Strategic bidding via the interplay of minimum income condition orders in day-ahead power exchanges

Dávid Csercsik

Pázmány Péter Catholic University, Faculty of Information Technology and Bionics, Práter u. 50/A 1083, Budapest, Hungary

a b s t r a c t a r t i c l e i n f o

Article history:

Received 20 July 2020

Received in revised form 5 January 2021 Accepted 11 January 2021

Available online 23 January 2021

Keywords:

Day-ahead electricity markets Minimum income condition orders Complex orders

Incentive compatibility Strategic bidding

In this paper, we study the so-called minimum income condition order, which is used in some day-ahead electric- ity power exchanges to represent the production-related costs of generating units. This order belongs to the fam- ily of complex orders, which introduce non-convexities in the market clearing problem. We demonstrate via simple numerical examples that if more of such bids are present in the market, their interplay may open the pos- sibility of strategic bidding. More precisely, we show that by the manipulation of bid parameters, a strategic player may increase its own profit and potentially induce the deactivation of an other minimum income condi- tion order, which would be accepted under truthful bidding. Furthermore, we show that if we modify the objec- tive function used in the market clearing according to principles suggested in the literature, it is possible to prevent the possibility of such strategic bidding, but the modification raises other issues.

© 2021 The Author. Published by Elsevier B.V. This is an open access article under the CC BY license (http://

creativecommons.org/licenses/by/4.0/).

1. Introduction

If one investigates trading and pricing mechanisms in various elec- tricity markets around the globe, it may be recognized that despite local market integration advancements and the convergence implied by them, the evolution of individual markets resulted in a diverse set of mechanisms and approaches (Oksanen et al., 2009; Sioshansi, 2011). Moreover, additional allocation and pricing mechanisms emerged in relation with electricity trade, as balancing markets (Singh and Papalexopoulos, 1999) and transmission-related allocation and pricing (Pan et al., 2000).

The paper (Imran and Kockar, 2014) summarizes the various aspects of differences between North American and European type market de- signs. One of these aspects is the format of generator hourly bids in the day-ahead market. While in the typical US market model cost-based multi-part bids containing fuel cost, no load cost and start-up cost are sub- mitted, the European design is fundamentally based on price-based single-part bids containing price and energy volume. In this paper we focus on generator bids in European-type portfolio-bidding markets, or day-ahead power exchanges (DAPXs). These markets are cleared in order to obtain zonal market clearing prices (in contrast to US type mar- ket designs, where locational marginal pricing is applied). In the general framework these markets are coupled, and the clearing mechanisms also take transmission constraints into account (Chatzigiannis et al., 2016a, 2016b;Biskas et al., 2013a, 2013b).

1.1. Simple hourly bids in DAPXs

The fundamental setting of these two-sided multiunit markets is very simple: Participants on the supply and the demand side submit bids characterized by quantity (q) and price per unit (p) for the respec- tive trading period(s) (typically hour) of the following day, which in general may be fully or also partially accepted, according to the resulting market clearing price (MCP) of each hour. In this basic setup, we practi- cally look for the intersection point of demand and supply curves, which ensures the balance of consumption and production. This way, in each period maximum one bid is partially accepted, which determines the MCP.

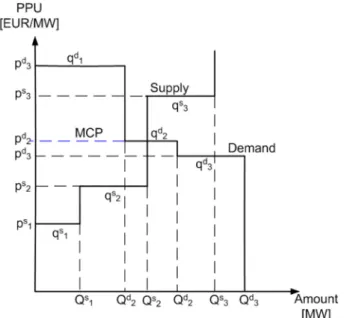

Fig. 1shows a simple example of such a market clearing for a single- period, single-zone case. We assume 3–3 bids on the supply and de- mand side denoted by S1-S3 and D1-D3 respectively. The supply and demand curves depict bids sorted by their price (in increasing/decreas- ing order).

The bid quantity of bidiof typew(w∈{s,d}) is denoted byqiw, while its price is denoted bypiw

. Demand bids are considered with negative quantity (qid< 0). Cumulative quantities, defining the breakpoints of the supply and demand curve are denoted byQisandQidrespectively.

Qsi ¼∑i

j¼1qsj Qdi ¼− ∑i

j¼1qdj ð1Þ

In this particular case, D2 (the second demand bid) is partially ac- cepted, thus its bid price determines the MCP (MCP=p2d), and the traded quantity equals toQ2s=q1s+q2s.

E-mail address:csercsik@itk.ppke.hu.

https://doi.org/10.1016/j.eneco.2021.105126

0140-9883/© 2021 The Author. Published by Elsevier B.V. This is an open access article under the CC BY license (http://creativecommons.org/licenses/by/4.0/).

Contents lists available atScienceDirect

Energy Economics

j o u r n a l h o m e p a g e :w w w . e l s e v i e r . c o m / l o c a t e / e n e e c o

We solved this simple case by determining the intersection point of the supply and the demand curves. As we will see in the next subsection (1.2), special bids in these markets may be present, which do not allow partial acceptance. In this case, the curve-intersection approach may fail, if the intersection point hits one of these bids.

However, the intersection point onFig. 1has an other important in- terpretation. Let us define acceptance values for each bid:yiw∈[0, 1] de- notes the acceptance ratio of bidiof typew(w∈{s,d}). The acceptance values which determine the intersection point in this case are

ys1¼1 ys2¼1 ys3¼0 yd1¼1 yd2¼3

7 yd3¼0: ð2Þ

In electricity trade, the supply must always meet the demand, thus we require the balance

∑

i

ysiqsiþ∑

i

ydiqdi ¼0 : ð3Þ

Let us furthermore define the concept of the total social welfare (TSW). TSW in this context is interpreted as the total utility of consump- tion, minus the total cost of production, formally

−∑i

ydiqdipdi−∑

i

ysiqsipsi : ð4Þ

(Remember thatqid< 0.)

This quantity equals to the area between the accepted part of the de- mand and supply curves. It is easy to see that if we start from the point defined by the values (2) and decrease or increase the total traded quantity (the supply-demand balance must still hold), the TSW is strictly decreased. In fact, the values described in (2) are exactly those values, which maximize the total social welfare of the market, assuming the balance constraint 3.

This concept of TSW maximization may be generalized to more com- plex cases. Indeed, this principle is usually a fundamental element of European-type market clearing mechanisms.

In general, if multiple trading periods are considered and no interde- pendencies arise between the periods, the above approach may be ap- plied for each of the periods independently. In this paper, we will assume a simple two-period case, but as we will see in the following, the characteristic order types of electricity trade will define interdepen- dencies between the periods.

1.2. Complex orders in electricity markets

It is easy to see that the setup detailed above does not consider tech- nological constraints of generating units: It is possible that the resulting MCPs imply that a unit submitting bids for two consecutive hours must produce at full capacity in thefirst hour and shut down in the second (if its bid is fully accepted in thefirst period, and fully rejected in the sec- ond), while the technological constraints of the unit make this impossi- ble. The first approach to address these problems has been the introduction of so-called block orders (Meeus et al., 2009), which con- nect multiple bids submitted for various periods and they must be

fully accepted or rejected in all of the respective periods (in other words, they are characterized by the‘fill-or-kill’condition). These bids imply non-convexities (integer variables) in the market clearing prob- lem (Madani et al., 2016), making the efficient clearing of large scale markets challenging (Madani and Van Vyve, 2018). To guarantee the existence of MCP when block orders are allowed, we must allow their deactivation, regardless of their bid prices (Madani, 2017). This may re- sult in so-called paradoxically rejected block orders (Madani and Van Vyve, 2014), the rejection of which seemingly contradicts to the resulting market clearing prices (but in fact, they can not be accepted without the violation of other constraints, since if they get accepted the MCP will not exist anymore (Madani et al., 2016)).

Block orders are also beneficial for incorporating the non-negligible start-up cost of the generating units. The simple cost model of generat- ing units usually includes afixed term (FT) corresponding to start-up costs and a variable term (VT), which is interpreted as the linear coeffi- cient describing the connection between the generated quantity and the variable (fuel) cost of the units (see e.g.Richstein et al. (2018)). The ef- ficient implementation and market effects of block orders have been discussed in the literature (Meeus et al., 2009;Madani and Van Vyve, 2014, 2015).

1.2.1. Minimum income condition orders

In addition to block orders, one mayfind further so-called complex orders and products in today's practical electricity market imple- mentations (Sleisz and Raisz, 2016;Dourbois and Biskas, 2015;Van Vyve et al., 2011;Chatzigiannis et al., 2016a, 2016b). One of these com- plex orders is the so-calledMinimum Income Condition (MIC)order. The MIC wasfirst introduced in the Spanish electricity market (Contreras et al., 2001) and since then it became quite commonly used in various market models (Garcia-Bertrand et al., 2006; Lam et al., 2018;

Dourbois and Biskas, 2015, 2017; Operator, 2013; Power Spot Exchange, 2016), including novel approaches which aim to provide optimization-based framework for the optimal joint energy and re- serves market clearing (Koltsaklis and Dagoumas 2018).

Nevertheless, the necessity (Poli and Marracci, 2011), the effects on market outcomes (Ruiz et al., 2012;Madani et al., 2016;Gil et al., 2017) and the efficient implementation of MIC orders (Polgári et al., 2015;

Sleisz et al., 2015;Sleisz and Raisz, 2015;Madani and Van Vyve, 2018;

Sleisz et al., 2019) are still subject to ongoing debates and studies.

Fig. 1.Fundamental scheme of the day-ahead electricity spot market for a trading period.

Qis

andQid

stand for the cumulative quantities.

Nomenclature

MCP Market clearing price DAPX Day-ahead power exchange ISO Independent system operator TSW Total social welfare

MIC Minimum income condition FT Fixed term

VT Variable term

EUPHEMIA, the market-coupling tool which was brought to life by European market integration trends, and serves as a kind of reference for European market design approaches, also includes MIC orders. In its public description (Commitee, 2019), Minimum Income Condition (MIC) orders are defined as supply orders consisting of several hourly step bids (elementary bids) for potentially different market hours, which are connected by the MIC which prescribes that the overall in- come of the MIC order must cover its given costs. These costs are defined by a fix term (representing the startup cost of a power plant) and a variable term multiplied by the total assigned production volume (representing the operation cost per MWh of a power plant).

Formally, the Minimum Income Condition constraint is defined by two parameters:

• Afix term (FT) in Euros

• A variable term (VT) in Euros per accepted MWh.

In thefinal solution, MIC orders may be activated or deactivated (as a whole):

• In case a MIC order is activated, each of the hourly sub-orders of the MIC behaves like any other hourly order, which means that they are accepted if and only if the MCP is higher or equal to the bid price.

• In case a MIC order is deactivated, each of the hourly sub-orders of the MIC is fully rejected, even the MCP is higher or equal to the bid price.

We can see that the MIC condition links multiple hourly bids, and the necessary condition for the acceptance of these bids is the activation of the MIC order, which can be described by a binary variable.

1.3. Incentive-compatibility and its relevance in electricity-related markets The concept of incentive-compatibility is originating from the 70's (Hurwicz, 1973;Groves and Ledyard, 1987), and it is related to the evaluation of allocation mechanisms under the assumption of strategic behavior of participants. The topic is discussed in auction theory (Klemperer, 2004), however most of the results in thisfield correspond to single-unit auctions of indivisible goods (Roth, 1982), while in the case of electricity markets a multi-unit auction framework applies. Let us however note that the problem of simultaneous allocation of multi- ple indivisible goods with complementarities is addressed in the

framework of combinatorial auctions (De Vries and Vohra, 2003;

Cramton et al., 2007).

As formulated byNisan et al. (2007),‘A mechanism is called incentive- compatible if every participant can achieve the best outcome to themselves just by acting according to their true preferences'. As the original problem statement assumes indivisible goods, which does not hold in multi-unit electricity auctions, preferences translate to evaluations in our case:

Considering the simple example depicted inFig. 1, in ideal case, bidders on the demand side bid their real consumption utilities and bidders on the supply side bid their real marginal costs. We consider strategic bid- ding compared to this reference case of truthful bidding.

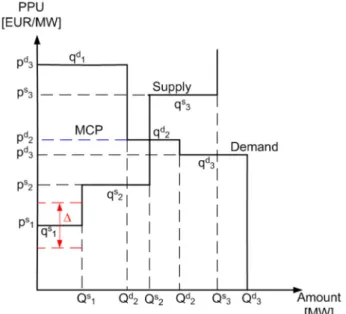

Fig. 2demonstrates, why the standard, marginal clearing model (i.e.

MCP based model) of multi-unit electricity markets is considered to be practicallyincentive-compatible.

If we perturb the bid price of supply bid 1 (S1) byΔas depicted in the picture, the outcome of the auction does not change: The MCP deter- mining the set of accepted/rejected bids will be the same as before. In addition, as bids are paid off according to the MCP, the resulting utility of the deviating player also remains the same. If e.g. the bid price is in- creased, the nominal income of the bid is increased, but the surplus resulting from the difference of the MCP and the bid price is decreased by the same amount.

The above deduction is on the one hand only true for small devia- tions (e.g. in our case we assume that for the modified valuebps1the in- equalitybps1<ps2still holds) and on the other hand it is not true for all bids. As in the proposed case the second demand bid (D2) sets the MCP, p2dis in fact affecting the market clearing price, and if the bidder of D2 decreasesp2d, it can effectively increase its own surplus (as long as the inequalityp2d≥p3dholds).

If we consider an other bid than D2, but perturb the price so much that it changes the ordering of bids, and the actual bid will be exactly the price-setter (e.g. if we decreasep1dtopd3<bpd1<pd2), the same effect arises.

In practice, the number of standard bids for any period in DAPXs is high (several thousand or tens of thousands), and as in the bid submis- sion process the actual other bids are not known, atfirst glance it seems unlikely that such manipulation can be effectively carried out. On the other hand, as recent examples have shown (Moylan, 2014), the num- ber of big players may be limited, and high proportion of bids may orig- inate from the same players. In this case, oligopolistic behavior and related phenomena may emerge on electricity markets (David and Wen, 2001).

Regarding MIC orders, according to the publicly available data of OMIE (the Spanish DAPX), where this formulation is used,1the number of these orders is significantly lower, about 75–85 per day.

In the above reasoning, we assumed the manipulation of bid price.

This is however not the only alternative. Let us assume a market sce- nario, where there are some large suppliers with significant bid quanti- ties, like S2 inFig. 1. As depicted inFig. 3, ifq2sis reduced tobqs2¼0:5qs2, the intersection point of the two curves will change, the MCP is in- creased, and the bidder of S2 receives significantly more payoff for one unit of energy. This phenomena is also termed ascapacity withhold- ing, discussed in (Aliabadi, 2016) in a similar auction-based but also network-constrained framework. The possibility also arises on the other side (demand reduction), although in electricity markets, large producers (i.e. big power plants) are more prevalent than large consumers.

While in this very case the supply is reduced in the market, in order to get a higher payoff, similar effects may arise if multiple participants are competing for afixed set of goods, as in the case of treasury and spectrum auctions. In this case, as discussed byAusubel and Cramton (2002), we talk about demand reduction.

Fig. 2.Possible small variations of the bid price of supply bid 1 (Δ) has no effect on the

MCP, thus the acceptance and payoff supply bid 1 is not affected. 1https://www.omie.es

Up to this point we discussed cases in which one participant unilat- erally changes its bidding behavior to improve its payoff, while it was assumed that the rest of the bids is unchanged. The question however may be formulated in a more general context as well, where all submit- ted bids are subject to strategic behavior. The paper ofAliabadi et al.

(2016)considers power generation companies (GenCos) located in a network as leaders of a Stackelberg type game, in which the indepen- dent system operator (ISO) plays the role of the follower. The paper de- velops a bi-level mathematical programming framework to model the market clearing mechanism of the ISO where the behavior of GenCos and network constraints are taken into account. In this model, the au- thors are able to describe the collusive behavior of GenCos, and also pro- vide numerical examples demonstrating the possible uniqueness/non uniqueness of Nash Equilibria. As we will see later, our main aim in this paper is to show how the minimum income condition orders may be used for strategic bidding. Potential equilibrium problems resulting from such strategic behavior are not the main focus of this study, they are discussed only marginally.

1.3.1. Pay-as-bid auction and incentive-compatibility

Let us note that in addition to the marginal clearing model described insubsection 1.1, the pay-as-bid method is also applies in the case of some electricity related markets, like for example the Iranian electricity market.2However, as discussed byTierney et al. (2008), in this case, in contrast to the marginal clearing market model, all participants do have clear incentives: Suppliers aim to raise their bid prices up to the maxi- mum acceptable level to earn the most payoff. This results in aflattened supply curve, and according toTierney et al. (2008), it exacerbates mar- ket competitiveness.

In other studies, agent based simulations were used to determine optimal strategic bidding behavior and market efficiency in the context of pay as bid vs marginal pricing (Xiong et al., 2004;Bakirtzis and Tellidou, 2006;Bower and Bunn, 2001;Liu et al., 2012;Aliabadi et al., 2017).

1.4. Contribution and structure of the paper

The possibilities of strategic bidding via MIC orders have not been explicitly discussed in the literature. In this paper, our aim is to show that under the current practice, bidders submitting MIC bids may have additional incentives for strategic bidding, if multiple such bids are pres- ent on the actual market. To demonstrate this, based on the widely used EUPHEMIA framework and the respective definition and formalism of MIC orders, we introduce a simple market clearing framework for a two period market, where the phenomenon may be studied in its purest form.

Insection 2, we introduce the computational implementation of the market in detail.Section 3demonstrates how strategic bidding may in- crease the payoff of MIC bids via the interplay of such bids, and also analyses the scenario, when a modification in the objective function of the market clearing algorithm is introduced to address this issue.

Section 4evaluates and discusses the proposed results, andfinally section 5concludes and drafts future prospects of the work.

2. Materials and methods

In the next subsection, we introduce the market model in which the interplay of MIC orders is studied. To clarify our terminology, MICorders are composed of multiple hourlybids (termed ‘sub-orders' in the EUPHEMIA description cited insubsection 1.2), belonging to different trading periods (hours).

2.1. Computational implementation

The market clearing in DAPXs is implemented as an optimization problem. In this section, we introduce the components (variables) of this problem and formulate the corresponding constraints and the ob- jective function.

We assume a simplified single-zone market model, where only two time periods are considered. In addition, we assume that only two types of bids are present on the market:

• Simple hourly bids. The acceptance of these bids is solely determined by the MCP of the respective period.

• Hourly bids belonging to complex MIC orders. The acceptance of these bids depend not only on the MCP of the period to which the bid belongs, but on the total income of the order, which, in turn, de- pends on the MCP values of other periods as well.

Since MIC conditions of complex orders define interdependencies between trading periods, the bids submitted for various periods must be cleared simultaneously.

The computational form of the market model used in this paper in- cludes the following variables:

• Market clearing prices (MCPs) of the two trading periods, denoted by MCP1andMCP2respectively. In the current paper we assume that everyMCPis nonnegative.

• Acceptance variables of simple hourly supply bids. The acceptance variable of the i-th simple supply bid is denoted byyis. All acceptance variables are bounded as 0≤y≤1.

• Acceptance variables of simple hourly demand bids. The acceptance variable of the i-th simple demand bid is denoted byyid

.

• Acceptance variables of hourly bids belonging to complex orders. The acceptance variable corresponding to the i-th component of complex ordercis denoted byyic

• Variables corresponding to the income of individual bids of complex orders. The income of bidyicis denoted byIic.

• Auxiliary integer variables corresponding to the big-M imple- mentations of logical implications. The vector of these variables is denoted byz.

Fig. 3.Reduction of supply: The quantity of the bid S2 is modified to the half of its original value. This causes the MCP to increase.

2http://www.irema.ir/trading/day-ahead-market

2.1.1. Simple hourly orders

The acceptance constraints in the case of simple hourly supply bids may be written as

ysi>0 ↔ psi ≤MCPt

ysi<1 ↔ MCPt≤psi ð5Þ

wherepisis the bid price of the simple hourly supply bidi, andMCPtde- notes theMCPof periodt, for which the bid is submitted (t∈{1, 2}).

The implications may be easily included in the MILP formulation. Let us consider e.g. thefirst implication of eq.5, which is equivalent to

psi ≤MCPt or ysi ≤0: ð6Þ

The equivalent of the logicalexpression (6)is the set of the inequal- ities (7), wherez∈{0, 1} is an auxiliary integer variable andMCPis the upper bound of the variableMCP.

psi−zMCPt≤MCPt

ysi−ð1−zÞ≤0 ð7Þ

We can use the variablezto‘cancel’one of the inequalities of 6, but not both of them. In the following we assume that all implications are implemented using the above‘bigM’method (where the bigM refers toMCPthe upper bound ofMCPused in the formulation).

Similarly to supply bids, in the case of simple hourly demand bids, the constraints may be written as

ydi>0 ↔ MCPt≤pdi

ydi<1 ↔ pdi ≤MCPt, ð8Þ

wherepidis the bid price of the simple hourly demand bidi.

2.1.2. Bids of complex orders

Thefirst part of the constraints described in theformula (5)is also active in the case of supply bids belonging to complex orders:

yci>0 ! pci≤MCPt, ð9Þ

wherepic

is the bid price of the i-th component of the complex orderc, corresponding to time periodt.

The considerations of an MIC bid described insubsection 1.2are for- mulated in the optimization framework of market-clearing algorithms as

∑i

yci>0!FTc þ VTc∑

i

qciyci ≤Ic ð10Þ

where

ykis the acceptance indicator of the elementary bidkbelonging to set of bids of the complex orderc.FTcandVTcdenote thefixed and variable cost terms of complex orderc.qicis the bid quantity of bidyic, andIcis the variable representing the total income of the complex (MIC) order c, which may be calculated as

Ic¼∑

i

Ici ð11Þ

IntuitivelyIicmay be calculated as

Ici ¼MCPtqciyci ð12Þ

whereqicstands for the quantity of the bidyic.

Eq.(12) however includes a quadratic expression of variables, namely the product ofMCPt andyic

, the implementation of which would result in a computationally demanding quadratically constrained problem (MIQCP). To overcome this issue, and obtain a linear form of

expressions, followingSleisz and Raisz (2015);Sleisz et al. (2019), we formulate the expressions for income as

yci>0 ! Ici ¼yciqcipciþqciMCPt−qcipci ð13Þ yci<1 ! Ici ¼yciqcipci ð14Þ As described bySleisz and Raisz (2015), taking into account the bid acceptance rule described in (9), three possibilities may arise:

1. If the bid is entirely accepted (yic= 1),Iicequals the product ofqicand MCPtaccording to (13).

2. If the bid is partially accepted (MCPt=pic),Iicequals toyicqicpic. Both (13, 14) are active in this case and they result in the same inequality.

3. Andfinally, if the bid is entirely rejected (yic

= 0), according to (14) Iic= 0.

2.1.3. Power balance

Formula (15)describes that the quantity of accepted supply bids must be equal the quantity of accepted demand bids for all periods.

Let us note again that the quantity of demand bids is negative by defini- tion.

∑i∈Bt

ysiþ ∑

f g∈c,i Bt

yciþ∑

i∈Bt

ydi ¼0 ∀t ð15Þ

whereBtdenotes the set of bids corresponding to periodt.

2.1.4. The objective function

Following the fundamental concepts of day-ahead electricity auc- tions (Madani, 2017), the objective function of the problem is to maxi- mize the total social welfare (TSW), defined as

TSW¼−∑

i

ydiqdipdi−∑

i

ysiqsipsi−∑

c,i

yciqcipci ð16Þ

In other words, the TSW is the total utility of consumption minus the total cost of production, in the context of the acceptance/rejection of hourly bids. AsqiD< 0 by definition for alli, the corresponding terms must be multiplied with−1.

Let us note that this objective is in accordance with the concept used in EUPHEMIA (Commitee, 2019), where a somewhat different terminol- ogy is used. The EUPHEMIA description aims to maximize the sum of the consumer surplusand theproducer surplus, which is in fact the TSW. The consumer surplus (CS) and the producer surplus (PS) may be derived as

CS¼∑

t ∑

i∈Bt

ydiqdi pdi−MCPt

PS¼∑

t ∑

i∈Bt

ysiqsiMCPt−psi ð17Þ

If one considers a simple case without block bids, as depictedFig. 1, the TSW is the area between the demand and the supply curve, consid- ering those parts which are leftmost of the intersection point. The MCP divides this area into two parts: The upper is CS, while the lower is PS (TSW=CS+PS).

The detailed formulation of the optimization problem of the market clearing process may be found in (Commitee, 2019) (annex C) or in (Dourbois and Biskas, 2015).

3. Results

In this section, we introduce a simple example bid set in a 2-period example, to demonstrate that due to the special interplay between MIC bids, participants may have incentives to bid false production cost. Let us assume the bids described inTable 1.

We suppose that S5-S6 and S7-S8 are part of complex MIC orders (c1 andc2 respectively), while the rest of the bids are standard bids, cleared purely according to the resulting MCP.

Let us furthermore assume that the production cost parameters of the units corresponding toc1 andc2 are described by the following pa- rameters:

FT1¼10 VT1¼2

FT2¼10 VT2¼2 : ð18Þ

We assume that the participant submitting the complex orderc1 is the only strategic player, and we call this participant player 1 in the following.

3.1. Case 1

In this case, we assume that player 1 submits its real production costs as parameters of the complex order (i.e. submits the realFT1and VT1values, as described in (18)). As player 2 is not considered as a stra- tegic player in this example, in the following we assume thatFT2andVT2

is always equal to the values in (18). This case serves as the reference describing truthful bidding.

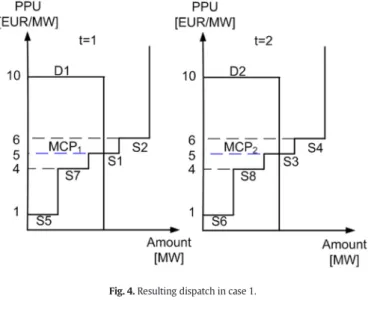

In this case, if we maximize the total social welfare based on the hourly bids (as described insubsection 2.1and as it is usual in the case of European portfolio-bidding type markets), we get the following result. The MCP is 5 in both periods, and regarding the standard bids, the acceptance indicators are as

ys1 ys2 ys3 ys4 yd1 yd2 0 BB BB BB BB B@

1 CC CC CC CC CA

¼ 0:5

0 0:5

0 1 1 0 BB BB BB BB

@ 1 CC CC CC CC A

: ð19Þ

The acceptance values of the bids corresponding to complex orders c1 andc2 are

yc11 yc12

!

¼ 1 1

yc21 yc21

!

¼ 1

1 ð20Þ

The total cost of MIC bidc1 is 18, while its total income is 20, thus the MIC condition holds. The profit of the strategic player is 2 units in this case. Similarly, the total cost of MIC bidc2 is 18, while its total income is also 20, thus the MIC condition holds here as well. The resulting dis- patch is depicted inFig. 4.

3.2. Case 2

In this case, we assume that the parameters of the hourly bids are the same (as described inTable 1), while player 1 increases the submitted FT value from 10 to 14.

FT1¼14 VT1¼2

FT2¼10 VT2¼2 ð21Þ

In this case, it is impossible to accept bothc1 andc2. If we consider the dispatch depicted inFig. 4, which corresponds to the simultaneous acceptance ofc1 andc2, we can see that the total income ofc1 is still 20, but the respective total cost (according to the reported parameters) is 22 (14 units from thefixed cost and 8 units from the variable cost), thus the market clearing algorithm will not allow this outcome.

If we perform the optimization of the market clearing in this case, we get the following results. The MCP is 6 in both periods, and regarding the standard bids, we get the acceptance indicators

ys1 ys2 ys3 ys4 yd1 yd2 0 BB BB BB BB B@

1 CC CC CC CC CA

¼ 1 0:5

1 0:5

1 1 0 BB BB BB BB

@ 1 CC CC CC CC A

, ð22Þ

while the values of the complex MIC bidsc1 andc2 are

yc11 yc12

!

¼ 1 1

yc21 yc22

!

¼ 0

0 ð23Þ

According to the submitted parameters, the total cost of MIC bidc1 is 22, while its total income is 24, thus the MIC condition holds. Consider- ing the real parameters, the production cost ofc1 is still 18, thus the real profit of player 1 is increased from 2 to 6 compared to the truthful bid- ding case described insubsection 3.1. As no hourly bid of MIC orderc2 is accepted, its cost is zero, thus the corresponding MIC holds.

The resulting dispatch is depicted inFig. 5As the complex orderc2 is deactivated, its hourly bids (S7 and S8) are not included in the supply curve.

We can see that by increasing theFTvalue, player 1 has‘pushed out’ MIC order S2, and increased its own profit. The reason behind this is the following: The increase ofFT1would intuitively imply the rejection of c1, because its MIC condition is not valid anymore. As the objective func- tion (the TSW) is however determined on the basis of the hourly bids, the solver does not want to‘loose’the hourly bids S5 and S6 correspond- ing toc1, since, due to their low bid price, they significantly contribute to the TSW. A more optimal solution is to drop the bidsS7 andS8 of

Fig. 4.Resulting dispatch in case 1.

Table 1

Hourly bids of example I: Parameters and corresponding variables.

ID t q p var

S1 1 2 5 y1s

S2 1 2 6 y2s

S3 2 2 5 y3s

S4 2 2 6 y4s

S5 1 2 1 y1c1

S6 2 2 1 y2c1

S7 1 2 4 y1c2

S8 2 2 4 y2c2

D1 1 −5 10 y1d

D2 2 −5 10 y2d

c2. By the deactivation of the complex orderc2, all corresponding con- straints are fulfilled, andc1 may remain active.

In this case,c2 is a paradoxically rejected MIC order in this case. If we consider only the resulting MCPs, it seems that the hourly bids belong- ing toc2 may be (fully) accepted, and its MIC may be fulfilled. This is however not a feasible scenario, exactly as in the case of paradoxically rejected block orders (Madani, 2017).

Let us note furthermore that any submitted FT value forc1 satisfying 12 <FT1≤16 will do the job for player 1, in the sense that in any such case the hourly bids ofc1 will fully be accepted, while the orderc2 will be deactivated. The resulting MCP and thus the (real) profit of player 1 is independent of the exact value of FT1in this case (if 12 <FT1≤16). IfFT1≤12, the MIC condition will also be satisfied with the MCP of 5, thus the acceptance ofc2 is allowed, and if 16 <FT1, the MIC ofc1 will not hold, thus it will be deactivated andc2 will be accepted.

3.3. Modifying the objective function

As the anomaly discussed above originates from the fact that the ob- jective function is determined solely by the acceptance values and pa- rameters of the hourly bids, a quite straightforward approach to resolve such problem is the modification of the objective function. In this case, the hourly bids corresponding to complex orders are not con- sidered in the objective function. Instead of them, the cost of production in the case of complex orders is considered based on the given price pa- rameters corresponding tofixed and variable terms (FT and VT). There are examples present in the literature, which follow a similar approach.

Start-up costs are included in the objective function in (Gabriel et al., 2013;Ruiz et al., 2012), andMadani and Van Vyve (2018)also consider the start-up costs in the objective, however the formulation is different in this case.

Formally, we can write the modified objective function as described in eq.(24).

TSW¼−∑

i

ydiqdipdi−∑

i

ysiqsipsi−∑

cycFTc−∑

c,i

yciqciVTc ð24Þ

whereyc∈{0, 1} equals to 1 if the complex ordercis activated,FTcand VTcare the respectively thefixed and variable costs of complex bidc.

In the following, we will show that this modification of the objective function resolves the possibility of strategic bidding described in subsection 3.2, but it implies a different kind of issue.

3.3.1. Outcome of case 1 assuming the modified TSW

If we apply the modified TSW described in eq.(24)for the bid set described in subsection 3.1, the results do not change. All the resulting acceptance indicators, MCPs and payoffs are the same as in the original case.

3.3.2. Outcome of case 2 assuming the modified TSW

On the other hand, if the modified TSW described in eq.(24)is ap- plied for the bid set described insubsection 3.2, the results are affected.

In this case, we get the following results. The MCP is 6 in both periods, regarding the standard bids,

ys1 ys2 ys3 ys4 yd1 yd2 0 BB BB BB BB B@

1 CC CC CC CC CA

¼ 1 0:5

1 0:5

1 1 0 BB BB BB BB

@ 1 CC CC CC CC A

ð25Þ

while the values of the complex MIC bidsc1 andc2 are

yc11 yc12

!

¼ 0 0

yc21 yc22

!

¼ 1

1 ð26Þ

As no hourly bid of MIC orderc1 is accepted, its cost is zero, thus the corresponding MIC holds. The total cost of MIC orderc2 is 18, while its total income is 24, thus the MIC condition holds.

We can see that assuming this formulation, increasing FT does not work for player 1, as it results in the deactivation of its bid, thus its profit is decreased compared to the reference scenario (Case 1, with truthful bidding). Atfirst glance, it seems that the modification of the objective function resolved the problem of the possibility of strategic bidding.

3.3.3. Case 3

In this subsection, we show that if we assume the modified objective function described by eq.(24), which omits the terms corresponding to the hourly bids of MIC orders, and considers the cost of these bids based on FT and VT, another potential problems may arise during the clearing process.

Let us assume that the true cost of units submitting complex orders is still as described insubsection 3.1. We have seen insubsection 3.3.1 that in the case of truthful bidding, the modified objective function (TSW) has no effect on the outcome.

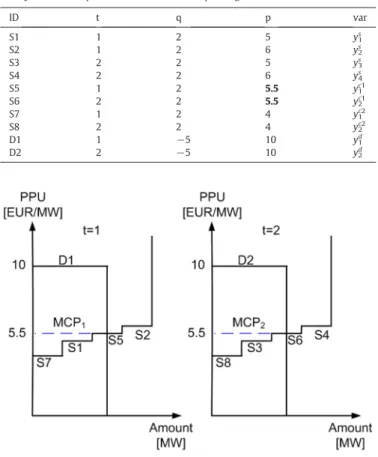

Let us now furthermore assume that player 1 modifies the bid price of the hourly bids belonging to its complex orderc1 from 1 to 5.5. We assume that all other hourly bids remain unchanged, as summarized inTable 2.

Furthermore, we suppose that regarding FT and VT, true values are submitted.

FT1¼10 VT1¼2

FT2¼10 VT2¼2 ð27Þ

Let usfirst note that in this case it is impossible to accept both com- plex bids.Fig. 6depicts the resulting dispatch in the case if both MICs are accepted.

As it can be seen, the bid acceptance constraints, which connect the bid prices of hourly bids to the MCP result in the MCP of 5.5 for both pe- riods, implying that the hourly bids ofc1 are partially accepted. In this case, the total cost of the MIC orderc1 is 10 + 4 = 14, while its income is 11, thus the MIC condition does not hold. This shows thatc1 andc2 can not be accepted in the same time. Furthermore, it can be seen in Fig. 6, that any price for the hourly bid between 5 and 6 will do the job: The implied MCP and thus the income ofc1 will be different, but Fig. 5.Resulting dispatch in case 2.

even an MCP of 6 and the implied income of 12 will not satisfy the MIC constraint (12<10 + 4).

Eitherc1 orc2 can be accepted, furthermore, as the hourly bids of complex orders are not considered in the modified objective function (the modified TSW), and the parametersFTandVTare the same forc1 andc2, they result in the same TSW. In both cases, according to eq.

(24), the resulting TSW may be calculated as the value of the accepted hourly demand bids (100), minus the value of accepted hourly bids, which are not part of complex orders (S1 and S3 are relevant, with the value of 20), minus the cost of MIC bids according to eq.10, namely 10 + 4 = 14, resulting in the TSW value of 66, considering either the ac- ceptance ofc1 orc2. In either case, the resulting dispatch will look like the one depicted inFig. 5, resulting in the MCP of 6, and implying an in- come of 24 for the accepted MIC order (in contrast to the original 20, while the cost is the same).

This means that the objective function has no unique maximum in this case. In such scenarios, the outcome of the market clearing depends on the implementation of the optimization problem, and on the proper- ties of the used solver as well. In general it can be said, that if player 1 modifies its bid parameters as inTable 2, it is possible that during the clearingc1 will be favoured,c2 will be‘pushed out’again, and the profit ofc1 will be increased. More importantly, the resulting optimization problem has no unique solution, and the outcome of the market may depend on implementation details.

4. Discussion

The modification of the objective function as proposed in eq.(24) may prevent strategic bidding through the manipulation of the submit- ted FT value, but this modification also implies that strategic bidding through the bid parameters of hourly bids becomes potentially possible.

Regarding the principle of the phenomena, the examples presented in the paper demonstrate that if a complex order brings large benefits for the objective function, but it can be accepted only under certain cir- cumstances (e.g. the MCP must be higher than a given value, as in the examples above forc1), the solver tends to drop other complex orders with less significant contribution to meet these requirements.

If we consider the original objective function described in eq.(16), which does not consider the production costs computed from the FT and VT values, the minimum income conditions based on these values may raise issues.

On the other hand, if we neglect the contribution of hourly bids be- longing to complex orders, but we do consider the FT/VT-based costs in the objective as in eq.(24), the bid acceptance constraints related to hourly bids can make some dispatches impossible.

One may raise the question if the inclusion of both the hourly bid- based components and the FT/VT-based components in the objective function is possible. Theoretically this can be done, however in this case the cost of these supply bids will be considered twice in the objec- tive, which will imply that standard supply bids will be preferred com- pared to MIC bids during the clearing.

Let us furthermore note that the implicit assumption of perfect infor- mation has been used through the paper. In realistic cases, the validity of this assumption depends on the publicly available data of DAPXs.

The general idea of the paper may be used however also without perfect information. If an MIC order submitted to a DAPX with low hourly bid price values is regularly accepted (thus the contribution to the TSW is large), the bidder may try to increase the submitted FT value in order to test, weather the order is able to‘push out’other MIC bids from the dispatch and increase the resulting MCP.

5. Conclusions and future work

In this paper, we have shown how the formalism of minimum in- come condition orders allows strategic bidding through the manipula- tion of various bid parameters and via the interplay of multiple MIC orders. In addition, we have also shown that various modifications of the objective function used in the market clearing (TSW) only partially resolve this issue. As these orders are widely used in various DAPXs (mainly because they make the bidding process of generating units eas- ier), and according to the current result they may open possibilities for strategic bidding, further research of the discussed topic is advised.

5.1. Future work

Irrespective of which formulation (Eq.(4)or eq.(24)) of the TSW is used, it is possible that players provide false FT and VT values to the ISO.

As we have seen, the consequences of this depend on the other bids present in the market and also on the clearing mechanism used, but in any case, such decisions may create the potential of gaming. A possible approach could be tofix these parameters during the registration of the users in the market, and allow their modification only relatively rarely.

It is also theoretically possible to ask the participants to defineVTas a given (fixed) function of actual fuel prices. However, the termsFTand VTalso depend on the applied technology, thus may change indepen- dently of the fuel cost, which makes the applicability of this approach questionable. Further future studies, approaches and discussion are re- quired to grasp every aspect of this problem.

In addition, in this paper we assumed only one strategic player. As a follow-up of this study, it is quite straightforward to ask, what happens if the participant submitting the other MIC bid also behaves as a strategic player. On the one hand, the resulting iterative game may be analyzed in this case, and on the other hand, the existence and uniqueness of equi- libria may be also subject to future studies.

Additional studies are necessary to determine the practical implica- tions of the discussed theoretical results. The scale of these possible practical implications depends on the typical number and parameters Table 2

Hourly bids of example I: Parameters and corresponding variables.

ID t q p var

S1 1 2 5 y1s

S2 1 2 6 y2s

S3 2 2 5 y3s

S4 2 2 6 y4s

S5 1 2 5.5 y1c1

S6 2 2 5.5 y2c1

S7 1 2 4 y1c2

S8 2 2 4 y2c2

D1 1 −5 10 y1d

D2 2 −5 10 y2d

Fig. 6.Resulting dispatch if both MICs would be accepted.

of MIC orders submitted to various markets. Further studies considering real market data (as in (Madani and Van Vyve, 2014) in the case of block orders) can provide results about the practical relevance of the results presented in this paper.

Furthermore, new approaches in the computational formulation of MIC orders and market clearing algorithms may possibly alleviate unde- sired properties and effects of MIC orders. In particular, innovative for- mulation of minimum income condition orders, as described in (Madani and Van Vyve, 2018), where the general class of so called’MP bids' covers the MIC orders as well, may be free of the disadvantages discussed in this paper–this, however must be the subject of future studies.

Acknowledgements

This work has been supported by the Funds PD 123900 and K 131545 of the Hungarian National Research, Development and Innova- tion Office, and by the János Bolyai Research Scholarship of the Hungar- ian Academy of Sciences.

References

Madani, M., 2017.Revisiting European day-ahead electricity market auctions: MIP models and algorithms. Ph.D. thesis. Université catholique de Louvain.

Aliabadi, D. Esmaeili, 2016.Analysis of collusion and competition in electricity markets using an agent-based approach. Ph.D. thesis. .

Aliabadi, D.E., Kaya, M., Şahin, G., 2016.Determining collusion opportunities in deregulated electricity markets. Electr. Power Syst. Res. 141, 432–441.

Aliabadi, D.E., Kaya, M.,Şahin, G., 2017.An agent-based simulation of power generation company behavior in electricity markets under different market-clearing mecha- nisms. Energy Policy 100, 191–205.

Ausubel, L.M., Cramton, P., 2002.Demand reduction and inefficiency in multi-unit auctions.

Bakirtzis, A.G., Tellidou, A.C., 2006.Agent-based simulation of power markets under uni- form and pay-as-bid pricing rules using reinforcement learning. 2006 IEEE PES Power Systems Conference and Exposition. IEEE, pp. 1168–1173.

Biskas, P.N., Chatzigiannis, D.I., Bakirtzis, A.G., 2013a.European electricity market integra- tion with mixed market designs-part i: formulation. IEEE Trans. Power Syst. 29, 458–465.

Biskas, P.N., Chatzigiannis, D.I., Bakirtzis, A.G., 2013b.European electricity market integra- tion with mixed market designs-part ii: solution algorithm and case studies. IEEE Trans. Power Syst. 29, 466–475.

Bower, J., Bunn, D., 2001.Experimental analysis of the efficiency of uniform-price versus discriminatory auctions in the England and wales electricity market. J. Econ. Dyn.

Control. 25, 561–592.

Chatzigiannis, D.I., Biskas, P.N., Dourbois, G.A., 2016a.European-type electricity market clearing model incorporating pun orders. IEEE Trans. Power Syst. 32, 261–273.

Chatzigiannis, D.I., Dourbois, G.A., Biskas, P.N., Bakirtzis, A.G., 2016b.European day-ahead electricity market clearing model. Electr. Power Syst. Res. 140, 225–239.

Commitee, N., 2019.EUPHEMIA Public Description: Single Price Coupling Algorithm, Technical Report.

Contreras, J., Candiles, O., De La Fuente, J.I., Gomez, T., 2001.Auction design in day-ahead electricity markets. IEEE Trans. Power Syst. 16, 88–96.

Cramton, P., Shoham, Y., Steinberg, R., 2007.An overview of combinatorial auctions. ACM SIGecom Exchanges 7, 3–14.

David, A.K., Wen, F., 2001.Market power in electricity supply. IEEE Transactions on en- ergy conversion 16, 352–360.

De Vries, S., Vohra, R.V., 2003.Combinatorial auctions: a survey. INFORMS J. Comput. 15, 284–309.

Dourbois, G.A., Biskas, P.N., 2015.European market coupling algorithm incorporating clearing conditions of block and complex orders. 2015 IEEE Eindhoven PowerTech.

IEEE, pp. 1–6.

Dourbois, G.A., Biskas, P.N., 2017.A novel method for the clearing of a day-ahead electric- ity market with mixed pricing rules. 2017 IEEE Manchester PowerTech. IEEE, pp. 1–6.

Gabriel, S.A., Conejo, A.J., Ruiz, C., Siddiqui, S., 2013.Solving discretely constrained, mixed linear complementarity problems with applications in energy. Comput. Oper. Res. 40, 1339–1350.

Garcia-Bertrand, R., Conejo, A.J., Gabriel, S., 2006. Electricity market near-equilibrium under locational marginal pricing and minimum profit conditions. European Journal of Operational Research 174, 457–479 URL.http://www.sciencedirect.com/science/

article/pii/S0377221705003814.

Gil, H.A., Trigo-Garcia, A.L., Santos, J.R., 2017.Minimum income orders in the european price coupling of regions: use or abuse? Electr. J. 30, 1–7.

Groves, T., Ledyard, J., 1987.Incentive compatibility since 1972. Information, incentives, and economic mechanisms: Essays in honor of Leonid Hurwicz, pp. 48–111.

Hurwicz, L., 1973.The design of mechanisms for resource allocation. Am. Econ. Rev. 63, 1–30.

Operator, I.M., 2013. Daily and Intraday Electricity Market Operating Rules. Technical Re- port, Tech. Rep. July, OMEL, Madrid, Spain Available:.http://www.omel.es/files/

20140509_reglas_v11_ingles.pdf.

Imran, K., Kockar, I., 2014.A technical comparison of wholesale electricity markets in north america and europe. Electr. Power Syst. Res. 108, 59–67.

Klemperer, P., 2004.Auctions: Theory and Practice. Princeton University Press.

Koltsaklis, N.E., Dagoumas, A.S., 2018.Incorporating unit commitment aspects to the eu- ropean electricity markets algorithm: an optimization model for the joint clearing of energy and reserve markets. Appl. Energy 231, 235–258.

Lam, L.H., Ilea, V., Bovo, C., 2018.European day-ahead electricity market coupling: discus- sion, modeling, and case study. Electr. Power Syst. Res. 155, 80–92.

Liu, Z., Yan, J., Shi, Y., Zhu, K., Pu, G., 2012.Multi-agent based experimental analysis on bid- ding mechanism in electricity auction markets. Int. J. Electrical Power Energy Syst. 43, 696–702.

Madani, M., Van Vyve, M., 2015.Computationally efficient mip formulation and algo- rithms for european day-ahead electricity market auctions. Eur. J. Oper. Res. 242, 580–593.

Madani, M., Van Vyve, M., 2018.Revisiting minimum profit conditions in uniform price day-ahead electricity auctions. Eur. J. Oper. Res. 266, 1072–1085.

Madani, M., Van Vyve, M., 2014.Minimizing opportunity costs of paradoxically rejected block orders in european day-ahead electricity markets. 11th International Confer- ence on the European Energy Market (EEM14). IEEE, pp. 1–6.

Madani, M., Van Vyve, M., Marien, A., Maenhoudt, M., Luickx, P., Tirez, A., 2016.Non- convexities in european day-ahead electricity markets: Belgium as a case study.

2016 13th International Conference on the European Energy Market (EEM). IEEE, pp. 1–5.

Meeus, L., Verhaegen, K., Belmans, R., 2009.Block order restrictions in combinatorial elec- tric energy auctions. Eur. J. Oper. Res. 196, 1202–1206.

Moylan, J., 2014. Energy Firms Face Competition Inquiry, Technical Report.https://

www.bbc.com/news/business-26734203.

Nisan, N., Roughgarden, T., Tardos, E., Vazirani, V.V., 2007.Algorithmic Game Theory.

Cambridge University Press.

Oksanen, M., Karjalainen, R., Viljainen, S., Kuleshov, D., 2009.Electricity markets in Russia, the US, and Europe. 2009 6th International Conference on the European Energy Mar- ket. IEEE, pp. 1–7.

Pan, J., Teklu, Y., Rahman, S., Jun, K., 2000.Review of usage-based transmission cost allo- cation methods under open access. IEEE Trans. Power Syst. 15, 1218–1224.

Polgári, B., Sőrés, P., Divényi, D., Sleisz, Á., Raisz, D., 2015.New offer structure for a co- optimized day-ahead electricity market. European Energy Market (EEM), 2015 12th International Conference on the, IEEE, pp. 1–5.

Poli, D., Marracci, M., 2011.Clearing procedures for day-ahead italian electricity market:

are complex bids really required? International Journey of Energy 5.

Power Spot Exchange, N.L., 2016. Technical Report. Available:.http://www.apxgroup.

com/trading-clearing/day-ahead-auction/.

Richstein, J.C., Lorenz, C., Neuhoff, K., 2018.An auction story: How simple bids struggle with uncertainty.

Roth, A.E., 1982.Incentive compatibility in a market with indivisible goods. Econ. Lett. 9, 127–132.

Ruiz, C., Conejo, A.J., Gabriel, S.A., 2012.Pricing non-convexities in an electricity pool. IEEE Trans. Power Syst. 27, 1334–1342.

Singh, H., Papalexopoulos, A., 1999.Competitive procurement of ancillary services by an independent system operator. IEEE Trans. Power Syst. 14, 498–504.

Sioshansi, F.P., 2011.Competitive Electricity Markets: Design, Implementation, Perfor- mance. Elsevier.

Sleisz, Á., Raisz, D., 2015.Efficient formulation of minimum income condition orders on the all-european power exchange. Periodica Polytechnica Electrical Engineering and Computer Science 59, 132–137.

Sleisz, Á., Raisz, D., 2016.Complex supply orders with ramping limitations and shadow pricing on the all-european day-ahead electricity market. Int. J. Electr. Power Energy Syst. 83, 26–32.

Sleisz, Á., Divényi, D., Raisz, D., 2019.New formulation of power plants’general complex orders on european electricity markets. Electr. Power Syst. Res. 169, 229–240.

Sleisz, Á., Divényi, D., Polgári, B., Sőrés, P., Raisz, D., 2015.Challenges in the formulation of complex orders on european power exchanges. European Energy Market (EEM), 2015 12th International Conference on the, IEEE, pp. 1–5.

Tierney, S.F., Schatzki, T., Mukerji, R., 2008.Uniform-pricing versus pay-as-bid in whole- sale electricity markets: does it make a difference? ISO, New York

Van Vyve, M., et al., 2011.Linear Prices for Non-convex Electricity Markets: Models and Algorithms, Technical Report. CORE.

Xiong, G., Okuma, S., Fujita, H., 2004.Multi-agent based experiments on uniform price and pay-as-bid electricity auction markets. 2004 IEEE International Conference on Electric Utility Deregulation, Restructuring and Power Technologies. Proceedings.

vol. 1. IEEE, pp. 72–76.