Introduction

The Harrod-Balassa-Samuelson Model

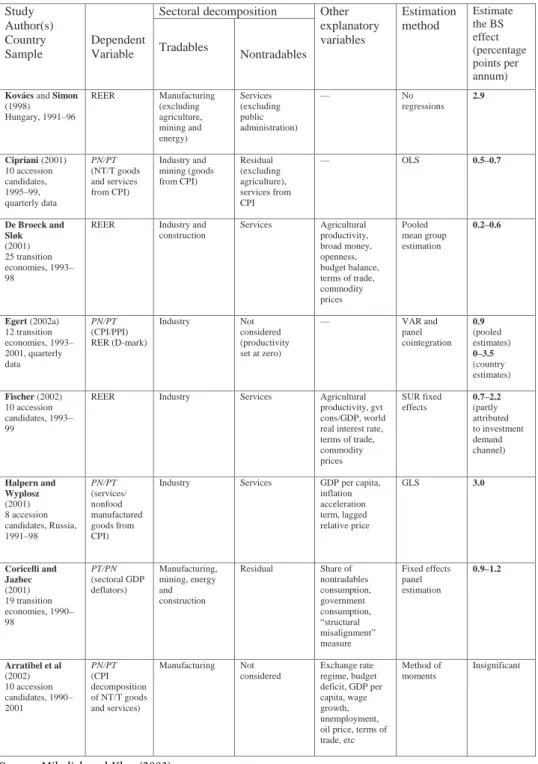

Empirical Studies

Furthermore, they find no support for the assumptions behind the HBS effect, including the law of one price in the exchange sector or the pattern of movement of non-traded prices relative to traded prices consistent with real exchange rate developments. However, they find less empirical support for the general effect of HBS—i.e. there is little evidence that long-run differences in the level of the real exchange rate reflect differences in the relative price of non-traded goods. Their results confirm the presence of the HBS effect in the range of 3 percentage points per year.

In summary, their results suggest that the role of the HBS effect in the price level convergence may be limited and that other factors may also be important.

Presentation of the Data

Data Sources and Definitions

According to the interpretation of the HBS model and its variants (see Chapter 2), their estimates require data on relative prices, relative productivity, and real exchange rates. As for the non-tradable sector, we use a single definition that includes the part of the economy that complements the second definition of tradable goods, i.e. all sectors except agriculture, fisheries, forestry and industry. We used the IMF IFS database for CPI and PPI data, and the OECD Main Economic Indicators database for exchange rates and the non-exchange component of the CPI.

10CANSTAT - Quarterly Bulletin of Candidate Countries completed by the statistical offices of the 8 new EU member states, as well as Bulgaria and Romania.

Data Description

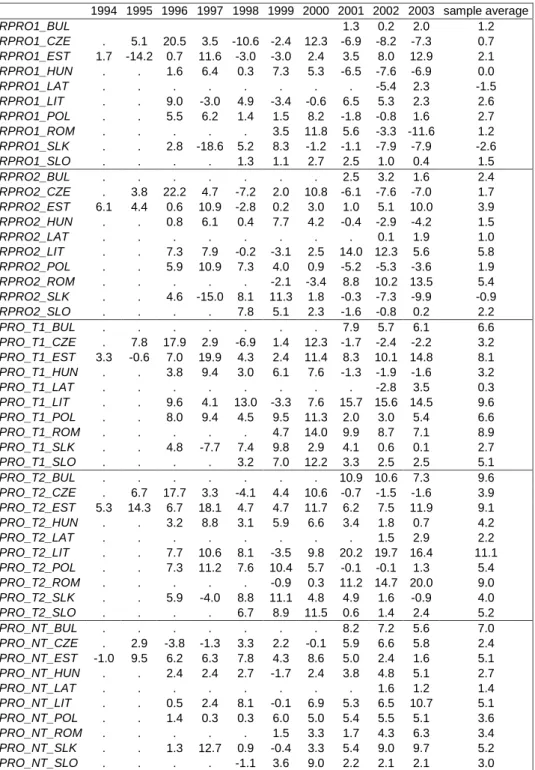

CPI_NT_xxx– CPI prices of services (national definitions), PPI_xxx– producer price index (industry excluding construction). DEF_xxx– Gross Value Added deflator for country xxx, CPI_xxx– the consumer price index for country xxx, PPIM_xxx– the PPI in manufacturing for country xxx. In terms of trends, if only industry is considered tradable, one can speak of a slight increase in relative productivity; when agriculture is added to the tradable sector, trend relative productivity has actually been declining since 2000.

Slovakia provides another example: both measures of relative productivity are highly volatile, but show stable relative productivity growth with an equalization.

Unit Root Tests

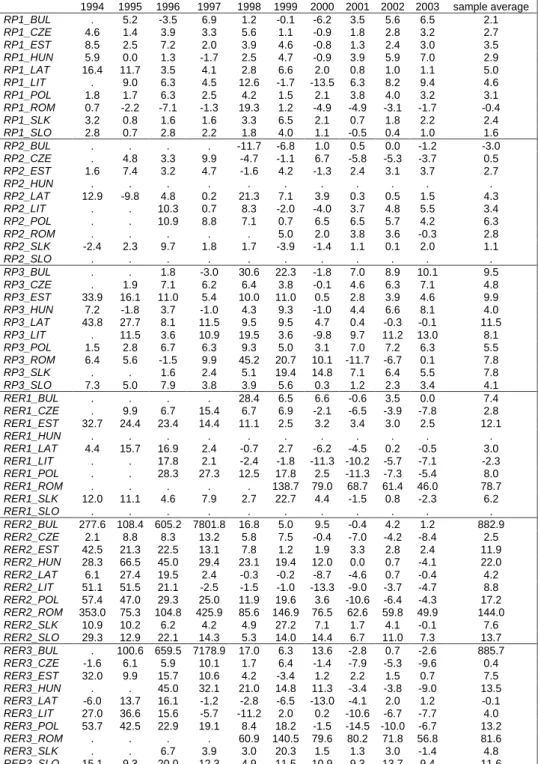

Relative price indices (Figure 2) have been increasing for the majority of the Central and Eastern European countries for most of the analyzed period. In the case of specifications with a trend, some tests point to the rejection of the null hypothesis of non-stationarity for all productivity indicators and the euro exchange rate (and PPI in the case of the IPS test). The internal and external transmission mechanisms of the HBS model rest on several restrictive assumptions, which were discussed in Chapter 2.

We start with the sectoral distribution assumption, then consider the wage equalization assumption, and finally conclude by considering the PKM assumption.

Empirical Verification of the Basic Assumptions of the HBS Model

Sector Division and Measurement of Prices

In the first case, due to the lack of data at a sufficiently detailed level, it is impossible to properly classify some branches or sub-branches of the economy into any sector. Undoubted bias in the series also causes the deviation of the actual standard error estimates from the estimates that would be obtained if both sectors were correctly defined. Therefore, if the empirical definition of the two sectors is problematic, there are reasons to expect problems with the final estimates of the elasticity of the HBS effect, such as bias in the coefficients and unreliable t-statistics.

There are many reasons for the persistence of the positive bias of regulated service pricing.

Wage Equalisation

In all countries, there is a tendency for wages in service industries to be higher than in manufacturing. Since 1994, the difference between relative wages in the (F-O)/(A-E) and (F-K)/D sectors has been almost negligible, meaning that the two definitions could be used interchangeably. The ratio of non-tradable wages to manufacturing wages shows the same upward trend, but does not reach 1 until 2000.

Non-tradable market wages in Romania, compared to wages in manufacturing, are among the highest in the sample (9% on average). The large difference between (F-O)/(A-E) and (F-O)/D is a result of the fact that manufacturing wages account for only 55% of wages in sectors C and E. This is due to low wages in public sector services, which are on average 7% lower than wages in manufacturing.

Looking at the behavior of relative non-tradable wages in accordance with the definition (lek without C-E)/(C-E), we record higher wages in tradable sectors. As in Bulgaria and Poland, wages in mining and quarrying, as well as in gas, water and electricity, are significantly higher than in manufacturing. An interesting feature of the performance of the pay gap in Slovenia is that wages in public sector services are 45% of those in manufacturing.

There is a tendency for wages in services to be higher than in manufacturing in all countries (d(∆wNT- ∆wT)>0). 30 On average, during the period under investigation, wages in manufacturing were only 52% of those in mining.

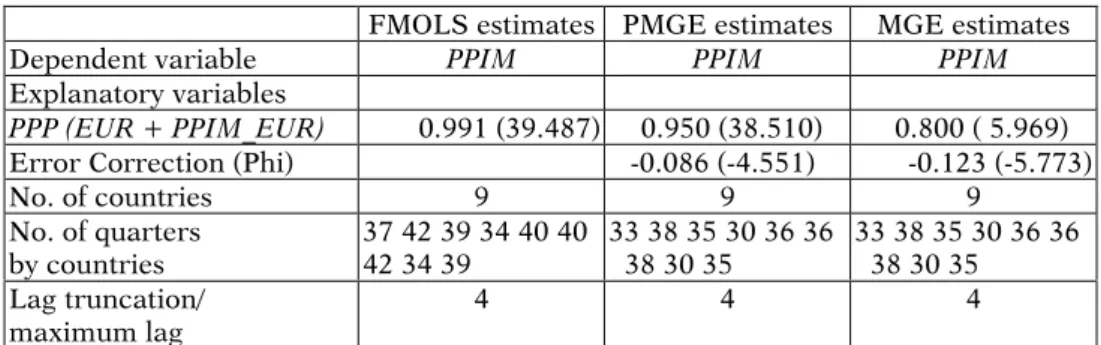

Purchasing Power Parity

In the Czech Republic there was also an increasing trend in the real exchange rate of the krona against the euro, with some exceptions in 1997 and 2002.34 However, due to the impossibility of obtaining measures of value added for such a small aggregate ( equivalent of section D), this real exchange rate formulation is not used for subsequent empirical analysis of the HBS effect. In Estonia, as a result of the early fixing of the krone to the German mark (to the euro in 1999), real exchange rate developments have been largely dominated by changes in inflation.

The real appreciation was mainly due to positive inflation in tradable goods (until 2001), as the nominal exchange rate of the euro showed a continued depreciation trend, with some reversal in 2002. After 1999 the inflation differential approached zero, but the nominal exchange rate started to to stimulate appreciation. and later the depreciation of the real exchange rate. In Slovakia, the nominal exchange rate against the euro largely showed a mean return over the period 1993–2001, with a depreciation from the mean in 1999.

In Slovenia, the real exchange rate of the euro fluctuated around a constant average but with long periods of deviation from the average and with large peaks and valleys. If the coefficients (α1 and α2) in equation (24) – the definition of the nominal exchange rate (e) – are equal to [1,-1], then the real exchange rate (deflated with prices of tradable items) will be constant and equal to one. The very simple theoretical framework of the PPP model does not indicate which variable should be dependent.

In the case of Bulgaria, due to the lack of PPI for production, prices for total industry were used. This may stem from the deliberate exchange rate policy of permanent nominal depreciation of the Slovenian tolar.

Panel Estimations of the HBS Effect

- Models and Cointergration Tests

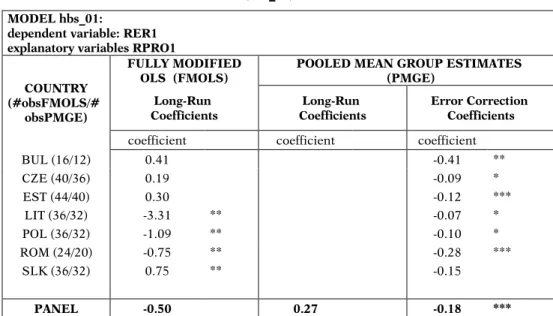

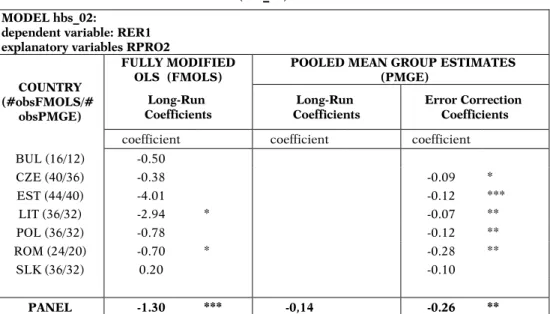

- Estimations of the HBS Equations

- Policy Relevance and Estimation of the Size od the HBS Effect 48

- Different Modes of Realization of HBS Effect and the Role

- Empirical Verification

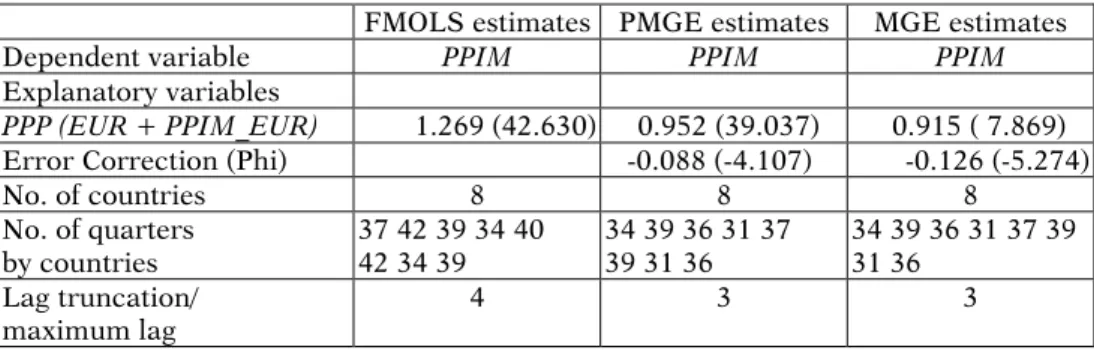

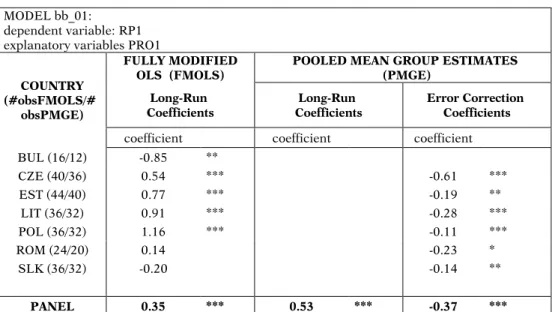

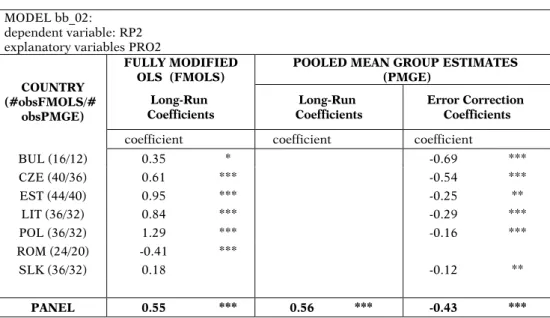

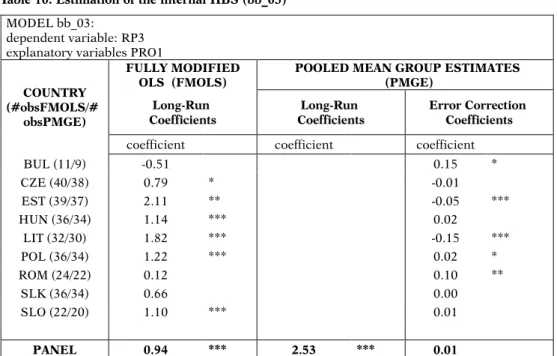

In our paper we consider multiple versions of the domestic and international version of the HBS model. There appears to be more evidence in favor of the effect of internal than external HBS. A natural continuation of the above evaluations is the quantification of the ABEF effect on VQL.

For all other countries, significantly smaller contributions from the HBS effect are reported, not exceeding 1.5 percentage points. The estimates of the contribution of the HBS effect to the fair valuation are shown in Table 17. They indicate the importance of the HBS effect in the fair valuation in most countries, both in the first and second periods, albeit to different degrees for different countries.

Regardless of the dispersion of estimates, the greatest contribution of the HBS effect to the real appreciation in the first period turned out to be for Poland and Hungary. However, it was not intended to undermine the application of HBS theory in the general context of the analysis of inflation and real appreciation in CEE countries. In a flexible exchange rate regime with unrestricted nominal exchange rate movements, HBS can occur through any combination of the above mechanisms.

As a consequence, estimates of the HBS effect may vary depending on the constraints imposed by the nominal exchange rate regimes. If this is the case, it can be argued that the utility of an estimate of the HBS effect based on a flexible exchange rate period (with presumably lower resulting HBS inflation) will be limited.

Summary and Conclusions

Based on regression estimates of elasticities, we have calculated the contribution of the ABEF effect to inflation and appreciation of the real exchange rate during two four-year periods and 2000-2003. Our estimates of the annual contribution of the ABEF effect to inflation (generally below 2 percentage points in the later period) and to real appreciation (generally below 3 percentage points in the later period) should be interpreted with caution. In the last part of the paper, the hypothesis of the possible influence of exchange rate regimes on the importance and magnitude of the HBS effect postulated in the literature was discussed.

It has thus been demonstrated that flexible exchange rate regimes can smooth the realization of the HBS effect (i.e. adjustments to the equilibrium suggested by the HBS). Estimates picked up a statistically significant impact of regimes on HBS estimates and showed that failure to account for their heterogeneity would tend to overestimate the size of the HBS effect for both types of exchange rate regimes. The Ballasa-Samuelson Connection”, CEPR. 1981), "The Determination of the Real Exchange Rate: The Productivity Approach", Journal of International Economics, June.

International Monetary Fund (1999), “Exchange Rate Arrangements and Currency Convertibility: Development and Problems”, Washington DC. 1997), 'Economic growth and real exchange rate: a review of the Balassa-Samuelson hypothesis in Asia', NBER Working Paper 5979. The contribution of the HBS effect to the annual dynamics of the gross value added deflator in the Central and Eastern European countries (average annual percentage changes over the periods indicated). The contribution of the HBS effect to CPI inflation in CEECs (average annual percentage changes over the periods indicated).

The contribution of the HBS effect to the appreciation of the real exchange rate (average annual percentage changes over indicated periods). Note: RPare ratios of the price level of non-tradables relative to the price level of tradables, For sources and definitions see Section 4.1 and Appendix I. Specific forms of the test differ with respect to enforcing homogeneity on the number of lags and coefficients in the autoregressive and deterministic component of equation II-2.

There are several alternative forms of the test (see Table 7), depending on how the dynamics are taken into account to correct for serial correlations (Harris and Sollis, 2003).