The case studies include a general overview of the SME sector, current status of SME financing, recommended financial instruments for the development of the SME sector and conclusions and policy recommendations. The Code is designed to inform both the private and public sector institutions about the impact of the SME financing policies and practices, to serve as a guide for the formulation and implementation of innovative SME financing policies and vehicles in the region.

GOVERNMENT SUPPORT TO THE SME SECTOR

The main feature of this phase was that it allowed for faster privatization and provided public evidence of the social justice of privatization. According to the studies and analyses, not all sectors of the economy have comparative advantages in export-oriented production.

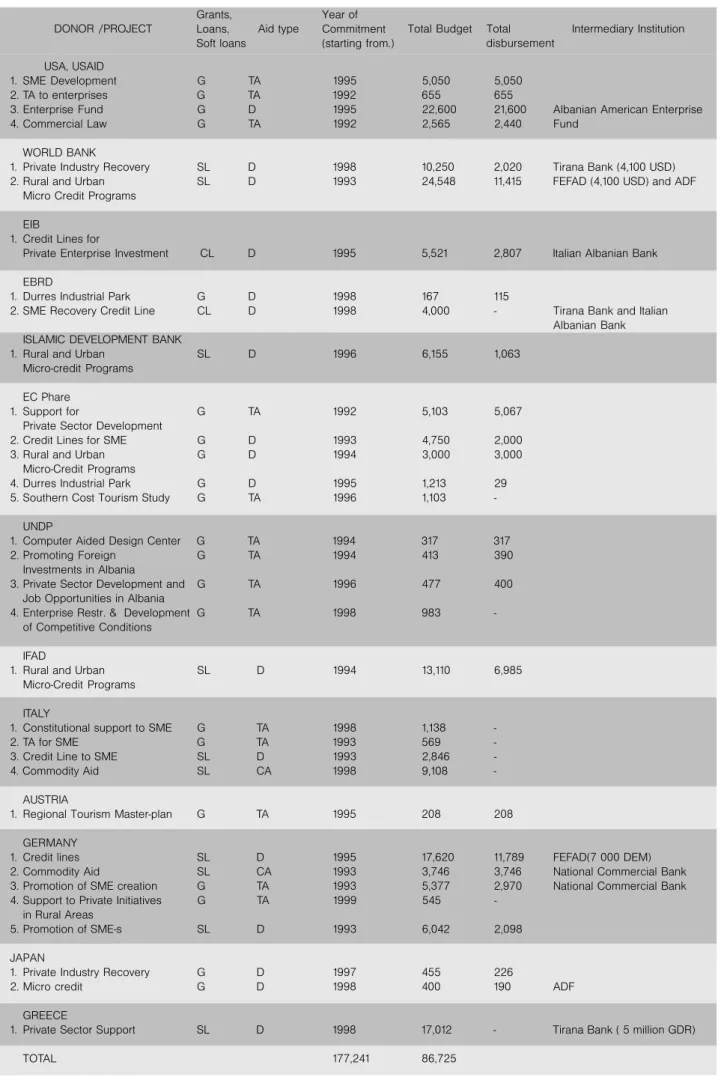

INSTITUTIONS SUPPORTING THE SME SECTOR

Most investors believe that a more liberal credit policy should be developed. They also believe that new institutions are necessary for the development of SMEs through a bottom-up approach.

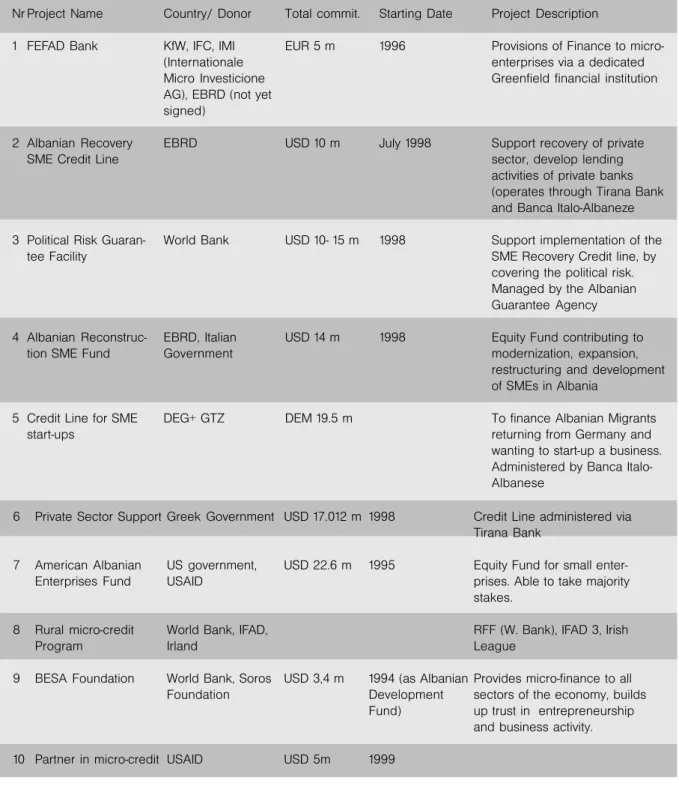

WORLD BANK AND IDA

Although, coordination should be improved, in order to avoid duplication and that there should be a strengthening of the SME Unit in the Ministry. Improving the financial sector through the development and strengthening of commercial banks and micro-enterprise banks.

EBRD FINANCING

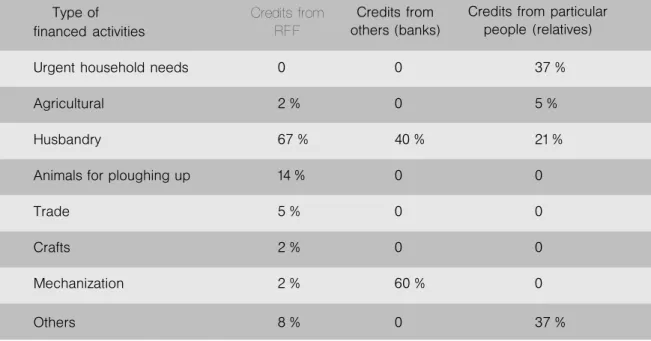

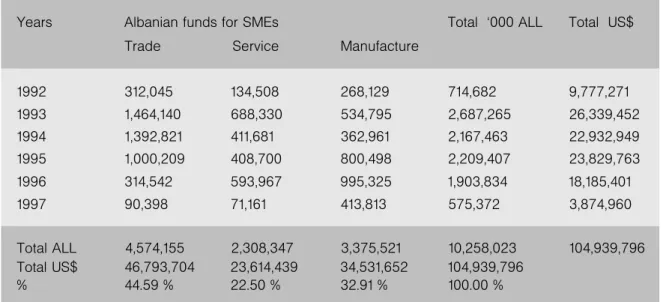

CURRENT STATUS OF SME FINANCING

- EXISTING FINANCIAL INSTRUMENTS

- GENERAL ACCESS TO FINANCING

- EFFECTIVENESS OF THE EXISTING FINANCIAL INSTRUMENTS

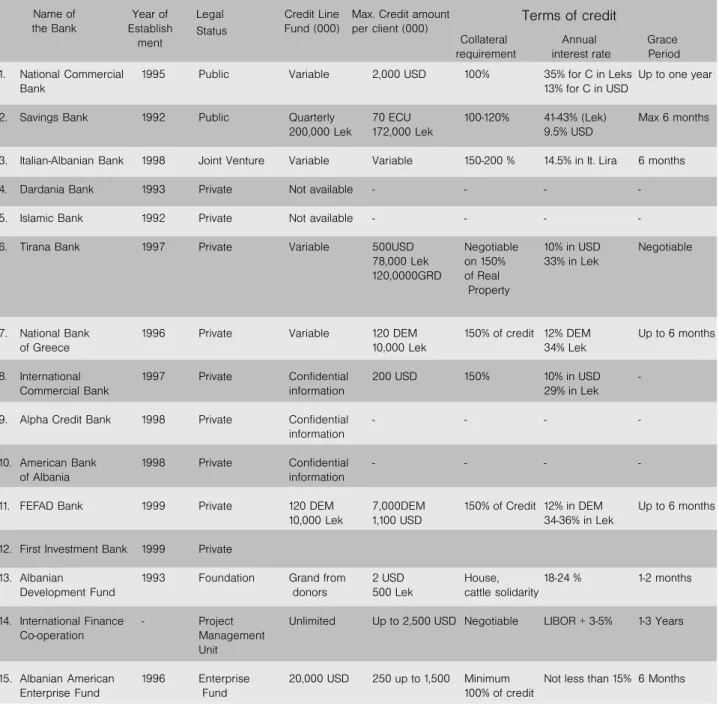

In the early 1990s, Albanian banks mediated most of the large flows of money sent home by Albanian migrants from abroad. Some IFI credit lines are not competitive due to the availability of cheaper funds from other donors in the past.

DEVELOPING SME SECTOR: RECOMMENDED FINANCIAL INSTRUMENTS

- SUGGESTED TYPES OF INSTRUMENTS

- IMPLEMENTING NEW FINANCIAL INSTRUMENTS

- THE POTENTIAL INFLUENCE OF THE SUGGESTED INSTRUMENTS TO

Eligible commercial banks are then invited to participate in the scheme by signing a separate agreement with the Guarantee Fund's managing institution (eg the Central Bank) regarding acceptance of the Fund's special rules and regulations and the payment of a agreed insurance fee. Eligible commercial banks are then invited to participate in the scheme by signing a separate agreement with the Guarantee Fund's administering institution (eg the Central Bank) regarding acceptance of the Fund's special rules and regulations and the payment of a agreed insurance fee.

THE SME SECTOR

CONCLUSIONS AND POLICY RECOMMENDATIONS

- PROPOSED CHANGES IN CURRENT POLICIES

- PROPOSED CHANGES IN CURRENT LEGISLATION

- PROPOSED CHANGES IN CURRENT PROCEDURES

The government could consider the relationship between these policies because they are all part of the reform process. First, the government should make vigorous and sustained efforts to reduce the size of the informal economy.

SME FINANCING IN BULGARIA

INTRODUCTION

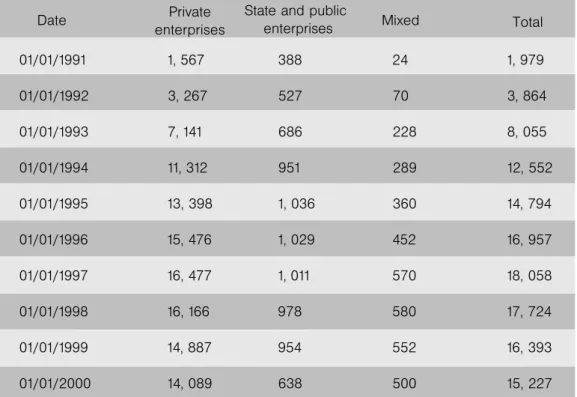

A GENERAL OVERVIEW OF THE SME SECTOR

- IMPORTANCE OF THE SECTOR OF SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- SWOT OF THE SME SECTOR

- POLITICAL ENVIRONMENT - SMALL AND MEDIUM-SIZED ENTERPRISES

- THE STATE POLICY RELATED TO SME S

The analysis of the data on operational profitability (expressed as the ratio of /operational income to operational costs/: sales revenue x 100) of technological SMEs in 1998 (Table 6) shows that this is the case for Industry. These unclear issues have hampered the practical application of Treaty preferences.

CURRENT STATUS OF SME FINANCING IN BULGARIA

- EXISTING INSTRUMENTS FOR SME FINANCING

- GENERAL ACCESS TO FINANCING BASIC PROBLEMS

50% of the credit risk incurred in the financing process is covered (only in the principal amount). The program supports investment projects in certain directions, and the size of the loan is up to BGN 15,000.

RECOMMENDED FINANCIAL

INSTRUMENTS FOR THE DEVELOPMENT OF THE SME SECTOR IN BULGARIA

CONCLUSIONS AND RECOMMENDATIONS

In the field of lending to small and medium-sized businesses, arbitration courts are particularly suitable, as possible disputes could be resolved quickly with minimal costs for the parties. Drafting of special programs together with organizations of small and medium-sized business branches, within which SMEs will receive free consultations in the preparation of business plans, financial statements, etc.

THE CASE STUDY OF CROATIA

THE IMPORTANCE OF THE SME SECTOR IN CROATIA

The Ministry of Crafts and SMEs has established itself as the center of policy articulation, organization and coordination in Croatia. Out of 21 Croatian counties, seven counties still have no local business support agency. a) poor entrepreneurial and management skills combined with low quality of consulting services; .. the problem with entrepreneurial skills is related to loan application problems because most business plans and other loan application support documentation are rejected due to their low quality and non-professionalism. - insufficient knowledge and skills of entrepreneurs to properly manage their businesses, as a result of which a significant number of small entrepreneurs do not make a profit in the first years of their businesses and are forced to close them. - lack of management skills, especially in relation to drawing up realistic plans, making decisions and the responsibility for their implementation and, a luck of advisory bodies in relation to these areas b) lack of information; general business information, information on market demand, including export opportunities (lack of market research data as well as lack of marketing ideas and concrete projects for the penetration of foreign markets) and finally a lack of information on loan and credit possibilities and procedures.

CURRENT STATUS OF THE SME FINANCING IN CROATIA

- LOANS

- SME- EQUITY PARTICIPATION SYSTEMS

- LEASING IN CROATIA

In return, the bank agrees to provide five times the amount of the deposit from its own bank assets for lending to SMEs in the region. The World Bank program in Croatia focuses on three main themes of the government's reform program: 1). In the case of NOA/Opportunities Intl. the goal is to create a financially sustainable credit union.

RECOMMENDED FINANCIAL INSTRUMENTS FOR THE DEVELOPMENT OF SME SECTOR IN

- POSSIBLE STEPS FOR IMPLEMENTING A MORE ADEQUATE SMES LENDING SYSTEM

- LAUNCHING ADDITIONAL MICRO-LENDING PROGRAMMES

- EXPANDING FINANCING THROUGH EQUITY FUNDS IN CROATIA

- EXPANDING THE ROLE OF LEASING IN SME FINANCING IN CROATIA

The idea is, for example, that local entrepreneurs in the countryside know agriculture, many of the potential borrowers and the local culture very well. The tenant may be able to benefit from the economies of scale of the landlord's purchasing power. Recommendation for the rental industry in Croatia. a) The finance lease/operating lease distinction for VAT purposes should be abandoned and VAT on any transfer at the end of the lease will be on the actual transfer price.

OVERVIEW OF THE SME FINANCE ENVIRONMENT AND RACTICES IN THE

REPUBLIC OF MACEDONIA

GENERAL OVERVIEW OF THE MACEDONIAN SME SECTOR

- COUNTRY AND SECTOR BACKGROUND

- MACEDONIAN SMALL BUSINESS ENVIRONMENT HIGHLIGHTS

The lack of an efficient and durable network of information gathering and dissemination, relevant to the SME sector, is cited as one of the leading constraints for private entrepreneurship and SME development in general (see Annex I - Main constraints for SME Development). The existing banking and financial system does not (yet) really adequately meet the needs of the SMEs. It seems to represent only the interests of the big companies, although membership is compulsory for all registered companies.

CURRENT STATUS OF SME FINANCE

- MACEDONIAN FINANCIAL SECTOR OVERVIEW

- INVESTMENT CLIMATE AND OPPORTUNITIES

- EXISTING FINANCIAL INSTRUMENTS

- GENERAL ACCESS TO FINANCING

- EFFECTIVENESS OF THE EXISTING FINANCIAL INSTRUMENTS

- ENABLING ENVIRONMENT FOR SME FINANCE

- CONSTRAINTS (CURRENT) IN SME FINANCE (SEE APPENDIX III)

The law also provides for tax reductions for foreign persons performing registered activities who are non-residents of the Republic of Macedonia for the first three years of operation. The Macedonian Stock Exchange (MSE) was established in late 1995 as the first organized stock exchange in the history of the Republic, trading stocks and bonds. The International Finance Corporation (IFC), a member of the World Bank Group, has been very supportive in the transition process of the economy in Macedonia and in building a quality business climate for foreign investments.

RECOMMENDED FINANCIAL INSTRUMENTS FOR THE SME SECTOR DEVELOPMENT

- TYPES OF FINANCIAL INSTRUMENTS

- FEASIBILITY OF IMPLEMENTING NEW FINANCIAL INSTRUMENTS

- PROPOSED CHANGES IN CURRENT POLICY, LEGISLATION AND PROCEDURES

However, more substantial (foreign) support for the Macedonian economy is highly conditional on the improvement of the general political climate in the region, which is still quite unstable. However, the lack of tradition in small business financing will remain for some time one of the most important constraints for the promotion of SME financing, in addition to the usual reluctance of banks to deal with it. Draft a new regulation for the establishment of independent industry associations and specifically redraft the existing (outdated) Law on the Chamber of Commerce of the Republic of Macedonia.

APPENDICES

MACEDONIAN BANKS

- BALKANSKA BANKA A.D. SKOPJE Types of Available Funds

- EXPORT-IMPORT BANKA A.D

- IZVOZNO KREDITNA BANKA Types of Available Funds

- KOMERCIJALNA BANKA A.D

- KOMERCIJALNO INVESTICIONA BANKA A.D. KUMANOVO Types of Available Funds

- KREDITNA BANKA BITOLA Types of Available Funds

- KREDITNA BANKA A.D. SKOPJE Types of Available Funds

- MACEDONIAN BANK FOR DEVELOPMENT PROMOTION Types of Available Funds

- MAKEDONSKA BANKA A.D

- OHRIDSKA BANKA A.D. OHRID Types of Available Funds

- PELAGONISKA BANKA Types of Available Funds

- RADOBANK

- SILEKS BANKA

- STOPANSKA BANKA A.D. BITOLA Types of Available Funds

- TETEKS BANKA Types of Available Funds

- TETOVSKA BANKA Types of Available Funds

- TUTUNSKA BANKA A.D. SKOPJE Types of Available Funds

- T.C. ZIRAAT BANKASI Types of Available Funds

Bayerishe Vereinsbank AG (BV) credit limit for purchasing equipment and services from Germany. Credit line for the development of small and medium-sized enterprises / Financing of exports through the Makedonsk Bank for Development promotion credit line. Credit limit for small and medium-sized enterprises from the International Cooperation Development Fund and from the Republic of China (Taiwan).

SMALL SAVINGS AND LOAN INSTITUTIONS

BAVAG Types of Loans

DIKUKO Types of Loans

FERSPED Types of Loans

INKO

INTER FALCO Types of Loans

KIRO KUCUK Types of Loans

MAK BS Types of Loans

MALESHEVKA Types of Loans

MIT STEDILNICA Types of Loans

MLADINEC Types of Loans

PEON

POSTENSKA Types of Loans

FULM

MULTILATERAL INSTITUTIONS

- DEUTSCHE INVESTITIONS UND ENTWICKLUNGS GESELLSCHAFT MBH (DEG)

- EUROPEAN BANK FOR RECONSTRUCTION AND DEVELOPMENT (EBRD)

- WORLD BANK - PRIVATE AND FINANCIAL SECTOR DEVELOPMENT PROJECT THROUGH NATIONAL BANK OF MACEDONIA

- THE INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT (IBRD)

- INTERNATIONAL FINANCIAL CORPORATION (IFC) SMALL ENTERPRISE FUND (SEF)

WORLD BANK - PRIVATE AND FINANCIAL SECTOR DEVELOPMENT PROJECT THROUGH THE NATIONAL BANK OF MACEDONIA PROJECT THROUGH THE NATIONAL BANK OF MACEDONIA.

INVESTMENT FUNDS

SMALL ENTERPRISE ASSISTANCE FUNDS (SEAF) MACEDONIA Types of Available Funds

THE DANUBE FUND Types of Available Funds

EAST EUROPEAN FOOD FUND (JUPITER ASSET MANAGEMENT LIMITED)

EUROMERCHANT BALKAN FUND Types of Available Funds

ICDF EQUITY INVESTMENT FUND FOR SMALL AND MEDIUM-SIZED ENTERPRISES IN MACEDONIA

GUARANTEE AGENCIES

MULTILATERAL INVESTMENT GUARANTEE AGENCY (MIGA) Services Offered

OVERSEAS PRIVATE INVESTMENT CORPORATION (OPIC) Services Offered

MICROLENDING INSTITUTIONS

MOZNOSTI (OPPORTUNITY INTERNATIONAL) Types of Available Funds

MACEDONIAN ENTERPRISE DEVELOPMENT FOUNDATION (MEDF) Types of Available Funds

NATIONAL ENTERPRISE PROMOTION AGENCY NEPA Types of Available Funds

CATHOLIC RELIEF SERVICES (CRS) HORIZONTI MICROFINANCE Services Offered

DEVELOPMENT AGENCIES AND PROGRAMS

- UNITED STATES TRADE AND DEVELOPMENT AGENCY (USTDA) Services Offered

- AGENCY FOR RECONSTRUCTION AND DEVELOPMENT Types of Available Funds

- ECOLINKS (EURASIAN-AMERICAN PARTNERSHIP FOR ENVIRONMENTALLY SUSTAINABLE ECONOMICS)

- LABOR RE-DEPLOYMENT PROGRAM SOCIAL SUPPORT PROJECT IDA- 3268-MK

- OPEN SOCIETY INSTITUTE MACEDONIA (SOROS FUND) Types of Available Funds

- REGIONAL ENVIRONMENTAL CENTER FOR CENTRAL AND EASTERN EUROPE

- AGENCY FOR ECONOMICALLY UNDEVELOPED AREAS Types of Available Funds

- WORLD COUNCIL OF CREDIT UNIONS (WOCCU) Types of Available Funds

- PRISMA PARTNERS FOR ECONOMIC DEVELOPMENT IN MACEDONIA Objectives

- ITALIAN EMBASSY Types of Available Funds

- TECHNICAL MISSION OF THE REPUBLIC OF CHINA (TAIWAN) IN THE REPUBLIC OF MACEDONIA

Creating new ways of doing business enabling local communities to create jobs and promote economic development;. TECHNICAL MISSION OF THE REPUBLIC OF CHINA (TAIWAN) TO THE REPUBLIC OF MACEDONIA IN THE REPUBLIC OF MACEDONIA.

TECHNICAL ASSISTANCE

ENVIRONMENTAL ACTION PROGRAM SUPPORT (EAPS) Types of Available Funds

KNOW-HOW FUND Types of Available Funds

LAND OLAKES INC

REGIONAL CHAMBER OF COMMERCE, SKOPJE Types of Available Funds

TURN AROUND MANAGEMENT PROGRAMME (TAM) Types of Available Funds

CROWN AGENTS Services Offered

SME FINANCING IN MONTENEGRO

- BACKGROUND INFORMATION

- ECONOMIC REFORMS IN MONTENEGRO

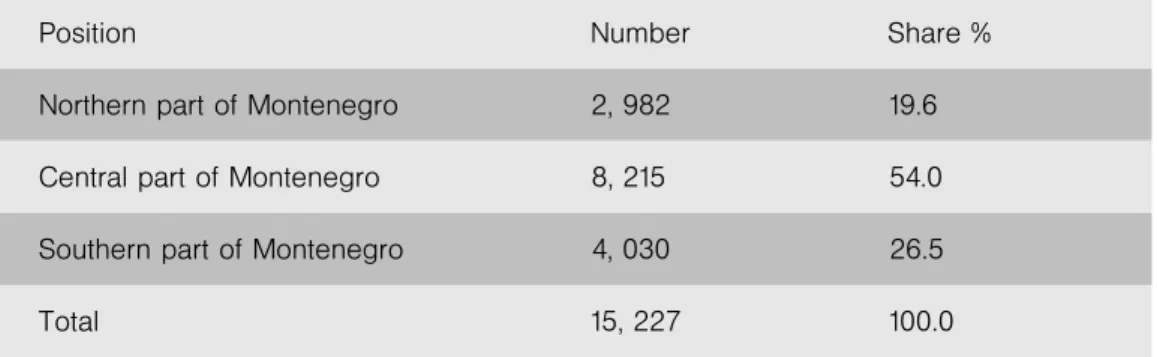

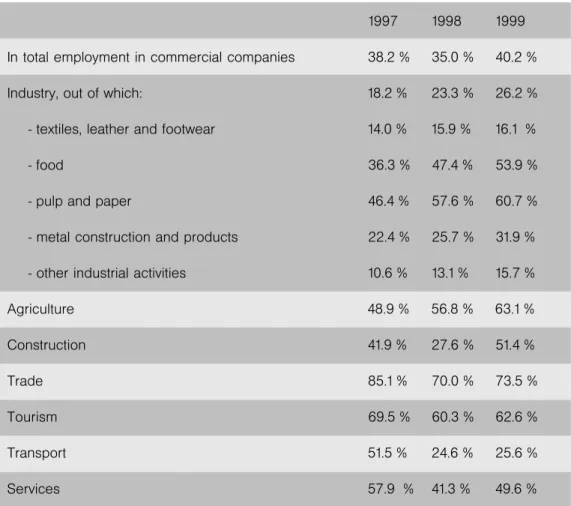

- SMEs IN MONTENEGRO

- SMEs FINANCING

- NO ACCESS TO OUTSIDE FINANICAL SOURCES AS A BARRIER TO SME

- CONCLUSIONS

- RECOMMENDED FINANCIAL INSTRUMENTS FOR THE DEVELEOPMENT OF

Total frequent changes in laws and regulations and sudden changes in the business and political environment). One of the most important obstacles is the cost and lack of access to investment capital. A large number of firms in Montenegro consider limited sources of financing to be a problem (according to the same survey results, more than 67% of firms consider limited sources of financing to be a problem, while more than 30% of surveyed firms consider it to be a very serious problem).

ROMANIAN CASE STUDY

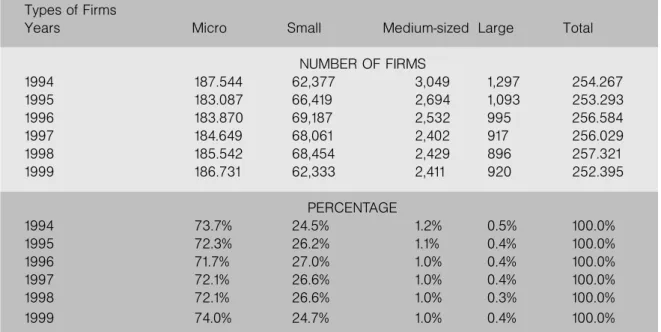

THE IMPORTANCE OF THE SME SECTOR FOR THE ECONOMY

The SME sector in Romania has steadily grown in importance during the transition years and in 1999 reached a share of 45% of turnover and 40%. Although the share of the SME sector varied in the last three years for many of the above indicators, it grew constantly in terms of number of employees and export earnings. However, the total number of exporting SMEs as well as their share of the total number of SMEs and their share of total export earnings have been increasing, indicating increased competitiveness and interest in foreign markets.

EXISTING GOVERNMENT POLICIES AND INSTITUTIONS SUPPORTING THE SECTOR

Several policy documents emphasized the government's commitment to supporting the development of the SME sector, but few real measures were actually put into practice. Law 133/1999 provided for the creation of the National Agency for Small and Medium-sized Enterprises (NASME). Part of the government's efforts should henceforth be devoted to promoting entrepreneurship and the development of a new private sector7.

EXISTING LEGAL FRAMEWORK FOR THE FINANCIAL MARKET

Interest is calculated according to market rates and provisions of the loan agreement. The Romanian-American Enterprise Fund Small and Medium Loan Program is run through Banca Romaneasca. CEC participated in the tender of the Ministry of Labor and Social Welfare in connection with the deployment of the financing line for SMEs.

RECOMMENDED FINANCIAL INSTRUMENTS FOR THE DEVELOPMENT OF

- TYPES OF INSTRUMENTS

Angel networks do not act as brokers or investment advisors and do not become involved in completing or structuring transactions. Entities that become involved in angel networks include corporations, academic institutions, government agencies, economic development authorities, and for-profit entities. Angel networks facilitate the provision of significant amounts of capital to finance startups and expansions.

PRACTICE AND PROSPECTS OF SME FINANCING IN SERBIA

AN OVERVIEW OF THE SME SECTOR IN SERBIAN ECONOMY

- THE DEFINITION AND TYPOLOGY OF THE SME SEGMENT OF SERBIAN (YUGOSLAV)

- THE ROLE AND IMPORTANCE OF THE SME SEGMENT OF SERBIAN ECONOMY FACTS

- SMES CONTRIBUTION TO EMPLOYMENT IN SERBIA

- THE MAJOR PROBLEMS AND LIMITATIONS FOR DEVELOPMENT OF YUGOSLAV SMES

THE DEFINITION AND TYPOLOGY OF THE SME SEGMENT OF SERBIAN (YUGOSLAVIAN) SME SEGMENT OF SERBIAN (YUGOSLAVIAN) ECONOMY. According to these data, the role of the large firms in the national economy is significant. According to the officially declared fiscal policy intentions of the new government of Serbia, that law should be introduced by the beginning of the year 2002.

THE CURRENT STATUS OF SME FINANCING

- MICROFINANCING

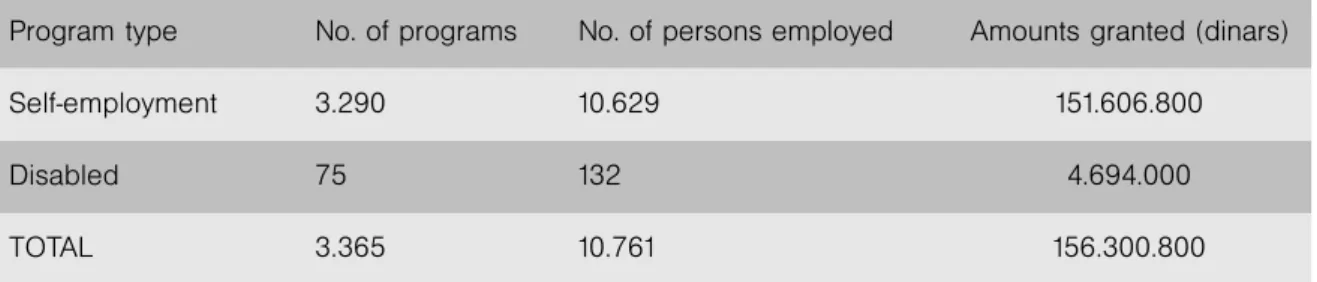

- THE REPUBLICS LABOUR MARKET SUPPORT OFFICE

- THE AGENCY FOR SME DEVELOPMENT

- THE FUND FOR SMES EXPORTS FINANCING

- COMMERCIAL BANKS

The employer is supposed to participate financially in the investment with a minimum of 50% of the total. The main (short-term) objective in establishing that Agency was the need to have an operative government body entitled to communicate with foreign financial and other organizations and institutions (eg: the European Agency for Reconstruction)2 that would be interested to finance the SME development in Serbia. One of the first actions of the Agency was to establish the Fund for Financing of SMEs.

THE RECOMMENDED FINANCIAL

INSTRUMENTS FOR THE SME SECTOR DEVELOPMENT

- ARRANGING THE LEGAL AND OVERALL ECONOMIC ENVIRONMENT

- RESTRUCTURING OF THE BANKING SYSTEM

- BUILDING THE CAPACITY OF SME S FOR RECEIVING (FINANCIAL) SUPPORT

- DEVELOPMENT OF THE APPROPRIATE SME STRATEGY FOR SERBIA

- RECOMMENDED FINANCIAL INSTRUMENTS FOR DEVELOPMENT OF THE SME SECTOR

- CONCLUSIONS

RECOMMENDED FINANCIAL INSTRUMENTS FOR SME SECTOR DEVELOPMENT FOR SME SECTOR DEVELOPMENT. These sources usually enter national economies at the end of the opening-up process (following the example of the international financial institutions, primarily the World Bank, the IMF, the EBRD and others). In terms of more common banking practices, microcredit is currently being introduced by the above-mentioned MFA.

REGIONAL CONCLUSIONS AND POLICY RECOMMENDATIONS