breakpoint experienced due to the previous “sudden termination”, a – different – breakpoint remained in the tax burden curve in that case again due to the higher amount of tax credit and the effects of the withdrawal rules.

However, this difference alone would not cause a problem leading to the rejection of the adequacy of the function fit, as shown by the adequate fit of the tax burden curve for tax- payers with two children.

The real tax burden curve for tax-payers with two children also shows the breakpoint observed in connection with the withdrawal of tax credit in the real tax system; however, this is only a minor problem in terms of the adequacy of the fit, so, in their case, the adequacy of the fit is good. In the case of tax- payers with two children – as opposed to those raising no children –, the tax burden of the real system starts from zero due to the child tax benefit available at low income levels, meaning that the fitting with the itemised benefits of the theoretical system works well, there is no major difference between the two tax burden curves in that respect.

According to the figure, in the case of taxpayers with no children, the difference in the tax burden for the two systems is 8 percent of the given income at low incomes, and 3.97 percent of the income at the breakpoint experienced due to the withdrawal and ceasing of the tax credit. In the case of the family- type with two children, the difference at low incomes is minimal, and the difference at the breakpoint due to the withdrawal of the tax credit is no more than 2.86 percent of the income.

All in all, we can state that a flat-rate theoretical system with two simple itemised benefits can almost compensate for a three- tax-rate income tax system applying a complex

and a simpler percentage and an itemised tax benefit; and the fitting is not entirely appropriate only in the case of tax-payers with no children, a phenomenon caused by the positive tax burden at low incomes.

examinaTion of The 2005 Tax year

In 2005, in the Hungarian personal income tax system, there were two tax rates in force, 18 and 38 percent. Tax credit was of 18 percent, up to a maximum of HuF 108,000 per year. Between HuF 1,350,000 and HuF 1,950,000 in total annual income, the tax credit decreased on the basis of an 18 percent withdrawal rate and then ceased. In addition, there was an additional tax credit in the system, which – similarly to the base tax credit system – was 18 percent of the part of the salary exceeding HuF 600,000, but not more than HuF 15,120 per year in the case of incomes between HuF 600,000 and HuF 1 million. In the case of annual incomes over HuF 1 million, the additional tax credit was gradually withdrawn at a 5% withdrawal rate, and was completely terminated in the case of higher incomes.

The family tax benefit represented a tax benefit of HuF 3,000, HuF 4,000, and HuF 10,000 per child per month in case of one dependant, two dependants, and three or more dependants, respectively. From this year, the benefit was made income-limited: if the total income exceeded HuF 8 million, the amount of the family benefit had to be reduced by 20 percent of the part of the income above HuF 8 million. However, the income-limit was so high relative to average incomes that it does not play a role in our analysis: as it is higher than 250 percent of gross average wages, it is outside the scope of the analysis.

The tax benefit for mandatory pension contributions was abolished in 2004, thus it

was not possible to use such a benefit in that year either.

In this year, therefore, the personal income tax system had only two rates, but the system of tax credits available as a tax benefit became extremely complicated. In addition, in general, only one itemised, income-limited child tax benefit was used in the system.

Figure 7 shows the tax burden curve of the flat-rate theoretical system determined by the optimisation software and that of the real tax system. The graph demonstrates that in this year, the breakpoint in the tax burden curve of the real system due to the reduction and termination of the tax credit is no longer as marked as in 2000, and the tax burden curve of the theoretical system tries to compensate for this discrepancy.

The figure also shows that, in the case of single earners with no children, there are three smaller or larger differences between the theoretical and the real tax liability: the difference in tax burden is 4.5 percent of the income at 48 percent of average earnings (where, according to the theoretical system, the tax burden starts to increase only at a higher-than-real income level due to the compensation of the above mentioned breakpoint), and 3.05 percent of the income at 77 percent of average earnings (where, according to the theoretical system, the tax burden is higher than the real level). The third

“outlier point” represents only a very small difference between the two tax burden curves:

1.65 percent of the income at 103 percent of average earnings. In single-earner households

Figure 7 tax burden of the flat-rate, theoretiCal inCome tax system

and that of the hungarian Central inCome tax system for single-earner family types with no Children and two Children, 2005

Source: own edited

% 35 30 25 20 15 10 5

00 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 190 200 210 220 230 240 250 earning as a % of gross average earnings

real tax system, no children, single-earner Theoretical tax system, no children, single-earner real tax system, 2 children, married Theoretical tax system, 2 children, married

with two children, the largest difference between the tax burdens is only 2.63 percentage points, observed at 78 percent of the average earnings.

The parameters of the theoretical tax system would be as follows:

• tax rate: 40.5 percent,

• itemised tax credit: HuF 372.169 per annum,

• child tax benefit: HuF 51,290 per child per year.

The relative errors of the curve fitting are summarised in Table 3. In this case, the relative error does not exceed the 10 percent limit (5.3 percent) for the childless single-earner family type either, due to the fact that the tax credit provides tax exemption for low incomes in the real system, allowing a better fitting for the theoretical system even in case of itemised tax credits. The fitting is also good for the two- child, single-earner family type, with a relative error of 4.3 percent.

Based on the above, our flat-rate theoretical system (using only a simple itemised tax credit and a child tax benefit) was able to ensure a fit (despite the breakpoint observed in the tax burden curve due to the tax credit withdrawal system) for the 2005 two-rate personal income tax system (using an extremely complicated tax credit and a simple itemised tax benefit) that would have provided an appropriate substitution in the parameters of the personal income tax system for this year.

examinaTion of The 2011 Tax year

In this year, personal income tax liability was determined based on a so-called super-gross tax base: the income amount had to be increased by the amount of the social security contribution (27 percent) payable by the employer on the income (tax base supplement), after which the income tax was calculated. However, the tax rate was 16 percent at all income levels.

The family tax benefit was changed into a tax base reduction item, the amount of which was HuF 62,500 per child per month in case of one child and two children, and HuF 206,250 per child per month for three or more children.

The rate of the tax credit was the same as the tax rate, 16 percent, but its rules were significantly simplified compared to 2005:

a maximum of HuF 145,200 per year was available, which was withdrawn – if the tax base exceeded HuF 2.75 million per year – at a rate of 12 percent for each forint exceeding the limit. The tax credit was terminated at a tax base of HuF 3.96 million.

Thus, in 2011, there was only a flat-rate personal income tax system in force, which was supplemented by a family tax benefit – available as a tax base reducing item –, the amount of which was significantly increased, even when measured compared to the change in its “place” in the system.12 The supplementary tax credit system was abolished, however,

Table 3 size of relative error for the theoretiCal tax system fitted to the hungarian

inCome tax system, 2005

family type size of relative error

single-earners with no children 0.0529

single-earners with two children 0.0431

Source: own edited

the percentage tax credit with a maximum amount, operated on the basis of a withdrawal system was maintained.

Tax burden curves for the theoretical system fitted to the real curve and for the real tax system are shown in Figure 8. For 2011, due again to the withdrawal and termination of the tax credit, there are breakpoints in the tax burden curve of the real system, to which the software application fitted – because of the characteristics of the theoretical system –“smoother” curves for both family types.

As a flat rate was applied – in addition to the super-gross system – in the real tax system, the tax burden at higher income levels for the childless family type is constant when the tax credit comes to an end (which, for households

with two children, could be claimed as an item deductible from the tax base).

For 2011, the largest difference observed between the tax burdens of the two systems due to the breakpoints connected to the tax credit does not exceed 2.24 percent of the given income, which is not a significant difference.

For those with two children, this maximum difference is 2.23 percent of the income.

Parameters of the theoretical tax system:

• tax rate: 24.4 percent,

• itemised tax credit: HuF 192.445 per annum,

• child tax benefit: HuF 119,826.5 per child per year.

The actual, large decrease in tax rates at that time, already mentioned above, is also

Figure 8 tax burden of the flat-rate, theoretiCal inCome tax system

and that of the hungarian Central inCome tax system for single-earner family types with no Children and two Children, 2011

Source: own edited

% 25

20

15

10

5

00 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 190 200 210 220 230 240 250 earning as a % of gross average earnings

real tax system, no children, single-earner Theoretical tax system, no children, single-earner real tax system, 2 children, married Theoretical tax system, 2 children, married

shown by the fact that, as opposed to the

“replacement” tax rates of 37.1–40.5 percent used in the theoretical tax system for prior years, we can calculate with a much lower tax rate of 24.4 percent for 2011.

According to Table 4, the relative error, for both family types, is within the accepted limit, therefore the fit is adequate despite the imperfect following performed by the theoretical system’s breakpoints.

To conclude, the difference between the flat-rate theoretical system and the real income tax system for 2011 was attributable to (i) the flat-rate system used for determining the tax base, which terminated the tax credit at higher income levels, and (ii) to a lesser extent, the difference still observed in the complexity of the tax credit system; additionally, both systems applied an itemised tax credit. Despite the breakpoints in the real tax system, the fitting of the theoretical system was appropriate in this year as well.

summary

The rules concerning the main elements of the Hungarian personal income tax system were constantly changed during the years examined.

The number of tax rates decreased, band limits were widened accordingly, and finally, the system became a flat-rate system. The tax credit system was – in the spirit of equity – made increasingly complex (the most complex

attempts were quickly discarded), then it was abolished when the income tax was completely restructured. In the case of the family tax benefit for children, the greatest debate over the years concerned the amount of the benefit that secures its effectiveness and its accessibility to higher-income taxpayers. Accordingly, it was first expanded, then it was limited, abolished, or made income-limited, and finally, in 2011, it was turned into an item deductible from the tax base, available concerning each child, in significantly increased amounts, especially for those with three or more children.

In the study, we examined a sample of some selected previous statuses of this system in order to determine whether the characteristics of the tax burden for each given year could be approximated by a simpler method.

The results of our analysis show that our flat-rate theoretical system applying two itemised benefits could, in most cases, replace the elements of the Hungarian income tax system, even when it includes more than two bands or many bands, a complicated tax credit and percentage benefit elements – connected to social security contributions – which are usually also additional to the theoretical system.

No major problem was caused in curve fitting when a multi-band system was used, as, when applied together with itemised tax credit, the tax burden curve could be well approximated with a single-band income tax system.

Table 4 size of relative error for the theoretiCal tax system fitted to the hungarian

inCome tax system, 2011

family type size of relative error

single-earners with no children 0.0587

single-earners with two children 0.0782

Source: own edited

In our previous analysis (szabóné Bonifert, 2020), we found that the theoretical, simpler tax model can, due to its chosen nature, well approximate such systems the tax burden curves of which (i) have no major breakpoints (e.g., a benefit that is terminated above a specified income level without withdrawal), or (ii) have no elements resulting in different taxation methods for the family types examined (e.g., splitting, or different access to a specific type of benefit by different social groups), or (iii) have such parameters but they are used by the tax model itself as well.

During the examination of the previous Hungarian personal income tax systems, first, a fitting problem arose that differed from the one outlined above: for the year 2000, the different tax credit characteristics of the theoretical and the real system caused approximation problems. concerning 2011, however, we encountered a smaller problem, similar to that found during the previous analysis: the combined application of the flat- rate system and the tax credit being reduced

to zero at high income levels resulted in a breakpoint in the real tax burden curve, which was followed by the theoretical system with larger deviations compared to the previous years studied, but ultimately with a proper fit.

The system of withdrawal and termination of the tax credit applied together with a multi- rate system caused a special deformation of the real tax burden curves, however, this was not of such an extent in the years studied for which real tax burden curves could not be approximated by the theoretical system to an extent that is acceptable according to the academic literature.

Based on our analysis of previous years of Hungarian personal income taxation, we can therefore again state that the application of a sophisticated equity and complex benefit elements in the system are worth considering carefully. A good way to do this is to use some well-defined basic elements in personal income taxation that work with simple rules, which simplifies tax assessment, self-declaration and control, but does not necessarily impair equity. ■

1 Directing decision-makers towards some predefined decision, while keeping the freedom of decision.

2 In 2012 – as the tax base supplement was determined in terms of bands (and was phased out over a two- year period) –, the system actually became double- band again, which lasted for one year.

3 Due to the phasing out of the tax base supplement, the tax rate actually became 16 percent in 2013.

4 The figure does not show how many taxpayers fell into each tax band; so, for instance, the “length” of

the top band in 1990 obviously does not show the size of the tax burden in relation to the number of taxpayers; limits of upper tax rates are depicted up to such high income levels in the initial years only due to the increase in band limits in later years.

5 However, when analysing the direct elements of income taxation, other factors affecting the income situation of taxpayers should not be overlooked either: for example, Baksay and csomós (2014) showed in their analysis that an increase in the minimum wage and the introduction of expected wage increases in the early 2010s fully compensated many lower-income households, Notes

Baksay G., csomós B. (2014). Az adó- és transzferrendszer 2010 és 2014 közötti változásainak elemzése viselkedési mikroszimulációs modell segítségével. Köz-gazdaság, [Analysis of changes in the tax and transfer system between 2010 and 2014 using a behavioural microsimulation model.

Economy](4), pp. 31–59

Balogh, L. (2013). Adórendszer kritériumok – adóreformok. In: Bánfi, T., Kürthy, G. (ed.) Pénz, világpénz, adó, befektetések. Tanulmánykötet, [Tax system criteria - tax reforms. In: Bánfi, T., Kürthy, G. (ed.) Money, world money, tax, investments. study volume], Budapest, pp. 135–164

Bánfi, A. (2011). Egyszerű adórendszer – méltányos adóztatás. In: Bánfi, T., Balogh, L.

(ed.) Adózó munkaadók és adózó munkavállalók a korrupciómentes gazdaságban. Tanulmánykötet, [Simple tax system - fair taxation. In: Bánfi, T., Balogh, L. (ed.) Taxable employers and tax paying employees in a corruption-free economy. study volume] Béta Book Kft. Budapest, pp. 83–

101

Diamond, P. A. (1998). optimal Income Taxation: An Example with a u-shaped Pattern of optimal Marginal Tax Rates. American Economic Review, 88, pp. 83–95

even in the short-term, for their losses of net income caused by changes in rules concerning PIT and contributions (mainly the abolition of the tax credit).

6 http://stats.oecd.org, Public sector, Taxation and Market Regulation / Taxation / Tax wedge decomposition

7 https://www.ksh.hu/docs/hun/xstadat/xstadat_

hosszu/h_qli001.html

8 This benefit was income-limited as the contribution itself did not have to be paid above the said income.

9 The relative error (relative residual standard deviation) shows the part of the average of the outcome variable (in this case, a squared mean was used in calculations due to frequent negative values) that is equal to the absolute error of the estimate. The absolute error (residual standard deviation) expresses the average deviation of the approximated values from the observed values of the outcome variable.

10 Non-private pension fund members paid the full amount of contributions to the public scheme, an amount corresponding to 8 percent of their income; private pension fund members paid 6 percent to the private pension fund and 2 percent of their income to the public scheme.

11 The itemised tax credit applied in the theoretical system would therefore make the tax negative for low incomes in most of the years studied if the system allowed it; however, since we do not recognise a negative tax, the itemised tax credit for low incomes only reduces the tax to zero.

This is why (i) a proper curve fitting, for both low and high incomes, is achieved only for such real systems where the tax burden is zero at low incomes, and (ii) the curve fitting is inadequate when the tax burden of the real system is positive constant at low incomes and then “rises up” at higher incomes.

12 It was turned from a tax credit into a tax base reducing item, meaning that its amount must be increased if the same tax effect is to be achieved.

References

Erdélyi A. (ed., 2020). Elemzés – Az állam mérete, a centralizációs ráta, az újraelosztási ráta alakulása, az állam által folytatott adópolitika hatása a versenyképességre, valamint az anticiklikus gazdaságpolitika alakulására. Állami számvevőszék, [Analysis - The size of the state, the centralisation rate, the evolution of the redistribution rate, the impact of the tax policy pursued by the state on competitiveness and the evolution of countercyclical economic policy. state Audit office] November 2020

Farhi, E., Gabaix, X. (2020). optimal Taxation with Behavioral Agents. American Economic Review, 110 (1), pp. 298–336,

https://doi.org/10.1257/aer.20151079

Gáspár A. (2014). A személyi jövedelemadó rendszerének alakulása Magyarországon [Evolution of the personal income tax system in Hungary]

(1988–2014). ECONOMICA, 2014(2), 23–33 Giday A. (2017). Melyik adónk legyen egykulcsú?

Pénzügyi Szemle, [Which of our Taxes should be Flat-rate Tax? Tax structure Diagnosis: VAT and PIT, Public Finance Quarterly] 62(2), pp.

131–151

Heady, c. (1993). Méltányosság és hatékonyság:

összeütköző elvek személyijövedelemadó-rendszerek tervezésekor. In: semjén, A. (ed.) Adózás, adórendszerek, adóreformok. Szociálpolitikai Értesítő (1993/1–2.), MTA szociológiai Intézet [Fairness and efficiency: conflicting principles when designing personal income tax systems. In: semjén, A. (ed.) Taxation, tax systems, tax reforms. Social Policy Bulletin (1993/1-2), Institute of sociology, Hungarian Academy of sciences], Budapest, pp. 215–227

Heathcote, J., Tsujiyama, H. (2019). optimal Income Taxation: Mirrlees Meets Ramsey. Federal Reserve Bank of Minneapolis, staff Report 507

Ilonka, M. (2004). Az adózás története az őskortól napjainkig. Nemzeti Tankönyvkiadó Rt.,

[The history of taxation from prehistory to the present day. Published by: Nemzeti Tankönyvkiadó Rt.]

Budapest

Juhász I. (2019a). Az adóreform és az azóta eltelt időszak – személyi jövedelemadó 1. [Tax reform and the period since then - personal income tax 1.]

https://ado.hu/ado/az-adoreform-es-az-azota-eltelt- idoszak-szemelyi-jovedelemado-1/

Juhász I. (2019b). Az adóreform és az azóta eltelt időszak – személyi jövedelemadó 2. [Tax reform and the period since then - personal income tax 2.]

https://ado.hu/ado/az-adoreform-es-az-azota-eltelt- idoszak-szemelyi-jovedelemado-2/

Kürthy G. (2010). Az egyszerű adórendszer In: Bánfi, T. (ed.) Adózó munkaadók és adózó munkavállalók a korrupciómentes gazdaságban.

Tanulmánykötet [The Simple Tax System In: Bánfi, T.

(ed.) Taxable Employers and Taxpaying Employees in a Corruption-Free Economy. study volume], Beta Book Kkt. Budapest, pp. 49–70

Lentner, cs. (2018). Az adórendszer és a közpénzügyek egyes elméleti, jogszabályi és gyakorlati összefüggései. Új Magyar Közigazgatás – Különszám [some theoretical, legal and practical contexts of the tax system and public finances. New Hungarian Public Administration - special issue] , october 2018, pp. 11–18

Mirrlees, J. A. (1971). An Exploration in the Theory of optimum Income Taxation. Review of Economic Studies, 38, pp. 175–208

Parragh B., Palotai D. (2018). Az ösztönző adórendszer felé. Pénzügyi Szemle, [Towards an Incentive Tax system, Public Finance Quarterly]

63(2), pp. 201–220

saez, E. (2001). using Elasticities to Derive optimal Income Tax Rates. Review of Economic Studies, 68, pp. 205–229

semjén A. (2006). A mai magyar adórendszer.

Jellegzetességek, problémák, kihívások. In: Elő- munkálatok a társadalmi párbeszédhez. Gazdasági és szociális Tanács [Today’s Hungarian tax system.

Characteristics, problems, challenges. In: Preparatory work for social dialogue. Economic and social council], Budapest, pp. 215–230

szabóné Bonifert, É. (2020). Egysze- rűsítési lehetőségek a visegrádi országok sze- mélyijövedelemadó-rendszereiben. Pénzügyi Szemle [opportunities for simplification in the Personal Income Tax systems of the Visegrad countries, Public Finance Quarterly], 65(4), pp.

531–553,

https://doi.org/10.35551/PsZ_2020_4_6

Varga J. (2017). Az adóteher-csökkentés és a gazdaság kifehérítésének pályája Magyarországon 2010 után. Pénzügyi Szemle [Reducing the Tax Burden and Whitening the Economy in Hungary after 2010, Public Finance Quarterly], 62(1), pp. 7–20

Központi statisztikai Hivatal: Gazdaságilag aktívak, bruttó átlagkereset, reálkereset (1960–) [central statistical office: Economically active persons, gross average earnings, real earnings (1960–)]. https://www.

ksh.hu/docs/hun/xstadat/xstadat_hosszu/h_qli001.

html

Public sector, Taxation and Market Regulation / Taxation/ Tax wedge decomposition, http://stats.

oecd.org