DOCTORAL SCHOOL FOR MANAGEMENT AND APPLIED ECONOMICS

S

ZABOLCSS

ZIKSZA

NE

VALUATION OF THEC

REDIBILITY ND ITSR

ELATINGA

TTRIBUTES OF THEH

UNGARIANI

NFLATIONT

ARGETINGR

EGIME(2001-2009)

DOCTORAL (PH.D)DISSERTATION

CONSULTAN LÓ ANDOR

VESZPRÉM

2010

AI

A

T:DR.LÁSZ

Contents Abs

onat 1.

2.

.1.

Transparency and predictability of monetary policy ...17

2.3. .1 .2 2. .2 .1 .2 . 1. 2. y 2. y 3. 3.1. 3.2. 3.3. 4. Su 4. 2. 3. 5. Sim 5. 5. p 6. 6. tract... 8

Kiv 9

Introduction ... 10

1.1. Research objectives ...12

1.2. Structure of the dissertation...13

Theoretical foundations of the research ... 14

2 The importance of credibility in monetary policy making...14

2.2. The importance of credibility in an inflation targeting monetary policy regime ...15

2.3. Other aspects related to credibility in monetary policy making...17

2.3.1. 2. Central bank communication...18

2.4. Measurement methods...20

2.4.1. Simple methods to measure the credibility of monetary policy ...21

2.4.1 An ex post measure of monetary policy credibility ...21

2.4.1 Ex ante measures of monetary policy credibility...23

4.1.3 Identifying a discrete structural break...27

2.4 . Dynamic methods to measure the credibility of monetary policy ...28

2.4.2 Svensson’s credibility concept revisited by Amisano and Tronzano (2005)...29

2.4.2 Evolving perception of credibility in the model of Goldberg and Klein (2005)...32

2.4.3. Method of measuring predictability ...39

2.4.4. Method of measuring the consistency of communication ...40

2.4.5. Method of measuring the effect of communication on financial variables ...41

2.5 Hypothesis of the research ...44

2.5. Hypothesis 1 ...44

2.5.2. Hypothesis 2 ...44

5.3. H pothesis 3 ...45

5.4. H pothesis 4 ...45

2.5.5. Hypothesis 5 ...45

A concise historical account of Hungarian monetary policymaking (2001-2009) ... 46

Foundations of the IT regime ...46

The Monetary Council ...47

Monetary policy decisions (July 2001 – April 2009)...48

Narrative evidence on the credibility in Hungarian monetary policy ... 58

4.1. rvey among the main stakeholders of monetary policy...58

4.1.1. Participants of the survey ...58

4.1.2. Findings of the survey ...59

4.1.3. Divergent opinions about credibility outside the survey ...61

2. Deep interviews and a short interview with economic policymakers of the time...61

4.2.1. From the viewpoint of an ex-Minister of Finance ...62

4.2. From the viewpoint of an ex-member of the Monetary Council ...63

4.2. From the viewpoint of MNB staff ...69

ple statistical analysis of the investigated period ... 70

1. Sub-periods in monetary policy ...70

2. Sim le statistical analysis of the success of MNB’s IT regime ...75

5.3. Inflation stationarity before and after the introduction of IT ...78

Simple tests of credibility... 79

1. Ex ante credibility of the exchange rate band ...79

. 1.

7.

7.

7.

Re

9.3. The effect of communication on financial variables ...108

9.3.1. The variables ...109

9.3.2. Results of the analysis of the conditional mean equation...110

9.3.3. Interpretation of the results of the conditional mean equation ...111

9.3.4. Results of the analysis of the conditional variance equation...111

9.3.5. Interpretation of the results of the conditional variance equation ...114

10. Summary of conclusions ... 116

10.1. Study findings ...116

10.1.1. Qualitative research ...116

10.1.1.1 Narrative evidence of the period by policymakers ...116

10.1.1.2 A non-representative survey on the perception of MNB’s credibility...116

10.1.2. Quantitative research – evaluation of the hypotheses...116

10.1.2.1 Stable inflation...116

10.1.2.2 Generally improving market perception of credibility ...117

10.1.2.3 Low to average predictability ...117

10.1.2.4 Low consistency of central bank communication...118

10.1.2.5 IT logic being increasingly reflected in the behavior of financial variables...118

10.2. The theses of the research ...119

10.2.1. Thesis 1...119

10.2.2. Thesis 2...119

10.2.3. Thesis 3...119

10.2.4. Thesis 4...119

10.2.5. Thesis 5...119

10.3. Novel and unique findings...120

10.4. Possibilities for practical use of study findings ...121

10.5. Directions for further research ...122

10.5.1. The interaction of fiscal and monetary policy in realizing monetary policy strategy 122 10.5.2. The interaction of fiscal policy and monetary policy in achieving a good market perception of credibility of monetary policy ...122

10.5.3. Accountability of monetary policymakers...123

10.5.4. Regional comparison of credibility of the IT regime and related measures...123

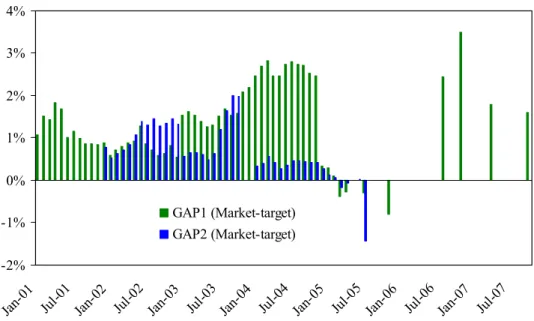

6.2 Ex ante credibility of the IT regime ...82

6.2. Credibility as of Svensson (2009) ...82

6.2.2. Credibility measure of Laxton and N’Diaye (2002)...85

Dynamic tests of credibility ... 87

1. The variables ...87

2. Results of the Elliot-Müller tests...88

7.3. sults of the Müller-Petalas procedure ...89

7.4. Result of the Chow-tests ...92

8. Comparative analysis of MNB MC’s predictability... 94

8.1. Gradualism of MNB MC’s interest rate decisions ...98

8.2. The correlation of ranks by predictability, gradualism and the average level of policy rates 100 9. Central bank communication... 104

9.1. Consistency of communication ...104

9.1.1. Communication data for the MC and the Governor ...104

9.1.2. Results ...105

9.1.3. Interpretation of results...106

9.2. The significance of the publication of Minutes...107

11. Relevant publications and co s... 124

11.1. Publications...124

11.1.2. Other, peer reviewed publications ...124

11.1.4. Other ...125

Appendix 1 ... 131

nference lecture 11.1.1. Book ...124

11.1.3. Magazine ...124

11.2. Conference lectures...125

References ... 126

Appendix 2 ... 141

Appendix 3 ... 147

Appendix 4 ... 148

Appendix 5 ... 149

Appendix 6 ... 151

Appendix 7 ... 157

Appendix 8 ... 164

Appendix 9 ... 170

Appendix 10 ... 177

period...71

Figure 4 Distribution of base rate changes, MC bias and Governor comments in the “Turbulence” sub- igure 5 Distribution of base rate changes, MC bias and Governor comments in the “Easing” sub-period ..72

Figure 6 Distribution of base rate changes, MC bias and Governor comments in the “Tightening” sub-period ...73

Figure 7 Distribution of base rate changes, MC bias and Governor comments in the “Transition” sub-period ...74

Figure 8 Distribution of base rate changes, MC bias and Governor comments in the “Pre-crisis” sub-period ...74

Figure 9 Distribution of base rate changes, MC bias and Governor comments in the “Crisis” sub-period....75

Figure 10 The inflation target and actual inflation rates...76

Figure 11 Seasonally adjusted quarterly average change of year-on-year VAICPI ...77

Figure 12 Expected and actual 3-month Bubor interest rates ...79

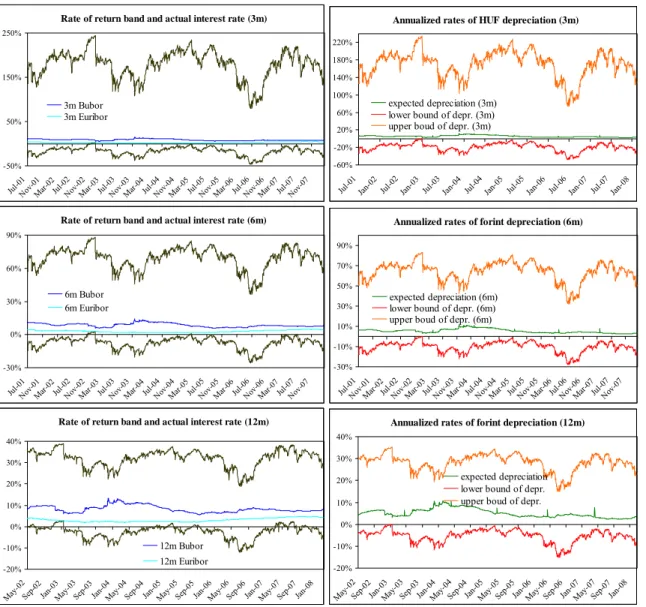

Figure 13 Rate-of-return bands and expected forint depreciation ...81

Figure 14 EURHUF exchange rate expectations within the official floatation band ...82

Figure 15 The gap between MNB’s CPI forecast and the respective CPI target...83

Figure 16 The gap between the market’s CPI forecast and the respective CPI target ...83

Figure 17 The correspondence between the market’s and MNB’s CPI forecasts as compared to the target .84 Figure 18 Credibility of monetary policy as discerned from the level of domestic interest rates ...86

Figure 19 Estimated smoothed parameter path of of the term spread change and the MNB base rate ...90

Figure 20 Estimated smoothed parameter path of of the EURHUF change and the MNB base rate ...90

Figure 21 MNB’s relative predictability by model [4] compared to developed peers...96

List of figures Figure 1 Concepts related to credibility in monetary policymaking...19

Figure 2 Credibility-induced changes in the pattern of the yield curve response to an inflation shock ...33

Figure 3 Distribution of base rate changes, MC bias and Governor comments in the “Honeymoon” sub- period...71 F

γi

γi

Figure 22 MNB’s relative predictability by model [4] compared to emerging peers...96

Figure 23 Cumulated market predictability of MN ase rate decisions...97

...107

igure 28 The correspondence of sum ex and MC base rate decisions ...108

B MC’s b Figure 24 Gradualism of central bank rate decisions...99

Figure 25 Consistency indicator of MNB MC’s monetary policy bias ...105

Figure 26 Consistency indicator of Governor’s comments ...105 Figure 27 Communication on future policy by MNB MC and Governor comments

F

this dissertation, we present the findings of our historical, narrative and empirical research on the

his later part is based on the application of statistical and econometric methodology already successfully Abstract

The dissertation focuses on the evaluation of the credibility of the Hungarian inflation targeting (IT) regime introduced in June 2001. Credibility of an IT regime is formed and reinforced when investors perceive the central bank to be acting in line with its IT strategy. Credibility is an important asset for the IT central bank as it helps anchor market expectations of the inflation rate to the inflation target and fewer and smaller policy moves are thus required to reach the target.

In

evolution of the credibility and its relating attributes – such as predictability and the consistency and effect of central bank communication – of the Hungarian IT regime from its first decision in July 2001 to April 2009. After a concise historical account of the monetary policy events in the period, we show the results of a short non-representative survey followed by the excerpts of deep interviews with influential policymakers of the period. Then we introduce and apply several approaches to estimate the credibility, predictability and the success of communication.

T

implemented for the evaluation of the practice of other IT central banks. The measurement methods applied in this dissertation are: the simple and dynamic assessments of evolving market perception of credibility of the IT regime and the exchange rate regime; the evaluation of predictability and gradualism of the central bank’s policy moves; the measurement of the consistency of central bank communication; and the evaluation of the effect of central bank communication on changes in market interest rates.

Kivonat

A disszertáció a Magyarországon 2001 júniusában bevezetett inflációs célkövetéses rendszer hitelességének

kivonatát. Ezt követően számos megközelítést vezetünk be s alkalmazunk az inflációs célkövetés rendszere hitelességének, előrejelezhetőségének és kommunikációja értékelését végzi el. Egy inflációs célkövetéses rezsim hitelessége akkor alakul ki és erősödik meg, amikor a befektetők érzékelése szerint a központi bank az inflációs célkövetés stratégiájával összhangban cselekszik.

A hitelesség a központi bank számára fontos eszköz, hiszen segít lehorgonyozni a piac inflációs várakozásait az inflációs célhoz, s így kevesebb és kisebb kamatváltoztatásra van szükség a cél elérése érdekében.

Ebben a disszertációban bemutatjuk a magyar inflációs célkövetés első döntésétől, 2001 júliusától a 2009 áprilisáig terjedő időszakban vizsgált hitelességének és annak vonatkozó jellemzőinek alakulásáról végzett történeti, narratív és empirikus kutatásunk eredményeit. Az időszak monetáris politikai események tömör történeti bemutatását követően közöljük egy rövid, nem reprezentatív felmérés eredményét, majd az időszak befolyásos döntéshozóival készített mélyinterjúk

é

sikerességének megbecslésére.

Ez utóbbi rész más inflációs célkövető központi bankok gyakorlatának értékelésekor már sikeresen használt statisztikai és ökonometriai módszerek alkalmazásán alapul. A disszertációban alkalmazott mérési módszerek: az inflációs célkövetéses rendszer és az árfolyamrendszer hiteleségéről kialakult piaci megítélés egyszerű és dinamikus értékelései; a központi bank kamatdöntései előrejelezhetőségének és fokozatosságának értékelése; a központi banki kommunikáció következetességének mérése; és a központi bank kommunikációja piaci kamatlábakra gyakorolt hatásának kiértékelése.

ince price stability became the primary objective of monetary policy authorities around the world, inflation

st financial investors. In the case of inflation targeting, this perceived credibility comes from the erceived anti-inflationary stance of the central bank. The more financial investors think the central bank is 1. Introduction

S

targeting has been the most widely acclaimed central banking technique. No country that has ever introduced an IT regime abandoned it later. Blinder (2006) points out that countries which desire disinflation are more likely to introduce inflation targeting but its advantages for any type of economy are clear. In a wide cross-country panel study, Mishkin and Schmidt-Hebbel (2007) show that inflation targeting helps keep inflation low in the long run, improves the efficiency of monetary policy and strengthens central bank independence in various types of economies ranging from large industrial economies such as Germany, Canada or the United Kingdom to emerging economies such as Brazil, Turkey or Korea. However, their analysis also concludes that the monetary policy performance of industrial-country inflation targeters dominates that of emerging countries. That is, inflation targeting has so far been more successfully adopted by industrial economies than by emerging ones.

The most important, but also the most tedious and, sometimes, painful task for a central bank switching to a new regime, such as inflation targeting, is to establish a strong perception of the new regime’s credibility among

p

inflation-averse, the more they perceive the regime as a credible one. As it was demonstrated in earlier historical examples – the most recent, and peculiar, example of that time was the establishment of the European Central Bank (ECB), a brand new institution –, the need to establish and maintain a strong feeling of an inflation-averse authority amongst financial investors is of key importance for any central bank to operate a successful inflation targeting regime (see the case of the ECB in Goldberg and Klein, 2005).

The Monetary Council (MC) of the National Bank of Hungary (MNB) decided to introduce inflation targeting in June 2001, after the government and the central bank decided to widen the floatation band of the euro-forint exchange rate to create more maneuvering room for interest rate decisions. The new nominal anchor, which replaced the nominal exchange-rate peg, was a converging target set together by the MNB and the government, but to be attained and maintained by the MNB alone. At the same time, new legislation gave the central bank independence in making monetary policy decisions. It was a brand new historical situation for monetary policymakers, who had to prove to the financial market that the new regime is up and

ther parts of the world where an inflation targeting regime is in place.

adiction of the two monetary policy objectives – the legal obligations to eet the inflation target and keep the euro-forint exchange rate within a ±15% floatation band around the parity

credibilit tually turned

out, t

framewor the IT regime and the exchange rate band played out badly in fin

strengthe the exchange rate out of the floatation

and.

hers) upports the view that the market perception of the credibility of MNB’s IT regime suffered a decisive blow

in the ank was

continuall me and acting to keep

the eu ssure, the exchange

rate re

But, later ernment to shift the parity of the band in the weaker direction, which, then, forced

events sh t the MNB could

not recover the substantial loss of credibility suffered in this turbulent sub period (Rozkrut et al., 2007, p.

194). They also show that the consistency of central bank communication was low in a large part of the period, which might also have affected the market perception of MNB’s credibility. Apart from that, the reliably working and is one that they can base their investment decisions on. Hungarian central bankers had to establish a new relationship with market participants from the scratch, one based on trust and credibility.

Thus, the credibility of monetary policy has become a vital and delicate issue in Hungary, just like in o

Seemingly, the success of the new inflation targeting regime in Hungary was warranted by the new independent status of the so far politicized monetary branch of economic policymaking. But the Hungarian case was a bit more complicated than the international average as the currency exchange rate band was left intact after the introduction of the IT regime. This added to the uncertainty surrounding monetary policymaking and made MNB’s task of establishing credibility even more difficult than it could otherwise have been. Given the potential contr

m

rate –, the MNB had to establish the credibility of its inflation targeting regime and maintain the y of the floatation band of the euro-forint exchange rate at the same time. As it even

he MNB could not successfully grapple with the dual nature of the Hungarian monetary policy k. The inherent contradiction between

ancial markets. Financial investors were aware that raising the policy rate to bring inflation down ned the forint against the euro and, thus, threatened to push

b

Eventually, the inevitable clash of these potentially contradictory monetary policy tasks jeopardized the credibility of MNB’s IT regime. Press evidence (see Nyíri, 2003 or The Economist, 2004, amongst ot s

turbulent sub period between October 2002 and November 2003, when the central b y faced with the dilemma to decide between acting in the logic of the IT regi

ro-forint exchange rate within the floatation band. When, due to speculative pre

ached the strong limit of the band, the MNB decided that maintaining the band was more important.

, it decided with the gov

it to put aside the IT logic again to defend the exchange rate of the forint. Logically, such a chain of ould go against the credibility of any IT regime. Rozkrut et al. (2007) claim tha

etween fiscal and monetary policy-makers – an example of which is

he purpose of this dissertation is twofold. One purpose is to provide a historical and narrative account of

edibility in the period?

3. What does historical and narrative evidence tell us about the evolution of the perceived credibility of the Hungarian monetary policy in the observed period?

The other purpose of the dissertation is to give a statistical account of the evolution of the financial market perception of the credibility of MNB’s monetary policy in the period between June 2001 and April 2009.

When we investigate the market perception of credibility, we seek answers to the following questions:

1. Was the introduction of inflation targeting in Hungary successful in anchoring inflation?

2. Were MNB MC’s interest rate decisions predictable in the observed period?

3. Did central bank communication signal future policy rate decisions properly?

4. Was monetary policy, including both the IT regime and the exchange rate band, credible throughout the period?

5. What does statistical evidence discerned from market prices tell us about the evolution of the perceived credibility of the Hungarian monetary policy in the observed period?

conspicuous lack of coordination b

presented in Madár (2003) – contributed a great deal to MNB’s missing the inflation target in the majority of the cases and further questioned MNB’s commitment to the inflation target in the eyes of the investors.

1.1. Research objectives T

Hungarian monetary policy after the introduction of the inflation targeting system. In our historical and narrative summary of Hungarian monetary policy events, we focus on those factors which could influence the market perception of MNB’s credibility. We also ask a number of stakeholders of monetary policy to give their opinion on MNB’s credibility in the IT regime. When we conduct this investigation, we seek answers to the following questions:

1. To what extent did the logic of the IT regime or the exchange rate band drive monetary policy decisions of the period and what other factors could have influenced these decisions?

2. What do the participants of financial markets mean by the concept of credibility and how do they see MNB’s cr

.2. Structure of the dissertation

The dissertation applies the approximation method to assess the credibility of MNB’s monetary policy. It follows with an analysis of predictability and the role of communication in fostering predictability and ends with a study of the measures of credibility, predictability

decisions, and the way MNB’s ommunication contributed to the market predictability of its actions and to the volatility of financial variables. Finally, the conclusions are drawn based on the above historical, narrative, statistical and eco

1

starts from the general concept of success,

and communication.

First, in order to provide a foundation to the later econometric analysis, historical, subjective (narrative) and objective (statistical) evidence is presented on the success of the Hungarian monetary policy in 2001-2009, as evidenced in press reports, as seen by the stakeholders of monetary policy and as attested by statistical data, respectively. The dissertation then moves down one level and closes in on the topic of credibility of Hungarian monetary policy. The methodology of this part relies heavily on simple and more advanced statistical and econometric methods. Two further important issues related to credibility are touched on in this empirical analysis is the level of predictability of MNB’s interest rate

c

nometric evidence.

ner, 1993, p. 51)

Their analysis, backed up with case studies, suggests that leaders can become credible (honest, competent

2. Theoretical foundations of the research

2.1. The importance of credibility in monetary policy making

The Merriam-Webster online dictionary defines credibility as “the quality or power of inspiring belief”1. This quality is an extremely important one in all walks of life, but it is certainly very important to possess in positions of leadership. Kouzes and Posner (1993) write in their research-based book entitled Credibility that the three most often cited management traits that can be identified with credibility are honesty, competence and the ability to be inspiring, of which, they think honesty is the most important trait. They find that these traits have a statistically strong correlation with positive work attitudes of company employees. Discerned from their comprehensive focus-group research, they write that gaining credibility in leadership boils down to following six fundamental disciplines. “These are:

1. Discovering your self 2. Appreciating constituents 3. Affirming shared values 4. Developing capacity 5. Serving a purpose

6. Sustaining hope” (Kouzes and Pos

and inspiring) by learning and practicing the above disciplines. They also stress that credibility is a quality based on reputation and “is rooted in the past” (Kouzes and Posner, 1993, p. 25). It also means that it takes considerable amount of time to build and earn credibility as “the credibility foundation is built brick by brick” (Kouzes and Posner, 1993, p. 25). What all this means for our analysis in specific is that

1. gaining credibility is a time-consuming endeavor;

2. and credibility, while its foundations rest in the honesty, competence and the ability to be inspiring of past actions, is indeed a dynamically evolving quality.

ee http://www.merriam-webster.com/dictionary/credibility

1 S .

central bank itself as reacting to changing conomic and market conditions. Then, based on central bank actions and communication, financial

nancial investors.

Probably, few observers would doubt that the makers of monetary policy, that is, central bankers are in a position of leadership. Using Michael Woodford’s phrasing, central banking is an art of “management of expectations” (Woodford, 2005, p. 3), and being a successful central bank means managing market expectations in a way that leads to lower inflation in the long run. This management of expectations is a complex process with a number of feedbacks that might alter the outcome. First, monetary policymakers announce their strategy with its targets and tools. Then, they start acting and communicating more or less in line with the announced strategy. At the same time, market expectations are formed of the evolution of market prices of financial assets and the policy moves of the

e

investors continuously check whether the central bank acts in a way that is in line with its strategy (e.g.

reducing inflation) or not, and change their expectations accordingly. To put it differently, investors might think of a central bank as a more or a less credible one and their perception of credibility evolves with time as they receive new signals from central bank actions and communication. Market expectations are, then, fed back into the prices of financial assets, continuously changing the market setting in which the central bank operates. Consequently, when the central bank is perceived to become more credible, it will meet less difficulty in its effort to realize its strategy, plus the actual success of realizing the strategy from time to time will improve credibility further. The reverse happens with a low market perception of credibility and/or a continuous mismanagement of the announced monetary policy strategy. To make a long story short, monetary policy success hinges to a great extent on the ability of the central bank to make itself look credible in the eyes of fi

2.2. The importance of credibility in an inflation targeting monetary policy regime

The market perception of a central bank’s credibility is a key component of success because it is the most important asset the central bank has in its mission of realizing its monetary policy strategy. As the Hungarian monetary policy authority operates an IT regime as part of its monetary policy strategy, the most relevant question in our case is how credibility can contribute to a strategy of reaching the inflation target.

According to Mishkin (2004), for an inflation targeting regime to be successful in an emerging economy – i.e. to achieve its inflation target –, it needs to be more than the simple announcement of a medium-term inflation target. Mishkin (2004) says that the strategy of an inflation targeting central bank also needs to be information inclusive, transparent and supported by good communication, with policy-makers held accountable for the success of their policy actions. All this is what, Mishkin (2004) says, it takes to make inflation targeting succeed in reducing inflation in emerging economies.

with the drive on the central bank’s art to establish credibility of its actions among the investors in financial markets. This is because, if an IT tion rate become well-anchored to the target and fewer and more gradual policy moves are required to reach this target (Amisano and Tronzano, 2005). In

markets. In this context, an inflation targeting entral bank, dedicated to price stability, is said to be credible when the perception of its pre-commitment to

ctor in monetary policy decision-making: after economic agents obtain a certain perception of e inflation aversion of a central bank, this perception of credibility then feeds back into monetary policy actions and increases (when credibility is high) or decreases (when credibility is low) their effectiveness.

In fact, all of the points mentioned by Mishkin (2004) above have to do p

regime is thought to be credible, expectations of the infla

this context, market perceptions of the inflation aversion of an inflation targeting central bank play a crucial role in making IT operate more effectively. As Blinder (1999) points out, a more credible central bank can engineer disinflation with a lower level of employment sacrifice as changes in the key monetary policy instrument will cause smaller GDP/employment gap volatility.

In his study based on a survey among central bankers and economists, Blinder (1999) shows that central bankers mostly identify credibility with “dedication to price stability” (Blinder, 1999, p. 5). An important, and difficult, issue is to measure this dedication. Obviously, when an inflation targeting regime is successful in keeping inflation low, it becomes credible. In other words, a central bank becomes credible when it matches its words with its deeds, i.e. if it says that it will and, indeed, does bring inflation down. But this is a simple, ex post assessment of credibility, based on the track record of the inflation-targeting central bank.

A more dynamic assessment of credibility, suited to real-life circumstances, comes from the measure of perceived, ex ante credibility as seen by investors in financial

c

disinflation or, in other words, its aversion to inflation as perceived by and implied by market prices of financial assets is high.

Even more importantly, this market perception of credibility dynamically evolves with time, as stressed by both Amisano and Tronzano (2005) and Goldberg and Klein (2005). Economic agents continually adjust their perception of credibility of the monetary policy based on matching the deeds and the communication of the central bank with their earlier expectations based on the logic of the announced monetary policy regime.

When a decision of the central bank is perceived to have been in contradiction with the policy framework or with previous communication, the market perception of credibility suffers. Vice versa, when the central bank seems to have decided in consistency with the policy framework and its earlier communication, the market perception of credibility improves. This perception of credibility then becomes an important exogenous fa

th

bility in monetary policy making

policy strategy. Besides other communication devices, as Eijffinger and Hoeberichts (2000) stress, ansparency may be most enhanced by regular communication explaining central bank decisions, such as 2.3. Other aspects related to credi

2.3.1. Transparency and predictability of monetary policy

After Mishkin (2004), transparency is an important element of a credible inflation targeting regime, and this can generally be said of any kind of monetary policy regime. Eijffinger and Hoeberichts (2000) think that transparency makes it “easier to make a judgement and to hold central bank officials accountable for their behaviour” (Eijffinger and Hoeberichts, 2000, p. 2). They stipulate transparency as one of the pillars of the democratic accountability of a central bank, besides the existence of a clear monetary policy strategy and a person or a committee bearing final responsibility for monetary policy decisions. Perez-Quiros and Sicilia (2002) opine that transparency “facilitates the understanding of what the central bank does and by doing so, it helps central banks to foster their credibility” (Perez-Quiros and Sicilia, 2002, p. 7). Based on these, the meaning of central bank transparency is straightforward: it implies how clearly financial investors see why the central bank is doing what it is doing and how closely central bank decisions are aligned with the monetary

tr

the publication of the minutes of monetary council meetings.

The predictability of a central bank’s decisions is a consequence, or, manifestation of the degree of its transparency. The better the motives of a central bank’s decisions are understood and the more its decisions are perceived to be in line with its strategy, the better economic agents are able to predict future policy moves. Vice versa, the degree of predictability as implied by financial market prices, according to Perez- Quiros and Sicilia (2002), shows how transparent a central bank is in the eyes of financial market participants. In other words, predictability is a measure of how well market participants understand monetary policy strategy and how precisely they anticipate future policy actions under various market conditions. In this vein, higher predictability of policy moves helps build central bank credibility. While measuring credibility itself can prove to be a difficult task, measuring predictability of both market interest rates in general and base rate decisions in specific is more straightforward. Evaluating predictability as implied by market prices gives a good first proxy for a central bank’s credibility as seen by market participants.

y – of the central bank through the publication of the minutes of meetings of the onetary council to individual comments made by the Governor or other members of the monetary council.

ost notably, the dynamics of

inflation and unemp s, monetary policy

strategy – that is, the specific targets and objectives of monetary policy – and the outlook – bias – for future policy.

Communication is important in establishing credibility for a number of reasons. First, it makes the commitment of the central bank to the monetary policy strategy verifiable in the eyes of the stakeholders of monetary policy (Woodford, 2005). Communication, be it regular or ad hoc, gives a firsthand feedback to financial investors as to whether the central bank consistently follows the monetary strategy laid out for itself and helps investors test whether central bank action is aligned with the announced monetary policy strategy. In case of an inflation targeter, each act of communication has to reflect the logic of disinflation.

Communication is also useful in “clarifying the consequences of the general strategy” (Woodford, 2005, p.

12). The central bank might wish to illustrate through “regular, detailed and structured” (Woodford, 2005, p.

12) communication – such as Inflation Reports – the potential consequences of following the monetary policy strategy. Moreover, communication helps economic agents better predict policy decisions of the central bank. Financial investors continuously match central bank communication with policy actions and see for themselves whether communication is useful or useless in signaling policy moves. If financial bank that “will do what it says” (Blinder, 1999, p. 4), they will conclude that the signals of this particular central bank are indicative and will act accordingly. This will be reflected in the 2.3.2. Central bank communication

Communication plays an important role in making central bank decisions transparent and in establishing a good market perception of its credibility. After Mishkin (2004), a key component of building credibility and making central bank decisions more predictable lies is good communication. Clearly, improving central bank communication with financial markets has become a focal endeavor in monetary policy-making, lately (see Woodford, 2005). Central bank communication may be regular or ad hoc and may take different shapes beginning with the publication of post-meeting statements (communiqués) by the monetary council – the decision-making bod

m

As Woodford (2005) outlines, communication can be about a number of factors important in the monetary policy decision-making process such as general economic conditions – m

loyment and the stability of the financial system –, policy decision

investors see a central

prices of major financial assets, i.e. they will move in the direction in which the central bank ushers them with communication.

o sum up figure 1 in short, the decisions and the communication of an independent central bank’s decision- making body reflect the general monetary strategy, that is, the targets and objectives the independent central bank is trying to fulfill. There is some interaction of central bank decisions and the consistency of communication as communication becomes more consistent when it explains decisions well while monetary We shall call communication consistent when it serves the above purposes well and, thus, helps the central bank establish a good market perception of credibility. In case communication is inconsistent with policy actions, financial investors will conclude that central bank communication is confusing and irrelevant and will, therefore, ignore it and rely instead on their own predictions in forecasting policy actions. Investors will reach the same conclusion when communication is inconsistent within itself. For instance, it might happen when policy-makers communicate the direct opposite of what they had just communicated or, when policy-makers communicate ambiguously. Inconsistent communication will, therefore, destroy, rather than build, credibility.

For the sake of clarity, figure 1 illustrates how these different concepts interrelate in independent monetary policy-making. In bold letters are the concepts discussed in this dissertation.

Figure 1 Concepts related to credibility in monetary policymaking

Accountability of monetary Central bank

decisions (actions)

Transparency (Predictability)

Market perception of credibility of monetary policy (ex ante credibility of

monetary policy) Consistency of

central bank communication

Success in realizing the monetary policy

strategy (ex post credibility of monetary policy)

Source: own illustration.

policymakers Monetary

policy strategy

Fiscal policy

T

unication preceding decisions. Central predetermine the level of

hile being ore credible ex ante makes it easier for a monetary policy authority to realize its strategy.

tary policy decisions, nd a higher degree of accountability improves ex ante credibility. The other is that fiscal policy decisions affect the probability of reaching monetary policy objectives. Furthermore, potential interactions between fiscal and monetary policy might affect the general perception of monetary policy credibility, as the teraction of monetary policy with fiscal policy always raises the delicate issue of central bank

2.4. Measurement methods

In this short review, we present the most important methods of measuring the credibility of monetary policy, gether with methods of measuring predictability of central bank decisions, and the consistency and

ness of central bank communication – two crucial factors influencing credibility. Although we present th ithin their context, it is impossible to give a full account of the listed mod rom what the purpose of this dissertation is. We only go

as far as e numerical measures of monetary policy

credibility i subsection provides a preliminary

theoretica e models, most of which we

will impl dissertation. Therefore, we will mainly – but not solely – focus

on metho e of an inflation-targeting regime from the above

perspectiv

policy decision-makers usually take into account central bank comm

bank decisions and the degree of consistency of communication together

transparency and predictability as well as affect the financial market’s perception of the credibility of the monetary policy regime (ex ante credibility). Ex ante credibility is also affected by the predictability and transparency of central bank decisions and the accountability of central bank decision-makers. Ex ante credibility and the success of realizing monetary policy strategy – ex post credibility – have a unique relationship: the act of realizing the strategy makes the monetary policy regime more credible, w

m

There are two important factors we will not dwell upon in this dissertation. One is that strategy and transparency serve as a basis for holding decision-makers accountable for their mone

a

in

independence.

to effective

ese methods of measurement w

els as they serve other purposes different f

to highlight the different methods of computing th

, predictability and the consistency of communication. Th s l founding of the credibility measures, as well as the description of th ement in the empirical part of the

ds that deal with evaluating the performanc es.

y .4.1.1 An ex post measure of monetary policy credibility

The ex post aspect of credibility of monetary policy lies in judging whether the central bank fulfilled its strategy. In the case of an IT regime it comes down to the question of whether the central bank had ucceeded in establishing a stable anchor for the inflation rate. As Leitemo (2005) notes: “If inflation were 2.4.1. Simple methods to measure the credibility of monetary polic

2

s

to drift without a firm anchor, it would severely reduce agents’ ability to produce expectations of future inflation, which in turn is a prerequisite for long-term nominal contracts” (Leitemo, 2005. p. 2).

To test for the stable anchor, two unit root tests are applied. First, the augmented Dickey-Fuller test with drift – first introduced in Dickey and Fuller (1979) – is performed, as suggested by Leitemo (2005), to see if the time series of inflation has a unit root. The equation used in this test is as follows:

t j 1 t

j j

1 t 0

t a σy θ ∆y u

∆y = + + − +

−

∑

= ,assuming that

t 1 t

t y u

y =ρ − +

k

ρ

−

= σ 1

where

is the first difference operator;

is the logarithm of the inflation measure;

is the constant quantifying the drift in the time series;

the coefficient of auto regression in the model describing

ey-Fuller values;

is the lagged level of the series;

∆

yt

a0

is yt;

ρ

σis the coefficient to be tested using the critical Dick

1

yt−

k, the lag order of the autoregressive process;

θjis the coefficient of the lagged change, which serves to deal with autocorrelation;

is the lagged change in the series;

and is the error term.

j

∆yt−

ut

ning that the time eries has a unit root problem and is non-trend stationary. In this dissertation, we use this test to show The unit root test checks the validity of the following hypotheses:

0 : H

0 : H

1 0

≠ σ

= σ

The null hypothesis of the existence of a unit root in the inflation time series can be rejected if the test statistic is smaller than the critical values at the different significant levels and lag lengths.2 In such a case, one can conclude that the observed inflation time series is trend stationary. However, if the test statistic is higher than the critical values then one cannot conclude to reject the null hypothesis, mea

s

whether inflation became anchored after the introduction of the IT regime, that is, whether the inflation time series became a mean-reverting, stationary process.

The second unit root test for used for checking the inflation anchor is the KPSS test, introduced by Kwiatkowski et al. (1992). It tests the null hypothesis of stationarity against the alternative of existence of a unit root. The KPSS regression is built on the assumption that if yt =µ+ut, where utis a stationary process with a mean of zero, then both µcan be consistently estimated by the mean of yt’s in the sample and the variance of utis finite. The test takes advantage of the fact that neither of these two properties is present under the alternative hypothesis. The statistic of the KPSS test is computed with the following quotient:

T 2 2i1

2t

T S

= σ η

∑

=where

∑

== t

1

s s

t e

S ;

and σ2is an estimate of the long-run variance of et =(yt−y).

The KPSS test is another one-sided test: it rejects the null hypothesis of stationarity if ηis greater than the critical value.

2 The critical values are negative and the test is non-symmetrical so maller means a larger negative value in this case. s

res of monetary polic credibility

e now continue with the introduction of a number of measures of monetary policy credibility, which we ex ante. The ex ante nature of monetary policy credibility can be understood from the point of view of financ akeholders of monetary policy, who are not in the position to judge the

credibility ns of whether the

central ba al market prices.

The ex an sset prices to give

approxim se

measures are based on information of the past but they are labeled ex ante because they can be used to

predict whether th re.

In his evaluation of the succes me, Svensson (2009) approaches the comparing inflation expectations with the relevant inflation targets. First, he says that the

In their cross-country analysis of the connection between unemployment-inflation trade-off and the credibility of monetary policy, Laxton and N’Diaye (2002) stress that an inflation-targeting regime becomes

erfectly credible when “inflation expectations … become regressive and at long horizons … become tely anchored to the monetary authorities’ long-term inflation objectives” (Laxton and N’Diaye,

2002, p. ard-looking autoregressive model of inflation

expecta which lu ectations

equation is:

2.4.1.2 Ex ante measu y

W label as

ial investors and other st

of monetary policy directly. Nonetheless, they formulate their indirect perceptio nk is on the right track to fulfill its strategy using information implied by financi

te measures we present in this sub-sub-section discern information from a

ations of monetary policy credibility as perceived by the participants of financial markets. The

e central bank will make decisions in line with its strategy in the futu

s of the Swedish inflation-targeting regi issue by

“credibility of an inflation-targeting regime is usually measured by the proximity of private-sector inflation expectations for different time horizons to the inflation target” (Svensson, 2009, p. 15). Then, he adds, that it is equally important to analyze how well inflation expectations (private inflation forecasts) correspond to the inflation forecasts of the central bank. In both cases, the closer the expectations are to the target or the forecast of the central bank, the higher the credibility of monetary policy. Going further, Svensson (2009) also deals with more forward-looking issues such as the correspondence between market expectations regarding the future policy rate and the central bank’s policy-rate path before and after interest rate decisions. His approach is mainly intuitive and lies in the graphic illustration of the above relations. In this dissertation, we provide some graphic evidence on the credibility of the Hungarian IT regime, based on

09).

Svensson (20

p comple

5). Their model includes a generalized backw

tions, inc des the effect of credibility on inflation expectations. Their inflation exp

[

1 t1 2 t 2 3 t 3 1 2 3 t 4]

t t

e t

t =cπ +(1−c )απ− +α π− +α π− +(1−α −α −α )π− π

with π*t =λπ**+(1−λ)π4t−1

where

et

*

*

is inflation expectation;

is the monetary authority’s long-term objective for inflation (inflation target);

π π

πtis 400 times the quarter-on-quarter change in the log of CPI (quarterly inflation);

π4 is 100 times the year-on-year change in the log of the CPI (annual inflation);

λ reflects the average time needed for the monetary authority to bring inflation to its target level;

1

0≤αi ≤ is the weight attached to πt−iin the expectation equation, provided that

∑

=

ity.

In this expectations model, the higher the value attached to credibility, the more inflation expectations become anchored to the long-term objectives for inflation. Furthermore, more anchored inflation

xpectations translate to a more favorable trade-off between unemployment and inflation, as higher ity implies that inflation will react less to short-term increases in the unemployment gap than the

extent to o the credibility effect on

inflation a d on Goodfriend (1993),

they argu a n for changes in the inflation risk

premium. uared deviation of the long-term rate

from the red deviations of the long-term rate

from th

≤ α

3

1 i

i 1; and ctis a measure of monetary policy credibil

e credibil

which it will react in cases when credibility is low. For a measure f expectations, they turn to information implied in fixed-income yields. B se

e that changes in long-term yields provide a good approxim tio They specify their measure of credibility as a ratio of the sq historical maximum level of yields and the sum of the squa e maximum and minimum level, such that:

[ ]

[ ] [

t LOW]

2HIGH2 t

HIGH2 t t

RL RL RL

RL

RL c RL

− +

−

= −

where

RLtare the actual long-term government bond yields;

and RLLOWand RLHIGHare, respectively, the lowest and highest levels of long-term bond yields.

e

. Clearly, their method is only applicable in case there exist long-term inflation expectations nd it can be shown that the variation in long-term nominal yields is mainly owing to variations in long-term inflation expectations. In lack of such proof, the results of calculating this credibility measure lack robustness. In this dissertation, we calculate the time series of and contrast it with

e time series based on German financial data to show the difference in stability between the two series.

In an ear e rget zone and offers a

simple as e te target zone operated by the Swedish Riksbank. He

presents the c-currency rate-of-return bands for

ifferent maturities. The lower and upper bounds are calculated using the relevant foreign interest rate – or a Laxton and N’Diaye (2002) fix the minimum level of long-term rates at 5%, but they stress that different specifications render similar results. Thereby, historically low long-term government bond yields indicate higher credibility, while historically higher long-term government bond yields m an lower credibility of monetary policy

a

for the Hungarian case ct

th

lier paper, Svensson (1990) discusses the credibility of an exchange rat ta sessment of the credibility of the exchang ra

methodology in two steps. First, he calculates domesti d

composite of relevant foreign interest rates –, the lower and upper bounds of the official exchange rate target zone and the spot exchange rate in period t, such that:

1 ) S / S )(

i 1 (

RtΤ = + *tΤ t 12/Τ− 1 ) S / S )(

i 1 (

RtΤ = + *tΤ t 12/Τ−

where

Τ

Rt is the lower bound of the rate-of-return band in period t with maturity Τ;

Τt

R is the upper bound of the rate-of-return band in period t with maturity Τ;

Τ

*t

i is the relevant foreign interest rate in period t with maturity Τ; Sis the lower bound of the official exchange rate target zone;

is the lower bound of the official exchange rate target zone;

S

and is the spot exchange rate in period t.

create an opportunity for safe arbitrage profit for economic agents borrowing from abroad and investing at St

Svensson (1990) suggests that a simple method of measuring credibility is to check whether the actual domestic interest rate is inside or outside the constructed rate-of-return band. He argues that, with perfect capital mobility, a domestic interest rate, which is, say, higher than the upper bound of the band, would

home. The reverse would be true for cases when the interest rate is below the lower bound. Thus, the target zone cannot be deemed credible when the actual interest rate falls outside the rate-of-return band.

The second step in Svensson (1990) is based on the assumption of uncovered interest rate parity. In this case, the expected value of the exchange rate in month t to rule in month t+Τ can be calculated using the interest rate differentials between the domestic and foreign interest rate for maturityΤ and the spot exchange rate, such that:

12

*t t t t

t 1 i

i S 1 S

Τ Τ Τ Τ

+ ⎥⎥

⎦

⎤

⎢⎢

⎣

⎡ +

= +

where

St+Τis the expected value of the exchange rate in month t to rule in month

t t+

ty

T;

Τt

i is the domestic interest rate for maturi Τ; and i*tΤ is the foreign interest rate for maturity Τ.

The ratio of the domestic and the relevant foreign interest rate for the same maturity indicates the expected depreciation or appreciation of the domestic currency for that particular maturity. A test of credibility is, then, to check whether the expected exchange rate is within or out of the official band for the different maturities. When the expected exchange rate violates t is band it can be interpreted as saying that the target zone is not credible beca preciation is higher than what the official band would make possible. In other words, in such a cas , the market expects a shift or widening of the band. In this dissertation, we show the evolution in time of the credibility of the official EURHUF exchange rate band maintained by MNB, based on Svensson (1990). It should be noted, however, that this model fails to grapple with the problem of the existence of the currency risk premium placed on the estic

h use the expected depreciation or ap

e

dom assets, denominated in domestic currencies, of small open economies. Therefore, the rate-of-return bands and es computed in this dissertation are imprecise in the sense that they are calculated using forint interest rates that carry some risk premium. In order to net out the effect risk premium on forint-denominated Hungarian assets, one should first estimate the currency ium on forint assets for all periods.

expected depreciation and exchange rat

currency of the currency

risk prem

Svensson e

credibility lute credibility

and credibili e that the future

inflation p. 1), which is a

way of all

ases. On the other hand, credibility in expectation is “when market agent’s expected value of the future

t might fall

d restrict our analysis for the period after 2006.

Simple statistical methods can be of major help also when one examines the stability or the evolution of the (1993) takes the above methodology one step further by introducing a way of assessing th of an inflation rate target zone. First, Svensson (1993) distinguishes between abso

ty in expectation. By absolute credibility, he means that “market agents believ will fall within the target range with 100 percent probability” (Svensson, 1993,

saying that the market believes that future inflation will remain within the inflation target zone in c

inflation rate falls within the target range” (Svensson, 1993, p. 1), which implies that the possibility, however slight, exists that i outside the target zone. Svensson (1993) introduces the concept of an inflation target-consistent range of real yields on nominal bonds by subtracting the upper and lower bounds of the inflation rate tolerance zone from the yield-to-maturity on nominal bonds. He suggests that if the market real interest rate – the interest rate on real bonds – for some maturity falls outside the target- consistent range of real yields on nominal bonds, the hypothesis of credibility in expectation – along with absolute credibility – of the inflation target should be rejected. This is one of the two models of all the mentioned that we do not implement in this dissertation for two reasons. One is that we do not possess reliable data on inflation expectations for all dates in the examined period. The other is that even if we had reliable expectation data, the fact that the Hungarian IT regime applied a point – end of year – CPI target in its first six years of operation woul

2.4.1.3 Identifying a discrete structural break

market perception of credibility of monetary policy using a regression specification based on the time series of some financial data relevant for monetary policy. One of the tests for stability of parameters in a specification is the Chow test, introduced first in Chow (1960), which tests for the existence of a discrete structural break in a linear regression model. The general methodology of the Chow test is the following.

The data sample of a regression model in the form of Y=Xβ+ε is split into two subsamples at the suspected break point or date tb so thatY=(Y1',Y2')',X=(X1',X'2)',ε=(ε1',ε'2)'. The two linear regression specifications are estimated for the two separate data sets such that Y1=X1β1+ε1, and The number of observations from the first subsample is n1, while the number of observations fro

subsample is n2. The Chow test is a test of the null hypothesis , using an F statistic by default – that is, unless the original model used a robust estimator matrix. The value of the statistic

distributed is:

. X

Y2 = 2β2+ε2 m the second

2 1 0: H β =β for the covariance )

k 2 n n , k (

F 1+ 2−

) k 2 n n ( ) e ' e e ' e

( 1 1− 2 2 1+ 2− k ) e ' e e ' e e ' e

FChow ( − 1 1− 2 2

=

and degrees of freedom. In such a case, the conclusion is that the oefficient of the original regression specification is unstable and that the coefficients of the restricted

2.4.2. Dynamic methods to measure the credibility of m policy

ynamic models such as the Bayesian framework or the evolving perception of credibility to be introduced ollowing sub-sub-sections serve purposes different from those of the above described simple models:

where

e is the residual vector obtained from the specification based on the entire data set;

e1is the residual vector obtained from the specification based on the data set before the break point;

e2is the residual vector obtained from the specification based on the data set after the break point;

e1

'

e is the sum of the squared residuals from the regression based on the entire data set;

1 1e '

e is the sum of squared residuals from the regression based on the first data set;

2 2e '

e is the sum of squared residuals from the regression based on the second data set;

and kis the number of parameters estimated in the original specification, including the constant.3

One can reject the null hypothesis if the calculated test statistic is significantly larger than the F-test critical value belonging to k n1+n2−2k

c

regression specifications based on the data sets of before and after the break point significantly differ.

Statistical theory explains such a phenomenon by a structural break in the original model at the specified break point. When applying regression on time series data, this break point becomes a specific date when there is a significant change in the structure of the regression specification so that the earlier specification no longer applies. We use Chow test in our dissertation as one of the tests for the stability – or variation – in time of the specification depicting the market perception of the credibility of monetary policy. Evidence of a structural break in such a specification will indicate a significant change in the market’s perception of monetary policy credibility.

onetary D

in the f

stical software – including Stata as well as Gretl, whic

3 Most stati h we use for the Chow-test – apply a more concise, although

slightly mo e identification of the break point: a specific date when or

an observat e regression specification. The second step is splitting the

entire sample i r it. This is where this method differs from the above

discussed simp ariable into the original specification, which takes the

value of ze terms between the dummy and the original factors

in the regre or the null hypothesis of the augmented regression

specification being homogenous with respect to the dummy. The result is the same as in the longer version.

re complex method of testing in three steps. The first step is th ion number after which there could possibly be a break in th

nto two data sets: one before the break point and the other afte le one. The splitting is usually done by introducing a dummy v ro before the break point and 1 after it, while also creating interaction

ssion. The final step is the calculation of the Chow statistic to test f