While the impact of monetary policy on the supply of credit in the economy has been widely analyzed (Bernanke and Blinder (1992), Kashyap and Stein (2000), Jiménez, Ongena, Peydró and Saurina (2012)), recent research on the impact of the monetary policy rate on the composition of the supply of credit has so far focused on direct credit risk taken (Jiménez, Ongena, Peydró and Saurina (2014a) and. Expansive foreign monetary conditions on the other hand encourage lending in the foreign currency but not in the domestic currency.

Foreign Currency Lending in Hungary and Data Sources A. Foreign Currency Lending in Hungary

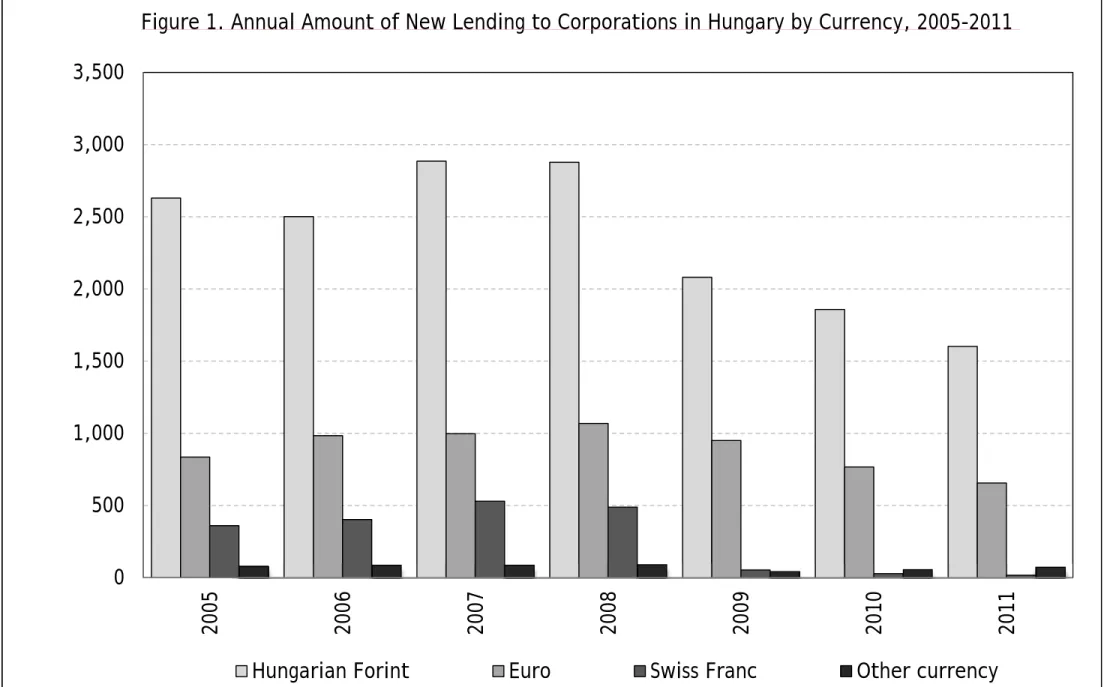

On the supply side, both the foreign ownership of banks and the intense competition in the banking sector contributed significantly to the spread of loans in foreign currency. In subsequent years, the share of loans in foreign currency decreased, loans in Swiss francs essentially disappeared, but lending in euros retained its importance both in the household and business sectors.

The Hungarian Central Credit Information System (KHR)

Identification Strategy

Do low monetary policy rates at home and/or abroad changes in the currency denomination of the credit provided by banks. This bank supply channel involves compositional changes in the supply of credit at the bank-firm-currency denomination level.

Estimated Model

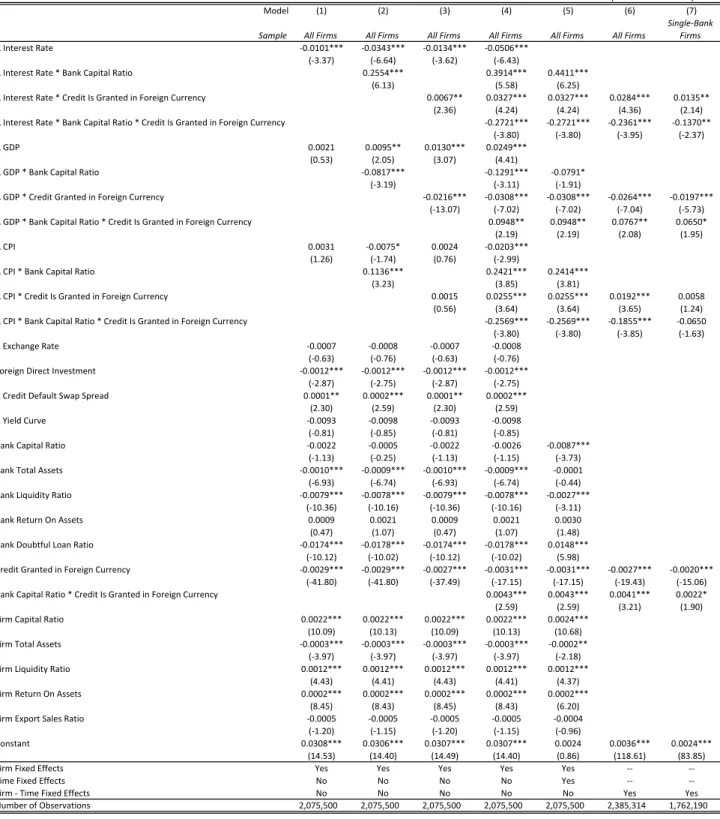

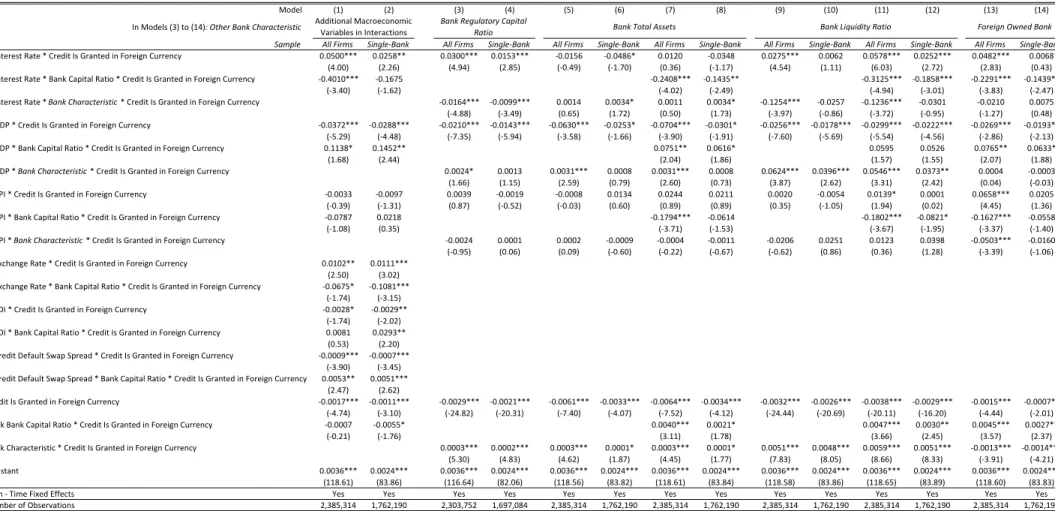

To identify the "currency composition channel" of monetary policy, we interact the change in the interest rate with a lagged bank capital ratio (in the spirit of Kashyap and Stein (2000)) and the currency of the bank-firm exposure. Since bank capital may be correlated with other bank characteristics, we also add the corresponding triple interactions (i.e., in which bank capital is represented) of different bank characteristics.

Horseracing Triple Interactions

Methodology and Variables A. Model Line-Up

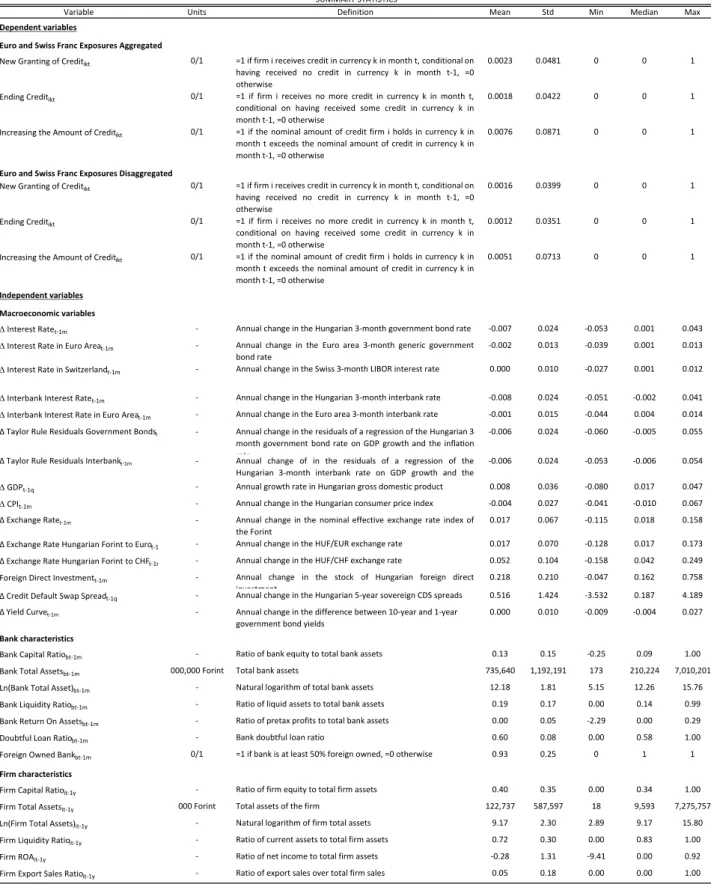

The total number of observations (ie, joint venture - currency credit - year:month) is the same, but due to computational limitations, the regressions in Tables II to VII use a 10% random sample. Aggregate statistics for banks (companies) are based on average values of bank (company) characteristics in the sample period.

Specification and Dependent Variables

The dependent variable is a measure of the CREDITikt granted to company i in currency k in month t. For each company, we know which banks the company has an account with, but we do not know the individual credit exposure of the bank and the company, except when the company has only one bank, which ('fortunately' in a sense) is 74 percent of the concerns companies. time. We first focus on the expanded margin of new credit, i.e. new lending, which is equal to one if company i receives credit in currency k in month t, provided that there are no debts in currency k in month t-1, and equals zero otherwise.

Later, we estimate ending credit and amount growth with two additional dependent variables: Ending Credit, which equals one if firm i receives no more credit in currency k in month t, conditional on having received any credit in currency k i month t-1 , and is equal to zero otherwise; and Increasing the credit amount, which is equal to one, if the nominal amount of the credit company i has in currency k in month t exceeds the nominal credit amount in currency k in month t-1, and is otherwise equal to zero.14. The main independent variables are IN FXikt, the abbreviated term for credit granted in foreign currency, which is equal to one if the credit to firm i in month t is in currency k, which is a foreign currency, and equal to zero otherwise, ΔINTEREST -1 is the annual change in. We will therefore also examine in robustness the extensive margin to end credit and the intensive margin to increase credit in a binary way.

We are interested in the three coefficients, namely , δ and , the coefficients of the currency and its double and triple interactions with the interest rate, and the interest rate and bank capital. The specification further loads the firm and time fixed effects (represented by i and t), and includes as controls the following sets of variables: (1) the three-way interactions of the change in GDP and inflation with bank capital, respectively, and currency; (2) capital ratio, size, liquidity, profitability and non-performing loans of banks; (3) the capital ratio, size, liquidity, profitability and expected turnover ratio, and (4) in specifications without time fixed effects that affect changes in the exchange rate, foreign direct investment, the sovereign credit default swap spread and the yield curve.

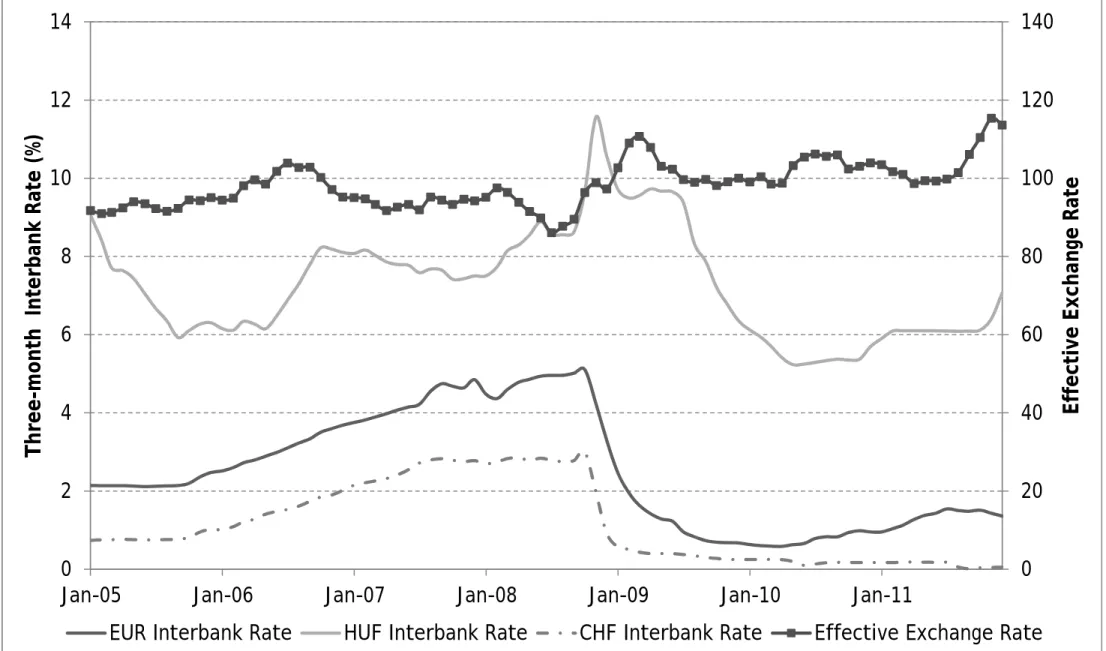

Main Independent Variables

The Euro interest rate is based on the average yield on the three-month Euro benchmark government bonds, while the Swiss interest rate is the three-month Swiss interbank rate. The average Euro and Swiss three-month interest rates in the sample period are -0.19 percentage points and -0.05 percentage points, respectively. To comprehensively account for changes in domestic GDP growth and inflation (Taylor (1993)), we include both variables at all levels of interaction where the domestic interest rate also appears.16 The average GDP growth rate in Hungary during the sample period was 0.80 percent ranging between -8.00 percent and 4.70 percent, while average inflation was -0.40 percent, ranging between -1.05 and 6.73 percent.

Additional macro controls are the annual change in the index of the nominal effective exchange rate of the forint, foreign direct investment covered by the annual change in the amount of foreign exchange reserves at the Central Bank of Hungary, the annual change in the CDS rate on 5-year Hungarian government bonds and the annual change in the difference between the yields of 10-year and 1-year government bonds. 16 Another option is to first calculate the interest rate based on GDP growth and inflation and use the residuals of this regression instead of the interest rate itself. We also include the bank's return on assets to measure profitability and the bank's doubtful loan ratio as a proxy for the current unprofitability and riskiness of the bank's portfolio.

We note that firm fixed effects also include control for time-invariant average characteristics of the banks that firms hold. In our final sample, observations with a negative bank-equity ratio represent less than 0.03 percent of the total number of observations, and removing these few observations does not change our main findings.

Control Variables Including Fixed Effects

Results

Effect of Domestic Monetary Policy on the Composition of Loan Supply

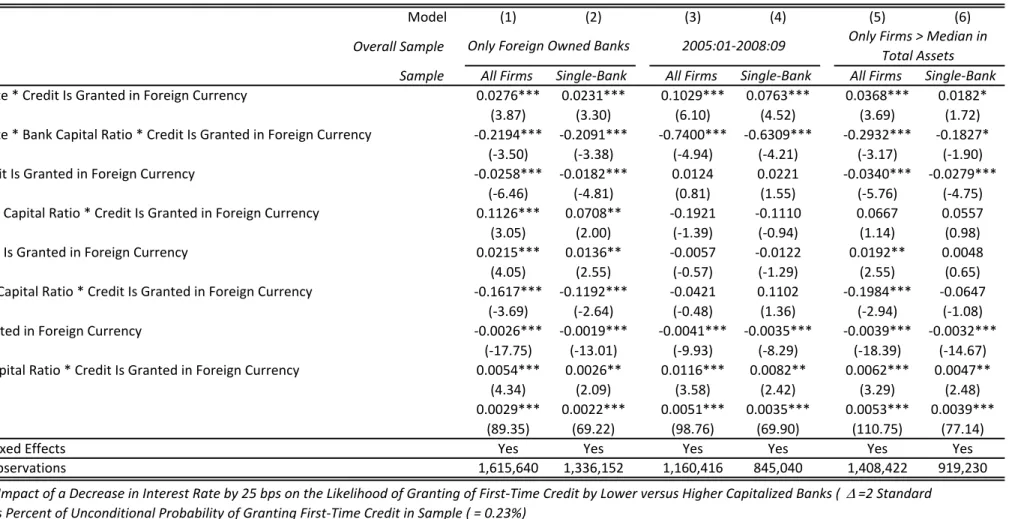

A reduction of 25 basis points in the domestic interest rate increases the probability of credit origination by a low capitalization bank by 0.019 percentage point more than for a highly capitalized bank (assuming that the difference between low and high capitalization is equal to two standard deviations of the sample capitalization ratio). This differential impact represents 13 percent of the probability of credit initiation in the sample and is therefore economically relevant. According to Model 4 (Model 5), a 25 basis point drop in the domestic interest rate generates a differential impact between low and high capitalization banks that is equal to only 4 percent (5 percent) of the unconditional probability of initiating credit in the sample .

The bottom panel in Table II shows that the magnitude of the difference in the economic impact between the domestic and foreign currencies is 8 and 4 percent, respectively. In other words, the bank credit channel of domestic monetary policy loses its power when it comes to providing foreign currency credit. Moreover, the coefficients of models 4 to 7 again indicate that an interest rate cut affects banks' credit initiation to a greater extent when credit is provided in the domestic currency than when credit is provided in euros or Swiss francs.

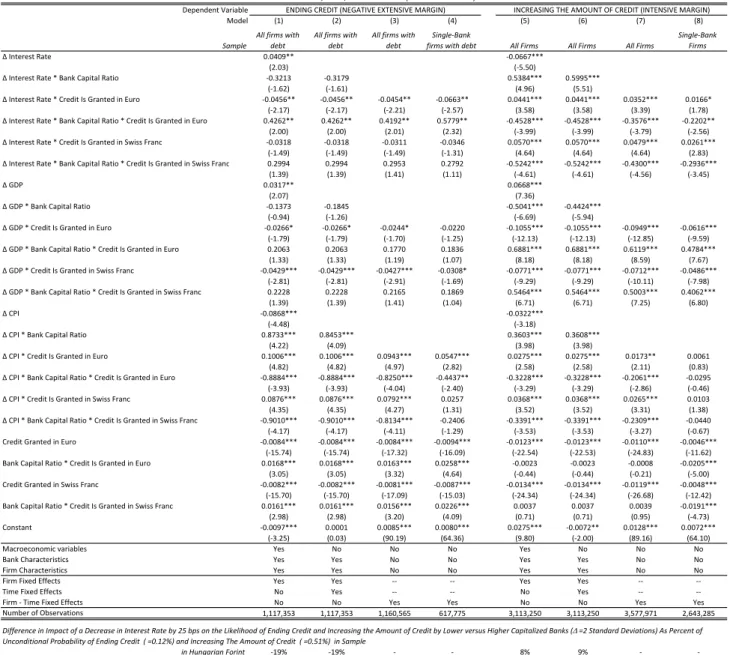

The economic impact accounts for 19 percent of the unconditional probability of credit initiation in the sample. In particular, we take into account the probability that bank lending will end (negative extensive margin) and the probability that bank lending will increase (intensive margin) in domestic and foreign currencies. According to Model 6, the difference in the response between banks with low and high capital ratios, when credit is granted in Hungarian forint after a decrease in domestic interest rates by 25 basis points, amounts to 9 percent of the unconditional probability of the amount of credit increasing.

Conversely, if the credit is granted in euros or Swiss francs, this differential effect does not exceed 1 and 2 percent of the unconditional probability of an increase in the amount of credit in the sample, respectively.

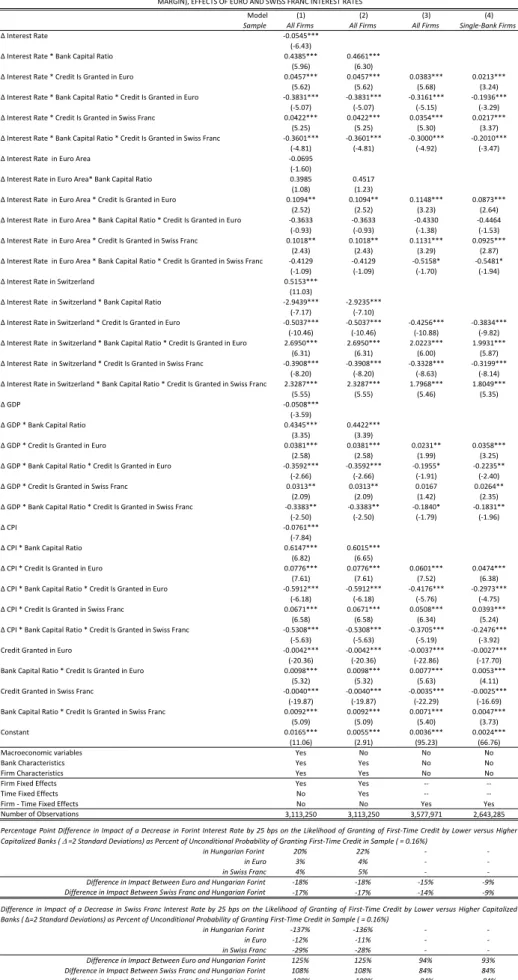

Compositional Effect of Domestic versus Foreign Monetary Policy

Conclusion

PROVISION OF CREDIT IN DOMESTIC OR FOREIGN CURRENCY TO BORROWERS IN CURRENT WITHOUT CREDIT IN DOMESTIC OR FOREIGN CURRENCY (EXTERNAL MARGIN). Difference in the impact of a 25 bps decrease in the interest rate on the probability of granting first credit by lower versus higher capitalized banks (=2 standard deviations) as a percentage of unconditional probability of granting first credit in the sample (= 0.23%). The dependent variable is a dummy equal to one if the firm is granted credit in domestic (foreign) currency in a given year:month, conditional on having received no credit in that currency in the previous month and otherwise equal to zero.

Company ‐ Time Fixed effects Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes. The difference in the impact of a 25 basis point reduction in the interest rate on the probability of first credit approval by banks with lower and higher capitalization (=2 standard deviations) as a percentage of the unconditional probability of first credit approval in the sample ( = 0.23%). GRANT OF CREDIT IN DOMESTIC OR FOREIGN CURRENCY TO BORROWERS CURRENTLY WITHOUT CREDIT IN DOMESTIC OR FOREIGN CURRENCY (EXTENDED MARGIN), ACCORDING TO THE SAMPLE.

THE GRANT OF CREDIT IN HUNGARIAN FORINT, EURO OR SWISS FRANC TO BORROWERS CURRENTLY WITHOUT CREDIT IN THAT CURRENCY (EXTENDED MARGIN). Difference in impact of a drop in interest rate by 25 bps on the probability of granting first time credit by lower versus higher capitalized banks (=2 standard deviations) as percentage of unconditional probability of granting first time credit in the sample ( = 0.16%). The dependent variable is a dummy equal to one if the firm receives credit in Hungarian Forint / Euro / Swiss Franc in a specific year:month, provided that they have not received any credit in this currency in the previous month and otherwise equal to zero.

LOAN REPAYMENT OF BORROWERS WITH LOANS IN HUNGARIAN FORINTS, EUROS AND SWISS FRANCES (NEGATIVE EXTENSIVE MARGIN) AND INCREASE IN THE AMOUNT OF LOANS OF BORROWERS IN HUNGARIAN FORINTS, EUROS OR SWISS FRANCES (INTENSIVE MARGIN).