We find the conditions under which the government's optimal two-part trade policy will induce foreign firms to behave like a monolithic Stackelberg leader at the second level of the game. There are also works demonstrating the dominance of quotas over tariffs. Corden (1971) provides an extensive survey of the effect of tariffs, quotas, and other aspects of trade policy.

In the work of Rousslang and Suomela (1985), the problem of how the tools of trade policy can be applied in practice is discussed. The author of the project dealt with some interpretations of the modified trade policy in modern literature (really not for a two-part policy and for a simple tariff). Thus, the use of a two-part trade policy for the case of a simple tariff is justified within the considered models, it can have additional strategic effects.

In the project, in the model of the third market, it is supposed to use the two-part trade policy. The common intersection of the best response functions (one for each firm) is the Cournot equilibrium.

In the third-market model optimum two-part tariff t which maximizies the government’s incomes is negative (subsidy) and the optimum payment for the license is equal to flowing

Two-part trade policy in model of the reciprocal markets with homogeneous structure of cost function

- Policy of a maximization of the governmental incomes

Where e, e* - license payment to domestic and foreign governments; t, t*- tariff per unit of production, applicable to domestic and foreign companies. Although this fact is known, it is new for the model under consideration. For G-type governments, the level of optimal two-part trade policy is defined by conditions of equality of zero income from the sale of foreign firms.

As the basic model, we will consider the two-step game with complete but imperfect information. In the first step, players 1 and 2 (the home and foreign governments) simultaneously choose their strategy and inform N+N* players (N home and N* foreign firms), who in the second step simultaneously choose their strategy. strategy. Then it is possible to define the two-step game N+N * + 2 persons with complete but imperfect information.

In the homogeneous case for N=N * = 1 the two-part optimal tariff t which maximizes government revenue is negative (subsidy) and the optimal license payment is equal to.

- Policy of a maximization of the domestic welfare

- Two-part trade policy in model of the reciprocal markets with inhomogeneous structure of cost function

- Policy of a maximization of the governmental incomes

- Policy of a maximization of the domestic welfare

- Modified two-part trade policy

- Policy of a maximization of the governmental incomes

- Policy of a maximization of the domestic welfare

- Choice of trade policy instruments

- Conclusion

In addition, for example 4.6, the case is considered, of the optimal two-part trade policy of the Pareto optimal regarding summarized welfare (W+W *), i.e. in the case of linear cost functions and linear inverse demand functions, there is an infinitely many optimal modified two-part trade policy that maximizes government incomes. Since we have an infinite number of solutions of the equations (5.5), there is an infinite number of optimal modified two-part trade policy that maximizes government incomes.

In the case of identical cost functions and identical linear inverse functions of demand, the modified two-part trade policy, which maximizes government incomes, gives the Pareto optimal outcome with respect to aggregate income. In the case of linear cost functions and linear inverse demand functions that are optimally adjusted, the two-pronged trade policy, which maximizes government incomes, dominates the other trade policy instruments. Theorem 5.2.1 In the case of linear cost functions and linear inverse demand functions, there is an infinite number of optimal modified two-part trade policies (such as the subsidy) that maximize domestic welfare.

Since we have infinitely many of the solutions of the equations (5.9), there is an infinitely many optimal adjusted two-part trade policy that maximizes household welfare. In the case of identical cost functions and identical linear inverse functions of demand, the modified two-part trade policy that maximizes household welfare gives the Pareto optimal outcome regarding joint household welfare. In the case of linear cost functions and linear inverse functions of demand, optimally modified, two-part trade policy that maximizes domestic welfare dominates other trade policy instruments.

The analysis of table 6.1 shows that optimal trade policy will be two-part trade policy or modified two-part trade policy. Two-part trade policy and modified two-part trade policy are equivalent with respect to a maximization of domestic welfare. However, with the modified two-part trade policy, the payment for the license is much lower, and the profit is different from zero.

In the case of nonlinear cost functions and linear inverse demand functions, the modified domestic welfare-maximizing two-part trade policy dominates the other trade policy instruments. Analysis of Table 6.1 shows that the optimal trade policy will be a modified two-part trade policy. At the beginning, we showed that the optimal two-part trade policy for the third market model is a subsidy.

In the case of maximization of government revenue, the modified two-part trade policy is not under any conditions the subsidy, although the protection of the domestic producer is possible in this case. The results of comparison of trade policy instruments show that the modified two-part policy dominates.

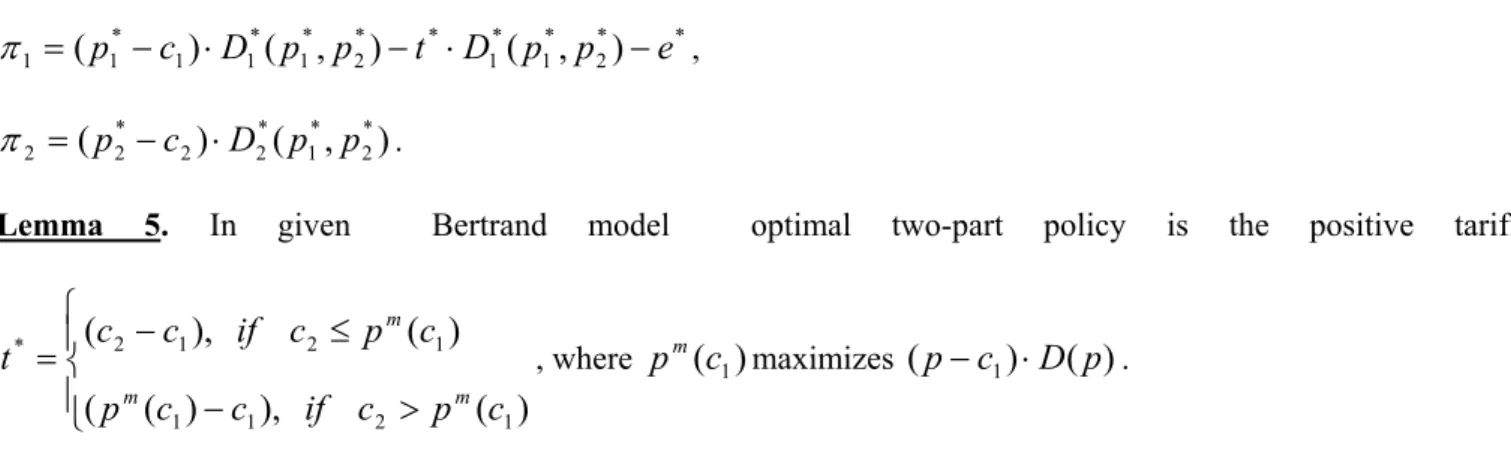

In given Bertrand model optimal two-part policy is the positive tariff

- The bibliography

- Appendices. The proofs of the theorems

- By the data 1),2) functions π 1 ( q 1 , v 1 ) and ) π 1 * ( q 1 , v 1 are continuous

- As according to the conditions 1) - 3) the theorems guarantee the following conditions

- Thus from I), II) and III) on the basis of the theorem of Nash it follows that there is an Curnout equilibrium on the second step of the game q 1 0 ( t , t * ), v 1 0 ( t , t * )

- In the beginning we shall show that the problem of maximization f 1 ( x ) by t can be considered on a segment (compact set) X 1 = [ t н , t в ] and the problem of maximization f 2 ( x ) by t* can be considered on a

- Further we shall prove concavity of functions f 1 ( t , t * ) and f 2 ( t , t * ) by t и t* accordingly

In practice, however, many over-quota tariffs are prohibitive and effectively exclude over-quota imports. A TRQ can be designed to reproduce the trading volume limit of the quota it replaces. Whoever acquires such rights can make a risk-free profit on the difference between the domestic price and the world price, including the domestic price.

Russian pork imports amounted to a quarter of the country's own production. Russia also imported 475,000 tons of beef and 1.39 million tons of poultry meat. Below in table 7.1 the comparative analysis of poultry meat for 2003 and the optimal two-part policy with the results of the single rate of 2001 is given. The above-mentioned practical examples of strategic trade policy speak to the actual theoretical results obtained in the project.

The considered example is also new as it is introduced for the first time for the two-country trade policy in the case of two countries and two markets, but is compared with known results for a case of free trade and simple tariffs. The references are not specified, since the results given are obtained by the author, as a special case of the two-part trade policy. From the example given, it appears that the optimal two-part trade policy is the subsidy by the positive payment for the license.

From the example given, it appears that an optimal two-part trade policy is the subsidy by the positive payment for the license. If the two-part trade policy is used by only one government, the optimal subsidy of an outside firm moves it to the leading Stakelberg output level and the inside firm moves to the follower level. If the two-part policy is used by both governments (at a maximization Gk), their optimal policy will still be the subsidy at the positive tariff.

However, in the case of welfare maximization (Gk +πk), the game at the government level resembles a prisoner's dilemma, because both producing countries are worse off under the strategic subsidy equilibrium than under free trade, but each country has A. This deviation thus does not refer to the simple tariff, but to the two-pronged trade policy, which clearly dominates over the simple tariff. For example 4.5, let us see whether the optimal two-part trade policy is Pareto optimal with respect to each government's policy (G+G *), i.e.

4 were simulated in Maple 7 and are illustrated in the graphs: .. optimal domestic government dual rate . optimal two-part tariff from foreign government. Now we return to the first step of the game and consider the game between governments.

At the beginning we will show that the problem of maximizing f1(x) with t can be considered in a segment (compact set) X1= [ tн, tв] and the problem of maximizing f2(x) with t* can be considered in a segment ( compact set) X1= [ tн, tв] and the problem of maximizing f2(x) with t* can be considered in a segment (compact set) X2= [ t*н, t*в]. Since the existence of the optimal policy is proved in the theorem, it is now possible to return to the problem of its search.

Since the existence of an optimal policy is proved in the theorem, it is now possible to return to the problem of finding it. 4.21). The second-order conditions are implemented here under the following power of conditions 1) and 2) of Lemma 4.2, since they ensure that. This decision tends to make companies sell their products both domestically and internationally.

At the beginning, we must show that the determinant can only attain the extreme value on the limit. It follows that the minimum value is only reached by D on the right edge, i.e.

As according to the conditions 1) and 2) the theorems guarantee the following conditions

Let us show that the conditions of the theorem also guarantee at the first step the existence of a Nash equilibrium, and consequently the existence of the perfect subgame Nash equilibrium, which will yield the optimal two-way trading policy.

Based on the Nash theorem, it follows that there is a Nash equilibrium at the first step of the game ( t0,t*0). Since the proof is very comprehensive in the most general case, we will prove the stated theorem for the case N=1 (one domestic company) and N * = 1 (one foreign company).